- 1 Global oil supply capacity is anticipated to reach 111 Million barrels per year by 2028.

- 2 AMPS stock closed at market value of $5.37 yesterday.

Rising inflationary pressures and soaring gas and oil prices are weighing in on energy stocks. Altus Power (NYSE: AMPS), a clean energy company, experienced a plunge in valuation. AMPS stock fell by over 5% in yesterday’s market, closing at $5.37. Other energy stocks including Exxon (NYSE: XOM), Equinor ASA (NYSE: EQNR), Canadian Natural Resources Limited (NYSE: CNQ) and more were down by over 1%.

Oil Demand May Rise

Shell Plc (LON: SHEL), a British oil and gas production company, recently announced it will boost their production in China, citing “very robust” demand in the Chinese market to book profits in near future. Company CEO Sael Sawan said, “ we have been very clear, we will be committed to our oil and gas businesses for a long time to come,” according to CNBC.

According to the International Energy Agency (IEA), an autonomous intergovernmental organization, oil demand may rise by 6% by 2028 worldwide. Global supply capacity is anticipated to reach 111 Million barrels from 5.6 Million barrels by then. The agency has urged everyone no new development in oil, gas or coal to attain net zero carbon by 2050.

The United States has committed to go carbon neutral by 2050. Altus Power being a clean energy producer may benefit from the target, potentially placing AMPS stock in an upward trajectory. The company has, to the date, generated 4.5 Billion kWh of solar power which is equal to consumption of 7.5 Million oil barrels or 3.6 Billion lbs of coal.

AMPS Stock Price Analysis

Woodies CCI has reached below zero while Williams percent range has left the overbought zone recently, indicating AMPS stock price might be losing strength. Spinning top patterns shows bears and bulls were involved in several head-ons recently. However, both failed to dominate the price.

AMPS stock broke $5.7 resistance yesterday but returned under 0.236 fib level, failing to make it a support. The price has followed a nice downtrend since the year’s beginning. Nevertheless, AMPS shares broke through the hawkish market, returning to a monthly bullishness until yesterday.

Growth Prospects For AMPS Stock

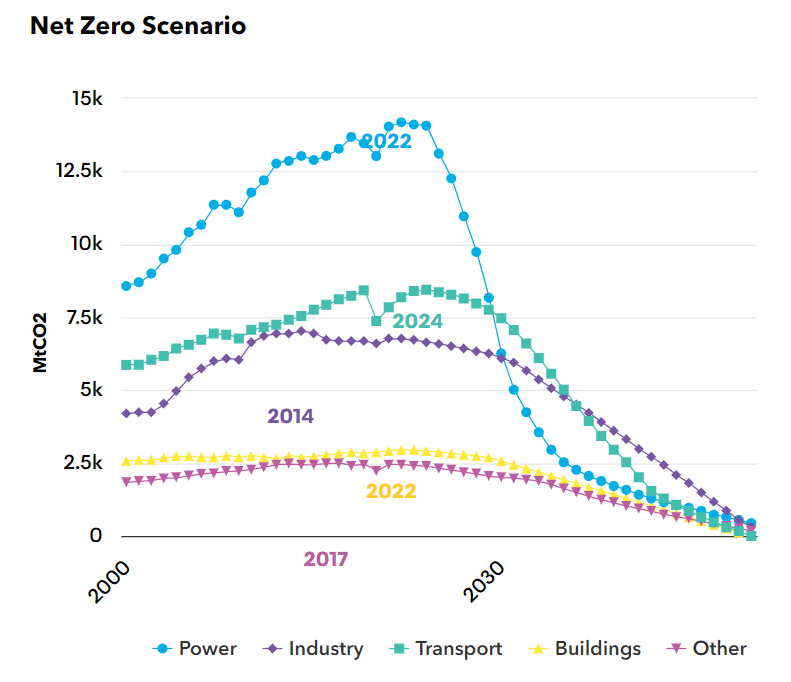

Attaining carbon neutrality is no easy feat for the U.S. Still, the nation believes focusing on certain aspects may help attain it. According to BloombergNEF (BNEF), a strategic research provider, the global energy sector was the leading source of carbon emissions during 2022, producing over 14K metric tons of carbon dioxide equivalent.

Bloomberg expects a steep decline in greenhouse gas emissions from power consumption, considering a large chunk of markets might turn to renewable energy.

California has Altus Power’s largest client base. The region can be a major profitability driver for AMPS shares. The government funded programs for renewable energy including Desert Renewable Energy Conservation Plan, Geothermal Grant, Renewable Energy for Agriculture Program makes the state apt for its operations.

Globally, China leads the way in renewable energy capacity with 1,161 gigawatts (annual), followed by the U.S. with 352 gigawatts/year and Brazil with 175 gigawatts/year.

According to the International Trade Administration, a part of the U.S. Department of Commerce, Uruguay is the only country drawing almost 100% energy using renewable sources.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only and do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Anurag is working as a fundamental writer for The Coin Republic since 2021. He likes to exercise his curious muscles and research deep into a topic. Though he covers various aspects of the crypto industry, he is quite passionate about the Web3, NFTs, Gaming, and Metaverse, and envisions them as the future of the (digital) economy. A reader & writer at heart, he calls himself an “average guitar player” and a fun footballer.

Home

Home News

News