- The Maker community agreed to transfer $500 million to Coinbase 2.6% yield annually.

- At press time, the native token of Maker is trading below $1.

MakerDAO, the leading lending protocol, recently announced that it is ready to set up a real-world asset vault for Coinbase Custody and transfer around $500 million in USD Coin(USDC) stablecoins. The information was revealed after the conclusion of the vote on April 20, 2023.

The second largest cryptocurrency exchange’s custodial arm will 2.6% yield annually to MakerDAO. Coinbase can use the invested amount to lend, reinvest or use in other ways. The lending protocol has its own native token known as DAI, a stablecoin primarily backed by USDC and Ethereum.

In the parallel vote Maker community favored that Coinbase should keep the tokens in its cold wallets. According to the blog post, the lending protocol can withdraw these funds within 24 hours, and cold wallet offers to deposit up to $500 million.

The recent announcement is inspired by the earlier decision to transfer $1.6 billion to the crypto exchange to earn yield.

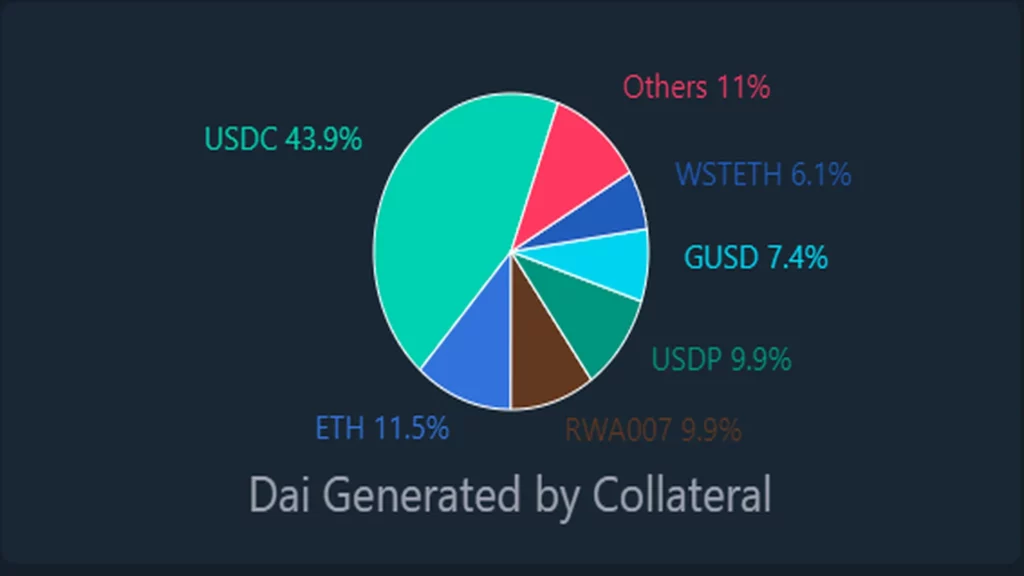

Source: Daistats(dot)com

Daistats(dot)com data shows that more than 43.9% of DAI is generated using USDC, and around 11.5% of DAI tokens are generated using ETH. Although over 13% of DAI are generated using GUSD and WSTETH as collateral.

Earlier on March 25, 2023, TheCoinRepublic reported that the Maker community agreed to keep USDC stablecoin as primary backing for its DAI stablecoin. Around 79% voted to keep USDC as DAI collateral, and the remaining favored diversifying the reserves.

In October 2022, Maker bought Treasury bonds for a MIP65 enhancement initiative. With the most recent plan, Maker’s ability to invest in liquid bonds is increased along with the debt ceiling for those investments.

The $750 million made available through the proposal, according to Maker, will be used to purchase U.S. Treasury bonds with maturities evenly distributed over six months. This strategy will guarantee that the Treasury bonds mature at a rate of $62.5 million every two weeks.

CoinMarketCap ranked DAI as the 17th best token among 23535 cryptocurrencies. At the press time, DAI was trading at $0.999 with a 24-hour trading volume of $150,144,059. The all-time high of DAI stablecoin was $3.6684, and the lowest trading price was $0.897. The market capitalization of DAI was $5,025,768,136.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only and do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News