- 1 Crypto market was down by over 3% at publication time.

- 2 Metaverse tokens survived both the contagion last year.

It is a bad time for the metaverse. On one hand, people are writing about its potential ‘death,’ while the U.S. regulatory watchdog, Securities and Exchange Commission (SEC), is trying to bury it completely. The recent clampdown of the government agency on the crypto industry has created chaos. The sector was unaffected by the LUNA and FTX contagion, but is now shaken after the SEC claimed several virtual currencies are securities.

Metaverse Tokens Coming Across Too Many Sell-Offs

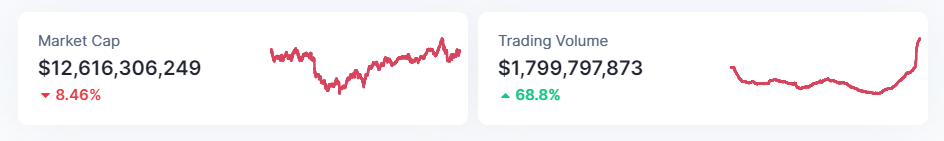

According to CoinMarketCap, a cryptocurrency data aggregator, the metaverse sector lost over 8% market capitalization during the past 24 hours. Data feed has turned red resembling a bloodbath in that particular section. A rapid sell-off in the market has led to an almost 70% gain in metaverse token sales.

The Sandbox (SAND) has lost over 15% while its rival Decentraland (MANA) has shed over 11% in its value. Axie Infinity (AXS) was struggling with a 9% downfall in price. Apecoin (APE), the native token to the Bored Ape Yacht Club ecosystem and its upcoming metaverse game Otherside, fell around 2% at the time of publication.

Theta Network (THETA), a decentralized video delivery platform, was down by nearly 5%. Moreover, the biggest metaverse token by market cap, Internet Computer (ICP), is trading around 8% low in a day. From over 250 metaverse cryptocurrencies, a lion’s share was affected after the news.

SEC vs Crypto Appears to Be a Lasting Battle

Gary Gensler, SEC chairman, has stated in the past that a majority of cryptocurrencies in the market will fail. The SEC is currently involved in a lawsuit against Ripple Labs, creator of Ripple (XRP), alleging that it traded as an unregistered security in the market. An asset is required to meet the Howey Test to be called a security.

In August 2021, the agency called the crypto currency sector a financial ‘Wild West.’ Gensler said, “Right now, we just don’t have enough investor protection in crypto. Frankly, at this time, it’s more like the Wild West.” Adding that, “This asset class is rife with fraud, scams, and abuse in certain applications. There’s a great deal of hype and spin about how crypto assets work. In many cases, investors aren’t able to get rigorous, balanced, and complete information.”

Virtual currencies are deemed an integral part in the metaverse, potentially driving the digital economy there. The market is rife with speculations about the impact of these serious claims on these tokens. Crypto sector witnessed a bloodbath last year, leading several investors to exit due to fear, uncertainty and doubt (FUD).

Seems like dark shadows have not left the industry yet. After FTX cratering, the market somehow managed to stand on its legs. However, this blow may force the industry to stay down. As of now, the crypto market is sitting atop over $1 Trillion in market capitalization with a 3% loss in the last 24 hours.

Anurag is working as a fundamental writer for The Coin Republic since 2021. He likes to exercise his curious muscles and research deep into a topic. Though he covers various aspects of the crypto industry, he is quite passionate about the Web3, NFTs, Gaming, and Metaverse, and envisions them as the future of the (digital) economy. A reader & writer at heart, he calls himself an “average guitar player” and a fun footballer.

Home

Home News

News