- 1 Lucid Group is testing its high-end Gravity SUV, slated to be launched soon.

- 2 LUCID stock is close to its lowest; earnings were also negative.

Lucid Group Inc. (NASDAQ; LUCID) produces premium quality electronic vehicles for those who can afford them. The LUCID stock price has decreased by around 59% since February 2023. Can the upcoming Gravity SUV boost the rally? Unlike Ford, Lucid targets the niche automotive buyers willing to spend on high-end luxurious EVs.

However, this strategy may or may not be profitable in the long run, but it could make the EV manufacturer a leader among high-priced EVs. Lucid’s Air is among the most luxurious EVs and won the prestigious Motor Trend’s 2022 Car of the Year. Its production in Q1 2023 was 2,314 units increasing by 235% from the previous year. Also, customer deliveries were up by 290% to 1,406 units.

They are currently testing the much-awaited Gravity electric SUV, slated to be launched soon. Analysts believe the model will be a strong seller and revenue generator for the manufacturer, thereby fuelling the rally.

Lucid Group Inc. – Financial Analysis

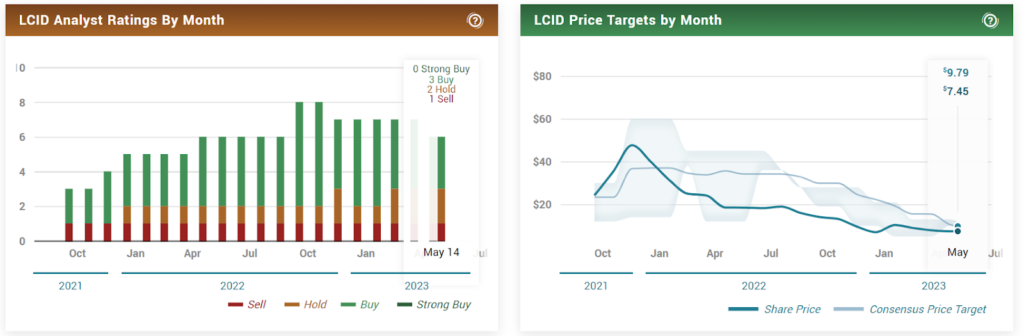

At press time, the LUCID stock was trading at $7.04 with a slight drop of 0.28%; the share price closed on May 12, 2023, at $7.06, while it opened at $7.09. With an average volume of 25.29 Million shares, the market cap of the EV manufacturer was $13.133 Billion. The 52-week change dropped 59.45%, and analysts placed the price target at $9.79 with an upside of 39.0%.

There was a 2.13 rating for HOLD, and the margins for profit and operation dropped by 286.13% and 392.34%, respectively. Concerning March 2023 data, the year-over-year (YoY) changes were as follows. Revenue hiked by 159.19% to $699.49 Million, revenue per share was reported to be $0.41, and the quarterly revenue growth was up by 159.10%.

Net income dropped by 858.99% to negative $779.53 Million, while the net profit margin suffered by 270.13% to negative $521.66. EBITDA stumbled by 25.13% to minus $699.83 Million. Total cash was reported at $2.98 Billion, while the total debt was $2.08 Billion, making the total debt-to-equity ratio 57.33.

The last earnings were reported on May 8, 2023, with reported revenue of $149.432 Million. It was, however, estimated to be $204.364 Million; this makes the surprise of negative $54.932 Million and a drop of 26.88%.

Lucid Group Inc. (NASDAQ: LUCID) – Candle Exploration

They recently announced negative earnings, but the price managed to sustain them, indicating $6.09 as strong support. Lucid Group is a loss-making company, and unless its financials changes, chances for an uptrend are limited. A downward-sloping trend line denotes the current price action; a similar EMA supports this point.

If the price breaks the trend line, it shall consolidate widely between support and R1. The release of a new SUV could fuel the chances of a breakout, but it’s a 50-50 chance. However, if the price drops below the support, it could be problematic for the investor.

Disclaimer:

The views and opinions stated by the author, or any people named in this article, are for informational purposes only and do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News