- 1 The next earnings for Home Depot Inc. (NYSE: HD) is coming on May 16, 2023.

- 2 A considerable gap-down was noticed in previous earnings in February.

Home Depot Inc. (NYSE: HD) is the largest home improvement retailer in the United States. Founded in 1978 and headquartered in Atlanta, Georgia, U.S., the company operates more than 3,500 stores in North America and adjacent states. HD stock is down by around 9% in 2023, with the next earnings on May 16. Can it bounce back?

Can Home Depot’s Next Earnings Revive the Rally?

The Home Depot Inc. (NYSE: HD) stock closed its last trading session at $287.93, dropping by 0.58%. This change was below the S&P 500’s gain of 0.05% for the day. Concerning this, S&P 500 gained 0.05%, and Dow Jones lost 0.17%, while the NASDAQ hiked by 6.02%. HD stock gained around 0.35% in the last 30 days, and in comparison Retail-Wholesale sector gained 1.63%.

The next earnings for the home improvement company are scheduled on May 16, 2023. The expected EPS is around $3.83, down by 6.36% from the prior-year quarter. Estimated revenue in the earnings should be around $38.63 Billion, again down by 0.72% from the prior-year quarter.

Zacks Consensus Estimates of the whole year for HD kept EPS at $15.82 with a year-over-year (YoY) drop of 5.21%. Also, the estimated revenue should be around $157.17 Billion, with a decline of 0.15%.

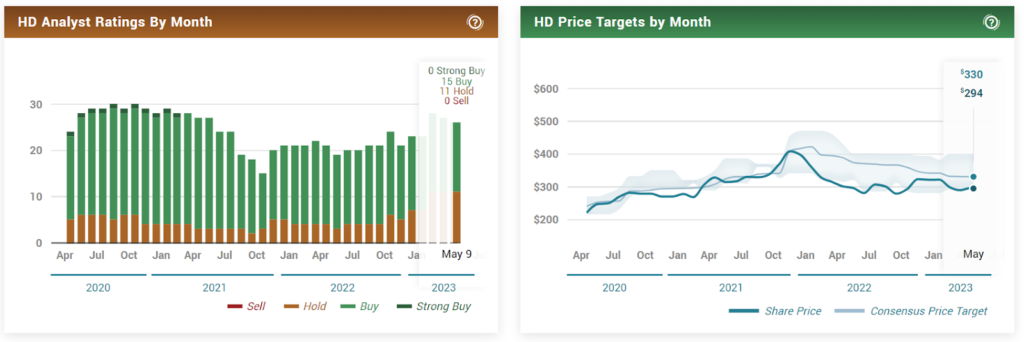

At press time, HD stock was trading at $287.93 with a drop of 0.58%; previous close and open were at $289.62 and $289.00, respectively. With an average volume of 3.74 Million shares, the market cap for Home Depot was $291.278 Billion. The 52-week change reported a drop of 1.11%. Analysts have placed the price target at $329.89, with an upside of 14.6%.

The P/E ratio of 17.25 is considered to be an ideal ratio for the company. Concerning January 2023 data, the revenue gained 0.31% with a YoY change from $35.83 Billion, revenue per share was 20.26%, and the quarterly revenue growth was reported to be 0.30%. Operating expenses hiked by 1.95% to $7.17 Billion; also, the net income was up by 0.30% to $3.36 Billion.

The net profit margin remained unchanged at $9.38, the return on assets hiked by 20.26%, and the gross profit was $52.78 Billion. Total cash was reported to be $2.76 Billion, and the company’s debt is $50.36 Billion.

Home Depot Inc. (NYSE: HD) – Candle Exploration

At the time of previous earnings reported on February 21, 2023, there was a considerable gap-down in price. The price then continued to consolidate, reaching a low of $279.36 which also supports the current price point. Also, the price is south of EMA, and a negative MACD indicates a relatively negative momentum.

The subsequent earnings are scheduled on May 16, 2023; if the report comes out favorable, the price will have to face EMA as the first resistance and crucial resistance as second; if it manages to cross them price could rally upward. If the report is negative, dropping below the support could be possible.

Disclaimer:

The views and opinions stated by the author, or any people named in this article, are for informational purposes only and do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News