- 1 VET stock price surged 3.03% in the last trading session and is currently trading at $13.59.

- 2 Vermilion Energy Share is good value based on its Price-To-Earnings Ratio (2.1x) compared to the peer average (2.1x).

Vermilion Energy is a company that explores and produces oil and gas in various countries. It has land holdings in Canada, the US, France, the Netherlands, Germany, Croatia, Hungary, and Slovakia.

Vermilion Energy’s share price is currently trading at $13.59, inclining 3.03% in the last trading session. VET stock holds a market cap of $2.2 Billion. It has a total of 164.7 Million shares outstanding. The PE ratio for the stock is 2.1. It has annual sales of $2,627 Million.

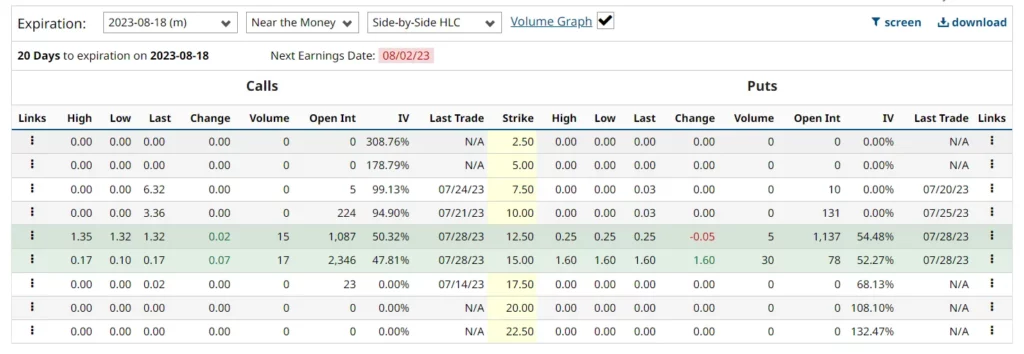

VET stock derivatives data states that the current Implied volatility in the market is 47.32% with an increment of 0.69% in the last trading session. It has a total of 90.08K open interest contracts as of now. The PUT/CALL ratio is 0.25 indicating a bearish sentiment coming to an end as PCR is bottoming out.

VET Stock Price Prediction Using Price Action Strategy

VET share price analysis reveals that the stock was in a correction phase and declined nearly 40% from January to May 2023, thus forming a new swing low of $10.80. Thereafter the price got the support of buyers and surged nearly 25% to change its character from bearish to bullish.

Thereafter, the price made a dip again but ended up forming a new lower high and surged to the previous high. Currently, the price is trying to sustain near the swing high and forming a triangle pattern.

Now, if the price breaks and sustains above the swing high, it may attract more buyers to enter into a trade and surge higher. Also, the price may surge as the result days are nearing.

VET Share Price Forecast from Indicators’ point of view

As per the EMA analysis, the VET stock price is trading above 50 EMA and surged higher after getting support which indicates the short-term presence of buyers in the market. Also, the price needs to surpass the hurdle of 200 EMA to surge higher.

At the time of publishing, the RSI value of the VET share price is 58.69 and that of the SMA line is 58.71. RSI is headed upwards by getting support from the SMA line which shows the short-term presence of buyers in the market.

Conclusion

VET stock price prediction concludes that the stock was in a correction phase and declined 40% from January to May 2023. Thereafter the price got buyer’s interest and surged nearly 20% thus changing its character. Currently, the price is trying to sustain near the swing high after the breakout of which the price may surge higher. The indicators are also leaving a positive note about the current sentiment in the market. Also, the results are awaiting which may affect the price to surge higher before the disclosure of the results.

Technical Levels

- Support levels: $11.94 and $10.75.

- Resistance levels: $14.02 and $14.94.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only and do not establish financial, investment, or other advice. Investing in or trading crypto or stock comes with a risk of financial loss.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News