The Forex market is the most liquid financial market in the world, with average daily trading volumes of almost $7 billion. This liquidity, which refers to the simplicity with which assets can be purchased and sold, is primarily attributable to the money’s perceived flexibility on a global scale.

However, the success of this industry is not a result of luck. Market efficiency and its participants’ success depend on a group of crucial actors known as liquidity providers.

Who are these liquidity providers, and what’s their role in forex market functionality?

The Importance Of Liquidity In Forex

At its heart, FX liquidity is about how swiftly and efficiently a currency can be bought or sold without causing substantial price swings. This level of fluidity in the foreign exchange market is made possible thanks to a wide array of participants, each contributing to the overall liquidity of the market.

This ensures there’s always someone ready to finalize a transaction, whether as a buyer or a seller. The end result? Currency pairs are traded smoothly, with efficient execution and minimal spreads, a testament to the market’s high liquidity.

The importance of liquidity cannot be overstated. It’s a vital cog in the machinery of market efficiency, enabling quick and smooth asset movements. Moreover, it acts as a buffer against sudden price changes by ensuring there’s always someone ready to either buy or sell an asset at the prevailing market price.

Liquidity Providers, or LPs as they’re commonly known, are crucial to keeping this machine well-oiled. They hold significant volumes of foreign currency and are willing to operate on tight spreads, thus ensuring the market remains liquid. Their presence makes the FX market more navigable for traders, providing a cost-effective and quick way to enter and exit positions. Without LPs, the market could become less efficient and more susceptible to large price swings.

Types of Liquidity Providers

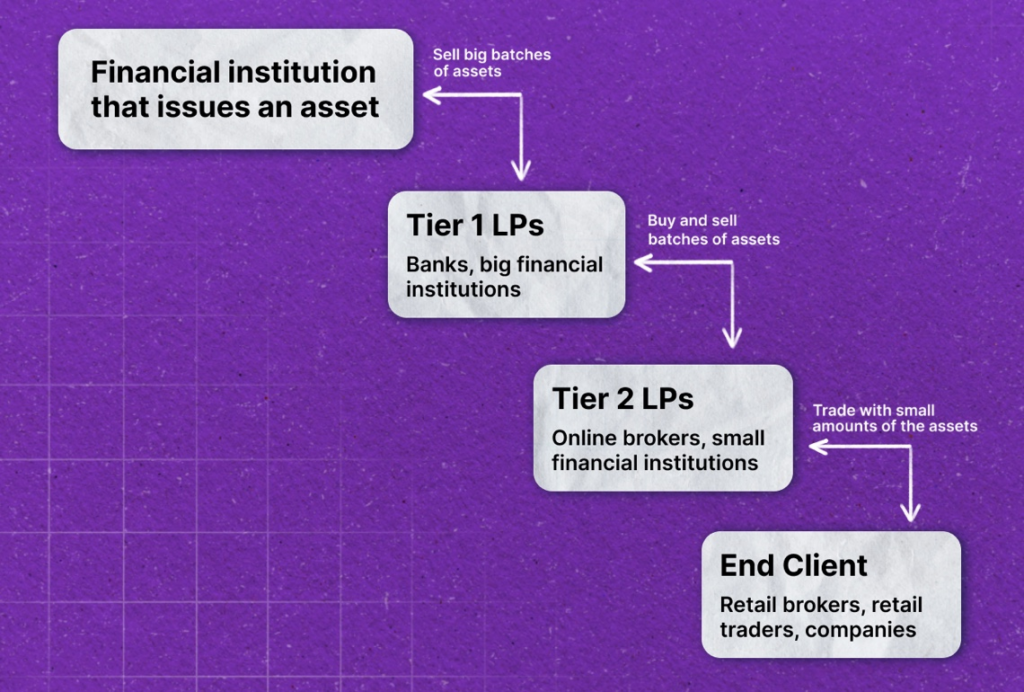

The foreign exchange market hosts a variety of Liquidity Providers (LPs), each critical to maintaining market liquidity. Typically, LPs are grouped into three primary categories: Tier-1 Banks, Non-bank LPs, and Electronic Communication Networks (ECNs).

