- 1 Microsoft issued an alert against a malicious attack carried out by Volt Typhoon.

- 2 MSFT stock was rising in the premarket.

Tech sector’s layoff spree appears not to have lost its momentum. Data shows that companies have cut more jobs than they did in 2022. Microsoft (NASDAQ: MSFT), an American multinational technology company, also announced job cuts during January 2023 that would affect over 10,000 employees. Currently, MSFT stock was trading at $324.20, up by over 3% in the pre-market.

The Deal is On!

Recently, the tech giant forewarned users on their official blog regarding Volt Typhoon, a state-sponsored actor in China. The alert notes that the group is carrying out an attack on crucial U.S. infrastructures that may harm several comm channels. It also mentions a National Security Agency’s (NSA) cybersecurity advisory issued this month to stay past the potential damages.

The company is getting a lot of heat from its Activision Blizzard (NASDAQ: ATVI) deal. News broke in January 2023 that the Windows maker is going after the Call of Duty publisher, acquiring it for $70 Billion. However, regulations became the crux of the matter as the Competitions and Markets Authority (CMA) blocked the biggest deal in the gaming industry.

Lawmakers were concerned about the Xbox creator becoming the monopolistic power in the gaming sector. A couple of weeks ago the European Commission, part of the European Union (EU) approved the deal. With this, light on the horizon has gotten brighter for Microsoft.

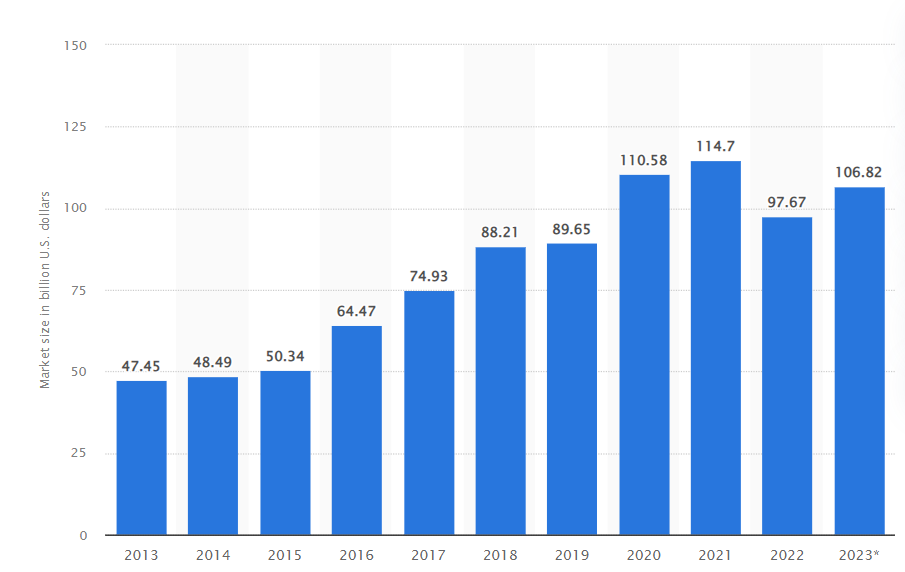

Gaming market is expected to be a boon for companies entering the space. Joost van Dreunen, an investor and financial advisor to startups, believes that the company needs the U.S. market or the deal is a bust. According to Statista, a consumer and market data aggregator, the nation generated $97.67 Billion last year. The number is expected to reach $106.82 Billion this year.

MSFT Stock Price Analysis

Money flow index (MFI) is currently hovering over the buyers’ territory, aligning with the current uprising in MSFT stock. The price is, at present, above the moving average ribbons, a potent sign suggesting an acclivous momentum. True strength index (TSI) is nearing a signal line, indicating a downtrend if it crosses below.

Williams alligator is currently eating with its mouth open, suggesting a potential rise in price. Bull bear power (BBP) shows buyers’ dominance in the market, nonetheless, there appears to have a steep fall in coming days, eliminating a potential move upwards. Fib retracement highlights MSFT stock having a breakthrough, and has primarily risen since. As of now, the price holds support at $292 and resistance around $330.

Microsoft Losing Console Wars

While the gaming market may prove to be a boon for the company, its video game segment is ailing. Phil Spencer, Xbox CEO, recently explained during a video game podcast dubbed Kinda Funny Games that the company is losing console wars. Currently, Microsoft stands at number 3 in this market meanwhile, Sony’s PlayStation holds the crown.

Nevertheless, cloud computing may become a driving force for the company. According to Gartner, a U.S.-based technological research firm, the market generated almost $500 Billion last year and is expected to add $100 Billion to the number this year.

If Microsoft successfully signs the papers with Activision Blizzard, it may become one of the largest companies in the gaming market. With cloud services already revolutionizing the way businesses operate and artificial intelligence (AI) simplifying several processes, the tech behemoth may rise colossally in the remote future.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only. They do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Anurag is working as a fundamental writer for The Coin Republic since 2021. He likes to exercise his curious muscles and research deep into a topic. Though he covers various aspects of the crypto industry, he is quite passionate about the Web3, NFTs, Gaming, and Metaverse, and envisions them as the future of the (digital) economy. A reader & writer at heart, he calls himself an “average guitar player” and a fun footballer.

Home

Home News

News