- 1 Latest earnings release sent the company shares skyrocketing.

- 2 PLTR stock gained over 6% in a day.

People and companies across the globe have started hailing artificial intelligence (AI), the reason being its implications in almost all the industries. Palantir (NYSE: PLTR), a U.S.-based big data analytics and tech company, is using the technology to provide assistance in different fields including aviation, military and more. Currently, PLTR stock was trading at $13.65 at the publication time.

A War on AI is Likely

Several technology stocks including Nvidia (NASDAQ: NVDA), Nutanix (NASDAQ: NTNX) and more were rising following the earnings reveal. The companies are inclining more towards AI, however, it can deliver perilous effects globally. According to Fox Business, John Grant, Palantir’s civil liberties engineer, said during the Reagan Institute Summit on Education (RISE), “AI is a nuclear bomb and the entire world has already got it.”

He added, “I’m not sure as a society we’re ready to handle that very well,” he explained. “We need people to take their own responsibility for how they use it — and that’s a challenge.” Additionally, he highlighted a quote from a Twitter engineer responsible for inventing retweets, “We might have just handed a 4-year-old a loaded weapon.”

The Washington Post’s columnist, David Ignatus, highlights in an article how Ukrainian forces are using Palantir’s equipment in the war. He mentioned his visit to Palantir’s Kyiv office, witnessing revolutionary technologies that can change the face of war. Additionally, the article also addresses that government agencies have misused their technologies.

War in Ukraine has sent devastating effects on the country’s economy. The Guardian reports that the nation has asked Germany for Taurus cruise-missiles. Previously, Britain has provided them with long range cruise-missiles. According to Bloomberg, the invasion may cause Ukraine’s economy to decline by 45%.

PLTR Stock Price Analysis

A large double-bottom pattern is visible on the chart, beginning a year ago. PLTR stock, in turn, has entered an uptrend. Recent quarterly earnings are likely to remain the primary reason for the momentum. Multiple doji candles have appeared since January 2023, however, a majority of them failed to see a price reversal.

The Chande momentum oscillator has risen above +50, a bearish signal for price. Moreover, average true range (ATR) climbed alongside the recent uptrend, indicating increased volatility in the stock. The price is well above the moving average ribbons so a trend is likely to continue in forthcoming days.

Palantir’s revenue has grown over 17% year-on-year. Latest earnings reveals the company came up with 26% surprise in its EPS and 3.83% in revenue. Q4 2022 earnings saw 49% surprise; however, EPS remained lower than the current. Recently, the organization struck a deal with Ukraine’s Ministry of Digital Transformation for restructuring the infrastructure.

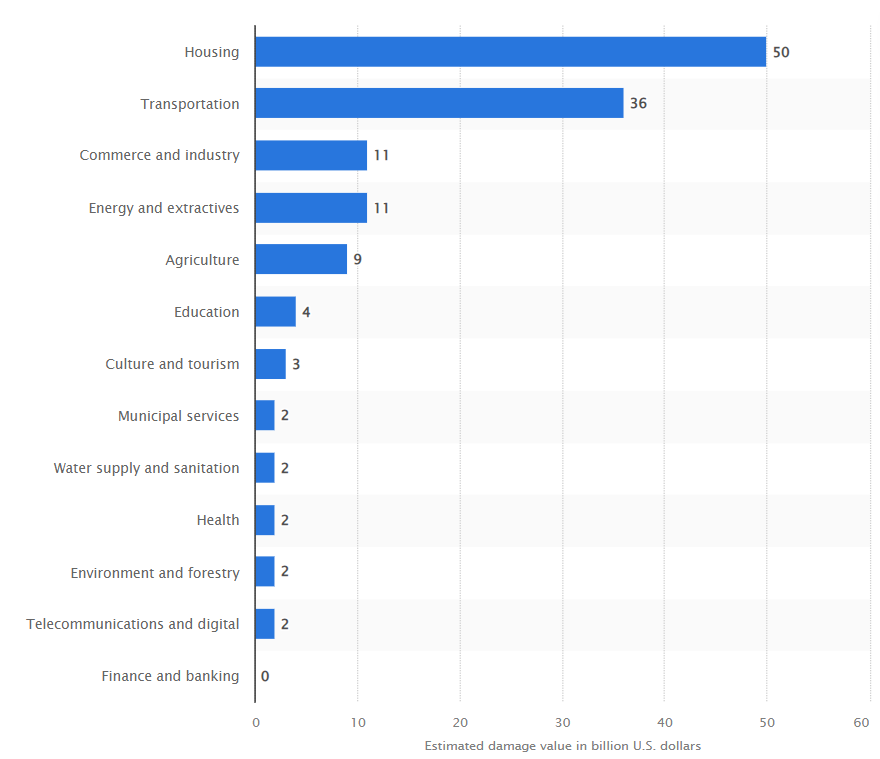

Metrics from data aggregator, Statista, shows that the war has cost Ukraine over $100 billion in damages. Housing and transportation remains heavily affected from the war’s perilous effects.

Anurag is working as a fundamental writer for The Coin Republic since 2021. He likes to exercise his curious muscles and research deep into a topic. Though he covers various aspects of the crypto industry, he is quite passionate about the Web3, NFTs, Gaming, and Metaverse, and envisions them as the future of the (digital) economy. A reader & writer at heart, he calls himself an “average guitar player” and a fun footballer.

Home

Home News

News