- 1 AVY stock showed a bounce from the support of $160 in the past sessions.

- 2 Buyers showed their presence and showed aggressive moves to rescue the gains.

Avery Dennison Corporation (AVY stock) showed volatile moves and regained momentum, trading near the upper trendline of $185, which is proving to be a solid hurdle to escape. However, the stock rebounded amid weak Q2 results which was released on 25 July. The results were below estimates. The EPS fell by 6.20% and revenues by 2.91% (QoQ), whereas net income dropped 53.19% to 100.40 Million and the EBITDA by 19.84% to 307.80 Million.

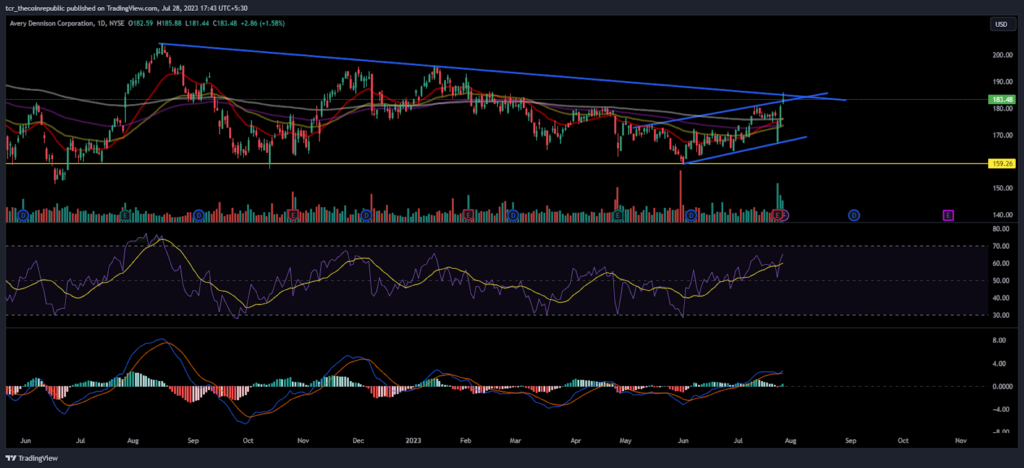

AVY price chart shows the three rising soldiers pattern and consecutive gains registered post Q2 numbers, as the market did not react negatively. The sellers were trapped and covered their positions. On the other hand, buyers took advantage of the bounces and persisted in making long positions.

From the start of 2023, AVY stock price continued to lose gains from the top of $200, and lower highs and lower lows stayed in a downtrend. Recently, the trend reversed, the price escaped the prompt hurdle of $170, and significant moving averages showed fresh reversal indications. If follow-on buying arises and the price hits the trendline of $185, the price is likely to stretch to the $200 level soon.

Avery Dennison Corp. is engaged in the provision of labelling and packaging materials and solutions. It operates through the Materials and Solutions Group segments. The Materials Group segment manufactures and sells pressure-sensitive label materials, films for graphic and reflective products, performance tapes, and other adhesive products for industrial, medical, and other applications, as well as fastener solutions.

The Solutions Group segment designs, manufactures, and sells a wide variety of branding and information solutions, including brand and price tickets, tags and labels, and related services, supplies, and equipment. The company was founded by R. Stanton Avery in 1935 and is headquartered in Mentor, OH.

At press time, AVY stock is trading at $183.48 with an intraday gain of 1.58% showing bullishness in the overnight session. Moreover, the trading volume increased by 3.25% to 1.026 Million. The market cap of AVY stock is $14.812 Billion. Analysts maintained a strong buy rating and remained overweight with a strong growth outlook.

AVY Stock Shows Fresh Bullish Indications On Daily Charts

On the daily charts, AVY stock price is trading near the important zone near the hurdle of $185, which, if surpassed, would lead to a massive breakout on the charts.

The RSI curve stayed in the overbought zone near 65 and formed a positive crossover which indicates a bullish indication and a further rise in the following sessions.

The MACD indicator showed a bullish crossover and indicates a positive outlook, suggesting further traction for the upcoming sessions.

Conclusion

Avery Dennison Corporation (AVY stock) price is on the verge of a breakout and indicates buyers’ dominance on the charts. Moreover, the double bottom pattern allowed buyers to stretch the reversal beyond the trendline of $185.

Technical Levels:

Support Levels: $175

Resistance Levels:$188 and $200

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only and do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News