- 1 Alibaba announced in March 2023 about separate IPOs for different business groups.

- 2 The Chinese tech giant is laying off 7% of its staff before its IPO.

Alibaba Group Holdings (BABA Stock) is planning 7% layoffs ahead of its separate IPO for its different business groups. In March 2023, Alibaba announced splitting into six business groups having individual listings. Moreover, former Vice President Al Gore’s firm Generation Investment Management sold its entire Alibaba holdings, saying it was a mistake.

Alibaba Group Holdings – Split Between Layoffs & Splitting

Chinese internet giant Alibaba is making 7% job cuts and planning to split into six business groups. Most laid-off employees would be from its Cloud division; the e-commerce king is offering severance packages for affected employees and looking at possibilities of transferring some workers to other facilities.

In August 2022, Alibaba had to let go of nearly 10,000 employees to cut costs amid a sluggish sales record and China’s slowing economy.

Alibaba plans to split into six business units, each with a separate listing and IPO. These include the Cloud Intelligence Group, Taobao Tmall Commerce Group, Cainiao Smart Logistics Group, Local Service Group, Digital Media and Entertainment Group, and Global Digital Commerce Group.

Each of the businesses, as mentioned above, would have its CEO and board of directors.

Generation Investment Management, an investment firm of ex-Vice President Al Gore, recently sold its entire investment in Alibaba in Q1 2023. The company owned 3.7 Million of BABA stock by the end of 2022. But sold its complete holdings, and company management did not paint the e-commerce company in good light.

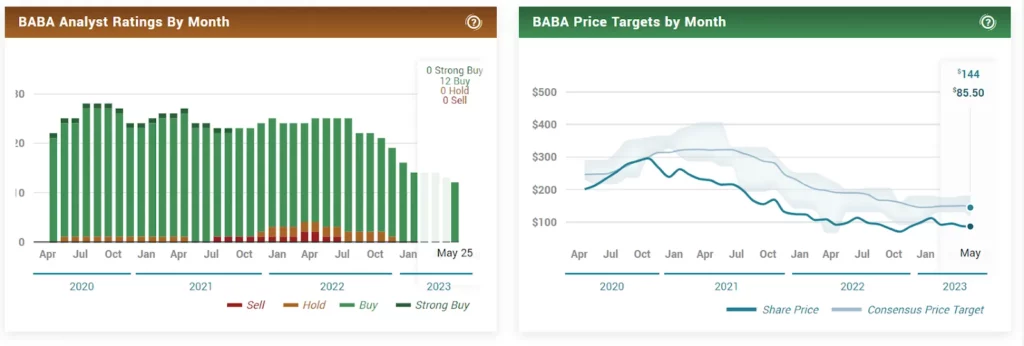

At press time, BABA stock was trading at $81.02 with a drop of 2.10%; previous close and open were at $82.88 and $82.17, respectively. 52-week change is a drop of 14.05%. With an average volume of 23.64 million shares, the market cap stays strong at $208.10 Billion. Analysts gave a 3.07 rating for Buy, placing the price target at $143.69 with a 76.9% upside.

Concerning March 2023 data, revenue hiked 2.03% with a YoY of $208.20 Billion, revenue trailing twelve months (ttm) $868.69 Billion. The income per share was reported to be $331.24, and the quarterly revenue growth was 2.00%. Operating expenses increased by 14.17% to $54.14 Billion, and the operating margin gained 11.86%.

Net income gained 367.07% to $23.64 Billion, and profit margin jumped by 8.38%. Return on assets and equity gained 3.74% and 6.00%, respectively. Earnings per share jumped 35.35% from $1.34; current essential EPS is $4.02. Price to earnings (P/E) ratio is 20.79, considered good, while the P/S ratio is 1.71.

The last earnings were reported on May 18, 2023, with reported revenue of $30.308 Billion, but it was estimated to be $30.378 Billion. The surprise was said to be minus $70.257 Million, with a drop of 0.23%.

Alibaba Stock – Candle Exploration

Trandlines’ descending trajectory, relatively flat movement of EMA, and an RSI of 45.04 indicate that bears are active in the market. The BABA stock price action is making lower-low swings and is bouncing off the $81.21 mark. Negative earnings contributed to the dip, and the price is expected to drop to S1 at $80.63.

If the IPO and splitting business works, the price could rally, but first, it must cross the trend line and test R1. Moreover, if the results of IPO listings are positive, the price could rally in the long run.

Disclaimer:

The views and opinions stated by the author, or any people named in this article, are for informational purposes only and do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

With a background in journalism, Ritika Sharma has worked with many reputed media firms focusing on general news such as politics and crime. She joined The Coin Republic as a reporter for crypto, and found a great passion for cryptocurrency, Web3, NFTs and other digital assets. She spends a lot of time researching and delving deeper into these concepts around the clock, and is a strong advocate for women in STEM.

Home

Home News

News