- 1 BAC stock price showed 1.26% of drop on its May 19th, Friday trading session.

- 2 The stock price of Bank of America further showed a bearish trend in its monthly analysis.

Bank of America (NYSE: BAC) stock price showed 1.26% of drop in its Friday trading session, while the stock closed at $28.11. The stock price opened at $28.46, rose up to 28.67 and gave low at $28.03. The 52-week low of this U.S. banking stock was at $26.32, that is quite far from its recent closing price.

BAC Stock Price Analysis

BAC stock price has shown more than 2% growth in its recent week analysis. But the one month and six month price shows that the U.S. banking stock dropped almost 6% and 25% respectively. The year-to-date (YTD) price also showed nearly 15% drop in its price, showing the low investors confidence in it.

According to the data sourced from Tradingview, BAC stock price is near its 20-day EMA as it seems like bears have shown their dominance. However, in the recent 5-days of trading, the stock price of Bank of America followed a bullish trend. Still, the bulls were unable to take the stock upside or near to its 50-day moving average.

Moreover, the RSI of the U.S. banking stock performed quite well last week as the stock has shown a bullish outlook. Notably, Bank of America has reported its Q1 2023 earnings and revenue mid April, which was positive. After this report, the share price of BAC fell down from its 50-day EMA and started trading near to its 20-day EMA.

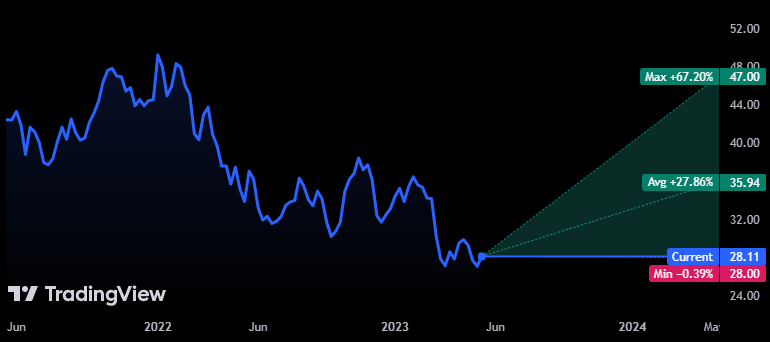

According to the research and analysis of some of analysts, they have set their price target for BAC at $35.94. However, their price target is nearly 27% from its recent closing price. They have set their 1-year price target having maximum estimate at $47.00 while minimum estimate is at $28.00.

Bank of America’s “Entrepreneurs-centered Program”

Last week, Bank of America announced its “new accelerator program.” In its program, the U.S. bank will provide economic opportunity to entrepreneurs from “underrepresented communities.” As it further added, this will be a 6-month program that includes “tailored mentorship and live instruction” that will help startups to grow their business.

We’re excited to announce our new accelerator program to provide #EconomicOpportunity to #entrepreneurs from underrepresented communities. The 6-month program includes tailored mentorship and live instruction to help startups grow their businesses. https://t.co/cugxFTl03t pic.twitter.com/0SuFLQiWvM

— Bank of America News (@BofA_News) May 16, 2023

Bank of America also mentioned that the “future participants will receive digital expertise and get access to potential investors and network with industry experts.”

Earlier in March 2023, one of leading U.S. banks, Silicon Valley Bank (SVB) collapsed due to a bank run that badly affected the whole U.S. stocks along with the trust of investors in banks. But after almost two months, the U.S. banking stocks are healing from the banking crisis. Still, it needs to gain quite strong bullish moves to be an investor’s choice.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only and do not establish financial, investment, or other advice. Investing in or trading crypto or stock comes with a risk of financial loss.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News