Tier-1 Banks, comprising major global banking entities like HSBC, Barclays, and J.P. Morgan, are the primary liquidity providers. Given their vast financial resources, they fuel the FX market with substantial liquidity.

Non-bank LPs, on the other hand, aren’t banking institutions, yet they significantly contribute to market liquidity. This group includes entities like hedge funds, private trading firms, and other financial institutions, adding depth to the market through consistent trading activities.

ECNs, the third category, function as intermediaries between small market participants and larger liquidity providers. By compiling quotes from various LPs, smaller investors and traders can tap into liquidity typically accessible only to more prominent market entities.

Why Should You Work With A Liquidity Provider As A Broker?

Working with an FX Liquidity Provider as a broker brings several notable benefits.

Enhanced Market Efficiency

As a broker, working with an FX Liquidity Provider (LP) contributes to market efficiency. LPs provide a platform that bridges buyers and sellers, effectively narrowing the spread between bid and ask prices. This optimized process significantly reduces transaction costs for traders.

Increased Market Transparency

Partnering with an LP also leads to greater market transparency. A centralized trading platform allows a clearer view of pricing trends and market activities. This heightened visibility increases market efficiency and diminishes the potential for fraudulent activities and market manipulation.

Improved Market Liquidity

Collaboration with an LP has a positive impact on market liquidity. LPs facilitate smooth interactions between buyers and sellers, keeping the market dynamic. This continuous flow of transactions assists in price stabilization, thereby preventing significant market swings.

Reduced Market Risk

Lastly, LPs aid in mitigating market risk. Providing a centralized platform for trade execution limits the potential negative impacts of market volatility. Short-term traders may find this especially advantageous for capitalizing on market fluctuations to maximize profits. Therefore, working with an FX LP as a broker can yield substantial benefits in terms of efficiency, transparency, liquidity, and risk reduction in the market.

Top Liquidity Providers In FX

After comprehensive research, we highlight three organizations as superior liquidity providers in the Forex market.

1. B2Broker

B2Broker, a dominant player in the cryptocurrency and Forex markets, is celebrated for its technology and liquidity services. They boast an extensive liquidity pool, aggregated from premier Banks and non-Bank providers, guaranteeing seamless execution of transactions of all sizes.

With over 800 trading instruments across eight asset classes and a global footprint, B2Broker is licensed by various prestigious financial regulatory bodies, enhancing its reliability.

2. Top FX

TopFX, a Prime CFDs Broker with a 12-year history, offers unparalleled liquidity services to a range of clients in the e-FX & CFD industry. It enables the trading of over 600 assets across various categories. With client funds maintained in secure, segregated accounts with reputable banks, TopFX ensures a safe and dependable trading environment.

3. FXCM Prime

FXCM Prime is a centralized platform for Forex market data and transaction execution. It integrates trades from various ECN and individual bank trading platforms, providing a consolidated view of client positions. FXCM Prime is a comprehensive solution for diverse trading firms offering cost-effective connectivity options and unbiased prime services.

Conclusion

Liquidity Providers undeniably hold a pivotal role in the foreign exchange market. Their presence ensures the vital infusion of capital required to sustain market liquidity, reducing transaction costs for traders. Beyond this, LPs are instrumental in augmenting market transparency and mitigating market manipulation risk.

When selecting an LP, it’s essential to consider the breadth of its product and service offerings. It’s equally crucial to verify their reputation in the market to receive smooth and healthy services.

Disclaimer: Any information written in this press release or sponsored post does not constitute investment advice. Thecoinrepublic.com does not, and will not endorse any information on any company or individual on this page. Readers are encourag to make their own research and make any actions based on their own findings and not from any content written in this press release or sponsor post. Thecoinrepublic.com is and will not be responsible for any damage or loss caused directly or indirectly by the use of any content, product, or service mentioned in this press release or sponsored post.

For publishing articles on our website get in touch with us over email or one of the accounts mentioned below.

Home

Home News

News