- 1 AVGO stock price is showing bullish sentiments in its all-time price performance.

- 2 The stock price of Broadcom also showed nearly 20% of upsurge last week.

Broadcom (NASDAQ: AVGO) stock price marked its 52-week high last weekend, at the trading price of $814.98. The stock price opened at $747.42 on May 26th, Friday and surged towards its 52-week high, while noted low at $747.02. On the same day, the stock price gained almost $83.93 in its trading price with 11% of upside. Meanwhile, the last 5-days of trading session, the stock price growth was near to 19%.

AVGO Stock Price Analysis

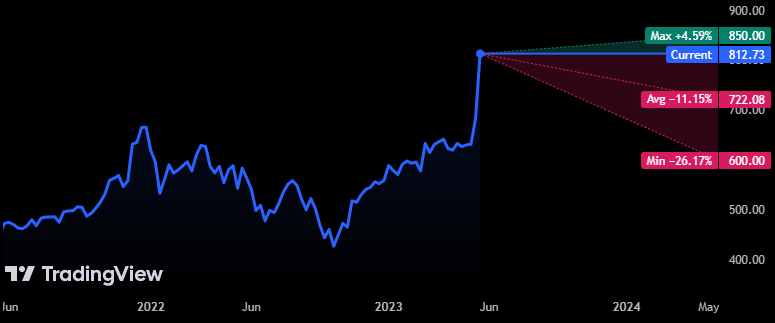

As per the data sourced from Tradingview, on its Friday trading session, AVGO stock closed at $812.73. The recent one-month growth of the stock is over 30% while year-to-date (YTD) price surge noted 43% of price gain. As the stock price shows bullish sentiments it leads towards its 52-week high with the help of active bulls in the market.

As shown in the above price chart, a quite good trading volume was seen in the Broadcom trading price. This eventually took the stock price to mark its 52-week high with the active bulls dominance. The dominance of bulls in the market took the stock above its 200-day EMA in its recent 2-days of trading. The RSI is already resting in the overbought zone further enhancing the investor’s confidence in the stock.

Furthermore, the analysts have set their price target at $722.08 that is nearly 11% down from its recent closing price. The one-year price forecasts are set by the analysts having a maximum estimate at $850.00, while the minimum estimate is at $600.00.

Earnings and Revenue Highlights

Broadcom Inc will report its second quarter earnings and revenue 2023 report on June 1st. And before that, the company has already experienced quite-good trading volume. However, before its first quarter and revenue report of this year, the company also showed bullish sentiments but was not like the present performance.

The total revenue of AVGO for the last quarter is $8.91 billion, and it’s 0.17% lower compared to the previous quarter. The net income of Q1 23 is $3.77 billion. The EPS for the last quarter was $10.33 whereas the estimation was $10.17 which accounts for 1.61% surprise. Broadcom revenue for the same period amounts to $8.91 billion despite the estimated figure of $8.90 billion.

The estimated earnings for Q2 2023 are $10.12, and revenue is expected to reach $8.70 billion. Its revenue for the last year amounted to $33.20 billion. The most of almost $25.82 billion came from its highest performing source at the moment, Semiconductor Solutions. Notably, the greatest contribution to the revenue figure was made by China which further includes Hong Kong. In the previous year, it brought Broadcom Inc $11.64 Billion.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only and do not establish financial, investment, or other advice. Investing in or trading crypto or stock comes with a risk of financial loss.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News