- 1 SAVE stock dropped more than 20% in the last 6-months, while its year-to-date price analysis also showed an 18% decline.

- 2 Late in April, Spirit Airlines reported its Q1 2023 report, after which SAVE stock price started declining.

Spirit Airlines (NYSE: SAVE) stock analysis shows that it followed a bearish trend and marked its 52-week low at $15.77. This airline stock almost lost investors’ confidence due to its not-so-good price performance. However, the other airline stocks such as Delta Air Lines (NYSE: DAL), JetBlue Airways Corporation (NASDAQ: JBLU), and American Airlines (NASDAQ: AAL) surged almost 0.77%, 0.70% and 3.53%, respectively.

The total revenue of SAVE for Q1 2023 is $1.35 Billion, and it’s 2.99% lower compared to the previous quarter. The net income of Q1 23 is $-103.91 Million. Spirit Airlines’ revenue for the last year amounted to $5.07 Billion, the most of which — $4.99 Billion — came from its highest performing source at the moment, Air Transportation for Passengers, the year earlier bringing $3.18 Billion.

Furthermore, the airline company reported its EPS for Q1 2023 are $-0.82, whereas the estimation was $-0.85, which accounts for a 3.74% surprise. The estimated earnings for the next quarter are $0.32 USD.

$SAVE Stock Price Analysis

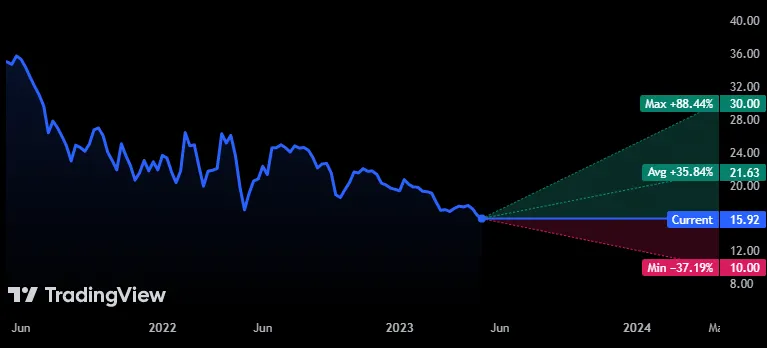

On Monday, May 8th, SAVE’s stock price dropped near its 52-week low. It closed at the cost of $15.92, with a 2.45% decline in the last 24 hours. In yesterday’s trading session, SAVE stock opened at $16.06, high at $16.24, while low at $15.77.

As shown in the above chart, SAVE stock has already marked its 52-week low while showing a bearish outlook. From here, the airline stock demands to take a bounce and then follow a bullish trend. However, active bears in the market have pulled down the price of SAVE stock, which is entirely below its 20-DAY EMA. The RSI of this stock rests in the oversold zone.

Earlier in March, the airline stock also dropped at the trading price level of $16.16, then took a bounce and noted a high at $18.00. Before reporting its Q1 2023 report, the stock price of Spirit Airlines tested its 20-day EMA level. Still, due to the dominance of bears in the market, SAVE stock did not reach its 50-day EMA.

The analysts have set their price target for SAVE stock at $21.63, up more than 30% from its closing price. Meanwhile, the 1-year forecasts by analysts have a maximum estimate of $30.00 and a minimum estimate of $10.00.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only and do not establish financial, investment, or other advice. Investing in or trading crypto or stock comes with a risk of financial loss.

With a background in journalism, Ritika Sharma has worked with many reputed media firms focusing on general news such as politics and crime. She joined The Coin Republic as a reporter for crypto, and found a great passion for cryptocurrency, Web3, NFTs and other digital assets. She spends a lot of time researching and delving deeper into these concepts around the clock, and is a strong advocate for women in STEM.

Home

Home News

News