Many individuals discover the possibility of crypto trading every day. So what makes it so alluring?

Due to their decentralized nature, transparency, and speculative nature, cryptocurrencies often see significant price increases. This offers up new opportunities for passive income generation that ultimately result in monetary security.

But how do you start trading cryptocurrencies? Does it suit everyone? In this article, we’ll go through the fundamental ideas of cryptocurrency trading and show you how to start making money right away.

Key Takeaways

- Trading cryptocurrencies may be very profitable, but it also includes a high danger of severe financial loss.

- Choose a brokerage or exchange, fund your account, choose a bitcoin asset to trade, and place an order to begin trading.

- The cryptocurrency market fluctuates for a variety of reasons, and using the right trading tactics can minimize your exposure to risk.

What Is Trading in Cryptocurrencies?

Trading cryptocurrencies technically means placing bets on the increase or decrease of one cryptocurrency in relation to another, whether it is a fiat currency like the US dollar or another cryptocurrency.

Cryptocurrency is sometimes described as a highly volatile digital asset that causes values to spike swiftly and offers users substantial rewards.

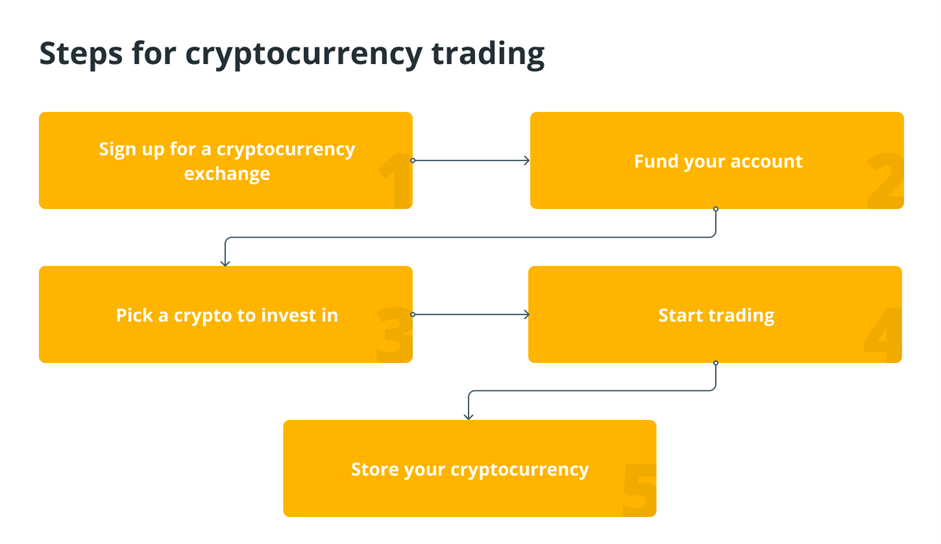

5 Steps To Begin Trading Cryptocurrencies

Technically speaking, it is simple to get started with cryptocurrency trading. Yet, it necessitates a thorough analysis of the terms provided by brokers and cryptocurrency exchanges as well as current market developments. Here are the five crucial actions that every beginner trader has to perform before beginning a career in bitcoin trading.

Selecting a Trading Platform

The first step is to choose a trustworthy platform. Either a bitcoin exchange or a conventional brokerage firm are your alternatives. Choose carefully because there are a few slight variations between the two.

Traditionally, stocks, bonds, and ETFs have been supported by brokerages. Although there is a limited range of digital currencies here, they are available. Interestingly, their trading charge rates are often cheaper.

Regarding cryptocurrency exchanges, they provide a wider range of digital assets along with a number of additional services, such as wallet storage options, different kinds of interest-bearing accounts, and more. A percentage of the total value of the assets purchased and sold is often charged as trading commissions on cryptocurrency exchanges.

It is crucial to take into account the crypto assets they support, their security protocols, the fees they charge, storage options, and withdrawal options when selecting a trading platform, whether it be an exchange or brokerage.

Invest in Your Account

The next step after choosing a trading platform is to fund your account. Usually, a debit or credit card may be used to buy cryptocurrency using fiat cash.

A few providers additionally allow ACH and wire transfers. Be aware that the processing periods and procedures for deposits and withdrawals vary between providers.

Invest In Cryptocurrencies

Bitcoin and Ethereum are where the majority of cryptocurrency investments are made. Nonetheless, Altcoins have a large amount of untapped earning potential.

Diversifying your portfolio is essential in the realm of bitcoin trading. It might be dangerous to put all of your eggs in one basket because the market can be unpredictable. New Altcoins with great growth potential can also become valuable, even though investors feel more comfortable investing in tried-and-true projects like Ethereum, Bitcoin, Ripple, etc. They also have more room to grow because their journey has only just begun.

Place an Order

You can place orders on online and mobile devices supported by your exchange or broker. Open the platform, select “purchase,” choose the order type or the amount you want to spend, and then confirm your order. The “sell” order process is the same.

Keep Your Cryptocurrencies Safe

It’s finally time to store the cryptocurrency you just bought. Cryptocurrencies are typically kept in digital wallets or on physical hardware. With certain brokers and exchanges, you may utilize a digital wallet to store and recover money without ever leaving the platform.

You might need to establish a different wallet and store your belongings elsewhere because not all trading sites offer wallet services for cryptocurrencies.

Which Trading Techniques For Cryptocurrencies Are Ideal For Novices?

The technical measures stated above are crucial, but trading without a clear plan might be risky. An effective crypto trading plan often reduces financial risks and prevents you from acting rashly. Here are a few tried-and-true trading techniques that every new trader should be familiar with.

● Day Trading

In cryptocurrency day trading, a trader enters and departs the market on the same day while the market is open for normal trading in cryptocurrencies. The act of making and closing deals during the same trading day is referred to as “intraday trading” as a result.

The whole objective of day-to-day cryptocurrency trading is to benefit from minute price movements. Day trading is a desirable alternative because of the bitcoin market’s high level of volatility.

It might be a good idea to discover any online courses or ask for expert help before you start since technical analysis is a critical ability for day traders of cryptocurrencies.

● Crypto Futures Trading

A contract between two parties to purchase and sell a certain amount of an underlying cryptocurrency, such as BTC, at a predetermined future price on a predetermined date and time is executed in a crypto futures trading strategy.

Futures trading tactics expose you to a wide range of tokens without really requiring you to buy any cryptocurrencies.

● HODL (buy and hold)

The simplest and most popular trading technique is to purchase an asset and hold it for an extended period of time (also known as “HODLing”). Investors that maintain their investments for an extended period of time can benefit from long-term value growth. Investors can avoid the danger of selling low and purchasing high while HODLing since they are not impacted by short-term volatility.

Final Claiming

You may start trading now that you are familiar with all the stages and some fundamental trading tactics. However keep in mind that while cryptocurrency volatility offers great benefits, it also carries significant dangers, so be ready to suffer loss and effectively manage your risks.

Disclaimer: Any information written in this press release or sponsored post does not constitute investment advice. Thecoinrepublic.com does not, and will not endorse any information on any company or individual on this page. Readers are encouraged to make their own research and make any actions based on their own findings and not from any content written in this press release or sponsored post. Thecoinrepublic.com is and will not be responsible for any damage or loss caused directly or indirectly by the use of any content, product, or service mentioned in this press release or sponsored post.

For publishing articles on our website get in touch with us over email or one of the accounts mentioned below.

Home

Home News

News