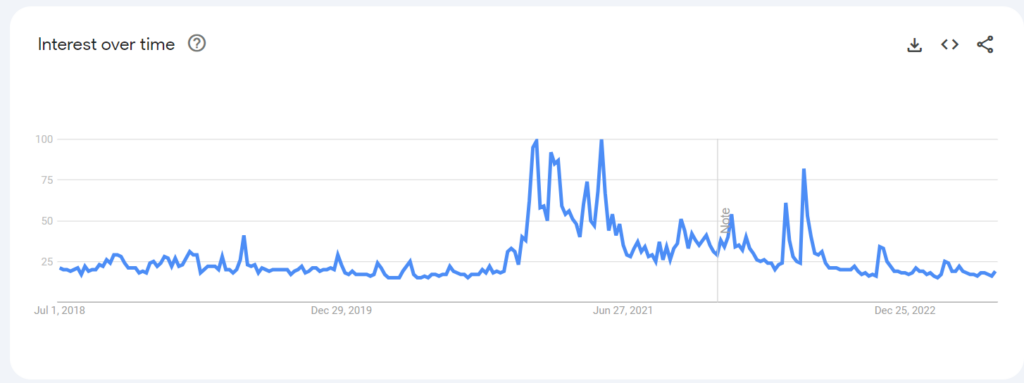

- 1 The search for Bitcoin is below 2018’s level and is expected to drop lower.

- 2 Bitcoin’s price is trading at $30,402, up by over 5% in the last seven days.

The biggest cryptocurrency in the world, Bitcoin (BTC), has also been one of the most trending topics, inside and outside the crypto space. However, recent data shows a loss of common interest in the leading digital currency.

Bitcoin Searches Drop in Contrast to Price

Google Trends data shows the interest in Bitcoin is at its lowest point in history. The trend is in contrast to the performance of crypto assets, especially since the year’s start.

source: Google Trends/Bitcoin

For the most part of 2022, the broader cryptocurrency space was struggling through the crypto winter phase. Every other crypto asset was seen to lose values during the time when major cryptocurrencies Bitcoin (BTC) and Ethereum (ETH) were also no exception. The phase caused many digital assets to lose their rankings in terms of market capitalization.

But since the start of 2023, the trend has reversed and the global crypto market which slid below $1 Trillion, has recovered. Bitcoin value saw a surge of over 80% from there, and is currently trading around highs of 2023.

However, in the aforementioned two different scenarios, the organic search for the digital asset is different and surprisingly opposite. Currently, Bitcoin price is in its recovery phase. The searches are indicative of common interest losing and is going below the level during crypto winter. The trend level at present is at a multi-year low.

Could be Losing Interest?

The free tool from the search engine giant, Google Trends, showcases the searches made by people on Google. “Interest” on any specific topic or the searched terms can be found by evaluating the searches in a particular time-frame. Thus, decreasing searches of “Bitcoin”’ then signifies the losing interest.

Current statistics show Bitcoin searches have slid below the levels in 2018, and are expected to drop even lower. The insight comes from the past momentum of the trend over the chart where it has been almost in a free-fall motion since the start of the year till this time. The loss of interest could be the continuation of the pattern followed in the later part of 2022.

Despite the statistics indicating the “disinterest” in Bitcoin, the cryptocurrency still remains a valid subject. This time it’s because of exchange traded funds (ETFs). Many traditional finance (TradFi) players in the United States are entering the space and filing for spot Bitcoin ETF with the Securities and Exchange Commission.

The recent rollout started when asset management giant, BlackRock, filed for a spot Bitcoin ETF around mid-June. The instance is followed by several other traditional finance institutions to take steps forward towards filing. WisdomTree, Invesco, Valkyrie, Fidelity, etc., are said to file for the crypto fund product. Experts believe there are more financial institutions in the queue to explore the opportunities in the space.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News