- 1 Crypto lending DeFi protocol FiIDA was hacked for $700,000 on April 23, 2023.

- 2 FiIDA Halts operations on the ESC chain and REI Network.

2023, so far, has been dotted with multiple hacks on DeFi platforms and crypto entities. The combined losses in Q1 2023 are around $320 Million. Adding to this infamous list is a cross-chain lending DeFi project FiIDA Finance. FiIDA lost around $700,000 in the exploit and halted operations on Elastos Smart Chain (ESC) and REI Network.

FiIDA Adds to the Exploited DeFi Platforms List of 2023

According to the press release by FiIDA, they were hacked during the early hours of April 23, 2023. The attacks affected all the digital assets on FiIDA’s ESC Chain, including Elastos token, BUSD, and Bitcoin. It is a relief that no other deployments have been affected by the exploit.

The team told the press that “the vulnerability has been identified and the attack vector isolated.” They are actively tracing the hacker’s activities, and preliminary investigations pointed out that the attacker’s address has interacted with multiple crypto exchanges. They are seeking help from law enforcement and have urged affected users to report the incident to local police.

This is not FiIDA’s first rodeo with a hack, in April 2022, they were exploited for around $2 Million in a flash loan attack. At the time, they set in motion a redemption plan for the affected users. However, it is not clear that they are willing to do the same this time around.

How Much Did the Exploit Affect FiIDA?

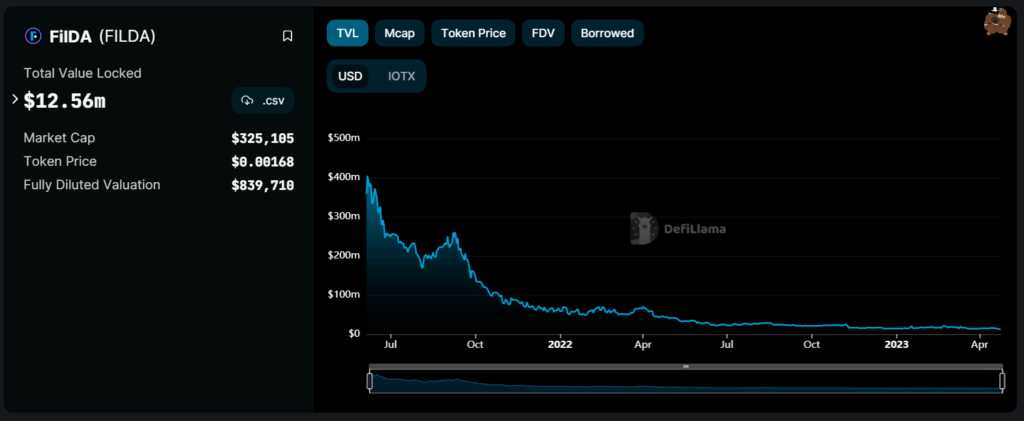

A February 2023 report from FiIDA reveals that total deposits and loans of the platform accounted for around $21.3 Million, and have 145,574 current users of the protocol. At press time, FILDA was trading at $0.001683 with a drop of 1.35%. The market cap remains unchanged at $104,651, and the trading volume fell by 2.43% to $55,583, in the last 24 hours.

The token suffered a drop of about 7% in the last 7 days, and around 13% in the last 30 days.

Crypto hackers were very active in Q1 2023 and exploited the industry for about $452 Million, interestingly the losses in Q1 2022 were $1.3 Billion more. The major part of the amount was stolen in the first three weeks of March 2023. Euler Finance lost $196 Million, and BonqDAO suffered $120 Million in losses.

A survey conducted around the exploited DeFi platforms revealed that the TVL decreases significantly after the attack and these protocols fail to recover. The majority see a TVL drop of around 96%.

Euler recovered a major part of the lost amount on April 3, 2023 developer team also fixed the vulnerability, but still, the TVL is down by around 28%. Beanstalks’ TVL is down by 100%, BonqDAO by 100%, CREAM Finance by 97%, Mango Markets by 100%, and BadgerDAO by 96%.

Even if the team solves the vulnerability and deploys safety measures, it is hard for them to regain the lost trust.

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News