- 1 America stands among the developed countries with the most debts.

- 2 World’s biggest economy sits over the biggest pile of debt.

The United States of America is facing the looming threat of default on its debt. For now, Congress has the responsibility of either raising the “debt ceiling” or removing the cap. But the time is ticking, and the US has till June 1, 2023, according to the US Secretary of the Treasury, Janet Yellen. Amid the uncertainties with one of the biggest economies in the world to default, the financial markets are in a dilemma.

As investors are peeping towards the debt limit, the so-called X-date to arrive soon, the markets are experiencing hiccups. The equity market shows no enthusiasm as major indices consolidate with bit drops. Bitcoin dropped below the 27,000 USD mark on Wednesday, May 15, and traded at 26,890 USD.

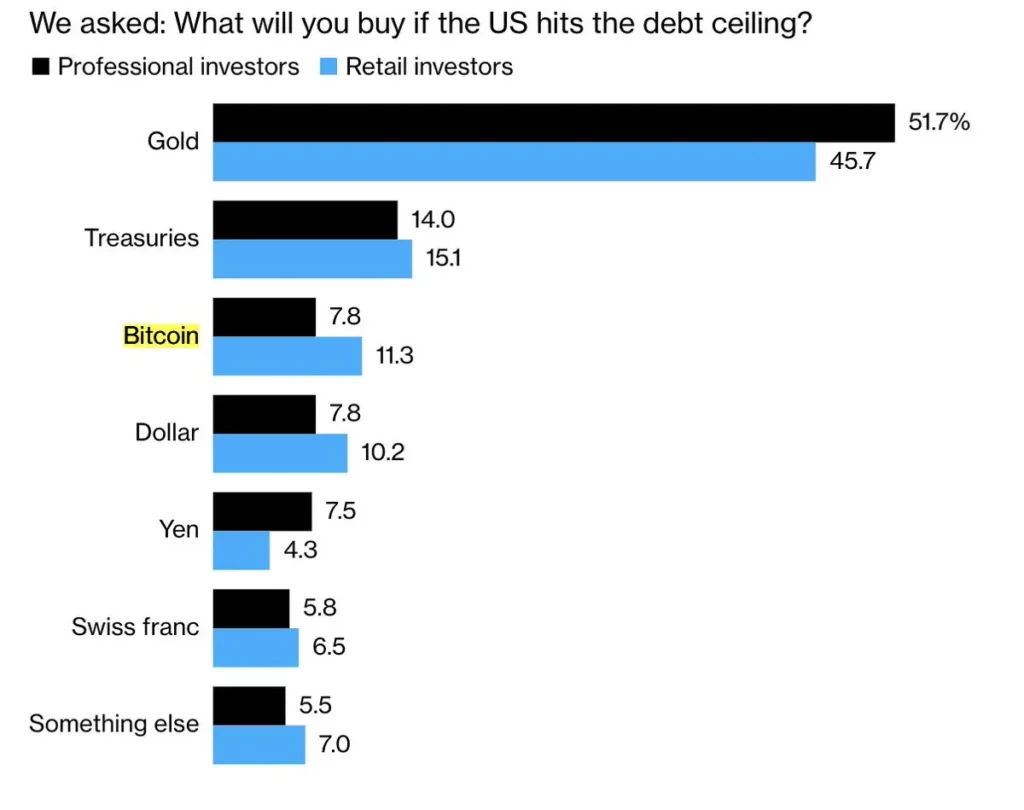

Though the flagship cryptocurrency is trading in red, the investors are said to hold the side of Bitcoin (BTC) rather than the US dollar in case of any chaos after hitting the debt ceiling. In a survey conducted by Bloomberg, it was found that retail investors would choose the leading cryptocurrency over the greenback. Gold and Treasuries still lead as the top go-to options for both professional and retail investors.

According to the US Treasury Department, Congress has raised the debt ceiling or extended the debt limit 78 times since 1960.

The Council on Foreign Relations (CFR) reported in early May that the “total national debt and the debt ceiling both stood at 31.4 trillion USD” by January 2023. It also added since 2001, the deficit in the US between spending and receiving tax averaged by approx 1 trillion USD per year. The spending remained more than the taxes and revenue it collected.

When the amount reaches an alarming level, all the eyes are on Congress to extend the limit again.

Bitcoin Whale Movement Tracked

Crypto transactions tracker Whale Alert reported two instances of Bitcoin transfers worth more than 627 million USD on Monday, May 15. Both BTC transfers took place simultaneously and had the amount of 316.3 million USD and 311.2 million USD, respectively. Given the timing, it was assumed that a single entity could have initiated the transactions, though there were two different wallet addresses involved

🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 11,533 #BTC (316,300,407 USD) transferred from #Coinbase to unknown wallethttps://t.co/VQKwWYtDtE

— Whale Alert (@whale_alert) May 15, 2023

With a background in journalism, Ritika Sharma has worked with many reputed media firms focusing on general news such as politics and crime. She joined The Coin Republic as a reporter for crypto, and found a great passion for cryptocurrency, Web3, NFTs and other digital assets. She spends a lot of time researching and delving deeper into these concepts around the clock, and is a strong advocate for women in STEM.

Home

Home News

News