- 1 Tesla stock price surged more than 7% this week, traded between the price range of $167.64 to $181.28.

- 2 Tesla (TSLA) stock has gained almost $3.25 this weekend and closed at $180.14.

Tesla Inc (NASDAQ: TSLA) stock price is following a bullish trend as shown in its recent price performance. Its year-to-date price analysis also shows TSLA grew more than 50%. The bullish trend in the stock took it upside while favoring bulls in the market.

Tesla Stock Analysis

The price of Tesla (TSLA) stock is holding its position at $180.14, with a bullish trend. According to the data sourced from Tradingview, the bullish run in the stock took it near to its 100-day EMA. While the stock also has quite good trading volume in recent months. The RSI as shown in the above chart, moved up towards the overbought zone. It clarifies the active bulls in the market taking the stock upside.

However, Tesla has reported its Q1 2023 earnings and revenue on April 19th, 2023. After which the stock price dropped nearly at $153.30 but then took a U-turn and rose upward.

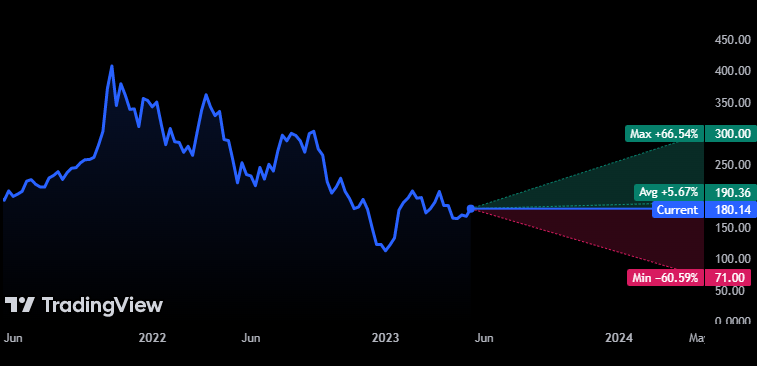

Analysts have set the price target for Tesla stock at $190.36 which is almost 5% up from its recent closing price. The analysts have set their one price target that has a maximum estimate at $300.00 while minimum estimate is $71.00.

Frank Cappelleri, CappThesis Founder and also an analyst also said that “the recent Tesla rally could stall out between $180 and $190 a share.” However, he is not making a fundamental call. He is looking at stock charts “to get a sense of what investors are thinking,” according to a report.

The total revenue of TSLA for the last quarter is $23.33 Billion, and it’s 4.07% lower compared to the previous quarter. The net income of Q1 23 is $2.52 Billion. TSLA EPS for Q1 2023 are $0.85 whereas the estimation was $0.85 which accounts for 0.48% surprise.

The company revenue for the same period amounts to $23.33 Billion despite the estimated figure of $23.60 Billion. Estimated EPS for the next quarter are $0.77, and revenue is expected to reach $23.92 Billion.

The automotive company’s revenue for the last year amounted to $81.46 Billion. The most of which — $77.55 Billion — came from its highest performing source at the moment, Automotive, the year earlier bringing $51.03 Billion. The United States accounts for the greatest contribution to the revenue. Last year it brought the automotive company $40.55 Billion, and the year before that — $23.97 Billion.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only and do not establish financial, investment, or other advice. Investing in or trading crypto or stock comes with a risk of financial loss.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News