- 1 SNDL stock price continued its bullish trend on Monday morning, as the stock gained nearly 4% in yesterday’s trading session.

- 2 Its stock price rose almost 10% in recent days, while its recent closing also showed bullish sentiments.

- 3 The pre-market price of this stock price is at present showing little upside growth trading at $1.87.

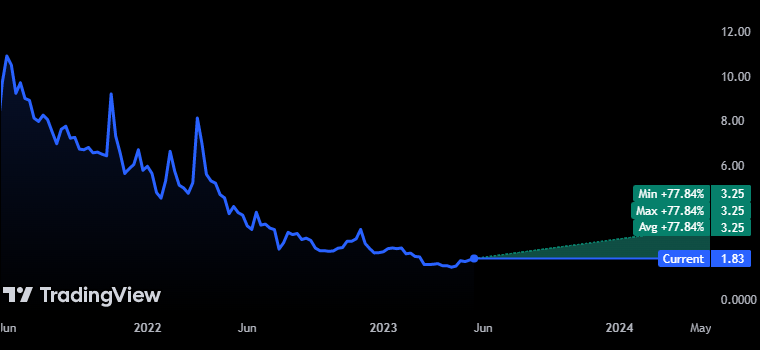

SNDL (NASDAQ: SNDL) stock price closed at the price of $1.83 on Monday, May 22nd, with 3.98% of price gain. Yesterday, the stock price opened at $1.79, gave high at $1.98, noted low at $1.78.

However, the 52-week low of this stock was at $1.29 that is pretty above from its recent closing price. The stock price also noted more than 20% of growth in 1-month, while year-to-date (YTD) price noted nearly 12% of decline.

SNDL Stock Price Analysis

The stock has shown quite good trading volume this Monday, that rose the stock price and took it above its 50-day EMA. However, the recent trading price of this stock is at its 100-day EMA. It clearly showed the dominance of active bulls in the market. Earlier last week, SNDL reported its Q1 2023 earnings and revenue after which the stock price started trading upside.

The RSI of this stock also surging upside and taking the stock in the overbought zone. The active bulls have shown the dominance that positively affects the stock price, while quite a good trading volume took the stock price to perform the stock near to its 100-day moving average.

As shown in the above chart, the analysts have set their price target at $3.25 which is nearly 77% up from its recent closing price. They are offering 1-year price forecasts that have a maximum estimate at $3.25 while minimum estimate is at $3.25.

Fundamentals of SNDL Inc

SNDL is a Canada-based licensed cannabis producer and also one of the largest vertically integrated cannabis companies in Canada. The total revenue of this company for Q1 2023 is $149.68 Million, and it’s 15.47% lower compared to the previous quarter. The net income of Q1 23 is $-26.30 million. Its revenue for the same period amounts to $149.69 million despite the estimated figure of $177.31 million.

Moreover, the estimated EPS for the next quarter are $0.01, and revenue is expected to reach $192.06 million. Its revenue for the last year amounted to $524.39 million, the most of which came from its highest performing source at the moment, Liquor Retail. Notably, the massive contribution to the revenue figure was made by Canada. Last year, this brought the company $547.06 million, and the year before that — $44.77 million.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only and do not establish financial, investment, or other advice. Investing in or trading crypto or stock comes with a risk of financial loss.

With a background in journalism, Ritika Sharma has worked with many reputed media firms focusing on general news such as politics and crime. She joined The Coin Republic as a reporter for crypto, and found a great passion for cryptocurrency, Web3, NFTs and other digital assets. She spends a lot of time researching and delving deeper into these concepts around the clock, and is a strong advocate for women in STEM.

Home

Home News

News