- 1 RFIA Act was reintroduced with amendments in the U.S. House of Representatives.

- 2 If passed, it would solve the crypto regulatory scenario in the United States.

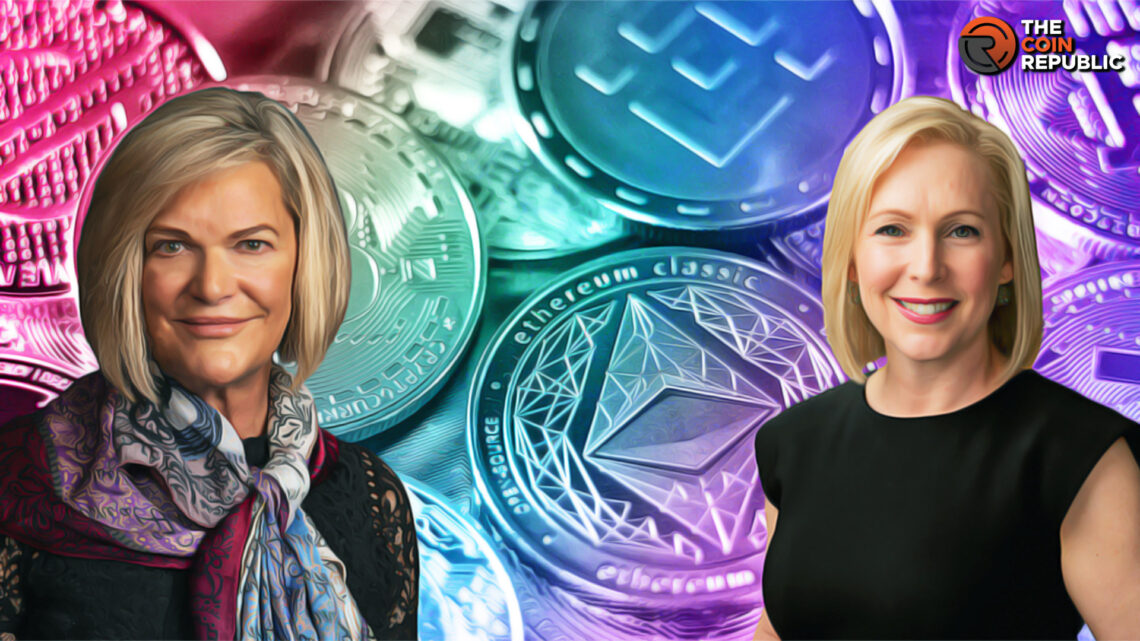

The Lummis-Gillibrand bill, aka the Responsible Financial Innovation Act (RFIA), will solve the crypto regulatory conundrum in the U.S. United States Senators Cynthia Lummis (R-WY) and Kirsten Gillibrand (D-NY) proposed a revised version of their previously introduced crypto regulations bill on July 12, 2023. If passed, it would fill the void in the regulatory framework in America.

United States and Crypto Regulation

The RFIA is aimed at enhancing the regulation of digital assets. During its various stages of implementation, it would clarify the regulatory roles of the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). These two agencies were locking horns over jurisdiction over the crypto industry, creating more than the required obscurity.

The new act would force these two regulatory bodies to join hands and regulate the digital asset industry. Also, it tries to solve the fiery issue of digital asset classification; securities would be governed by the SEC, while the CFTC would police commodities.

Recently, the SEC sued Coinbase, the world’s biggest crypto exchange, and listed several digital assets as securities. Also, the CFTC took action against Blockratize, bZerox, and others. After the Black Swan event of FTX collapse, the regulatory actions by the SEC over the crypto industry surged by 183%, creating a hostile environment for the industry.

The proposed digital asset, which does not represent debt or equity or provide its investor with a financial interest in the business, will not be considered a security, even if it benefits from entrepreneurial and managerial efforts that determine the value of the assets. While digital assets like Bitcoin and Ethereum, which add up to more than 50% of digital asset market capitalization, would be considered commodities.

How Would the CFTC and SEC Regulate the Crypto Industry?

Per the bill, the primary regulatory authority would be the CFTC, placing the agency on a higher pedestal than the SEC. The CFTC would exercise its jurisdiction only over an agreement, contract, or transaction involving a contract of sale of a crypto asset that is commercially fungible, which shall not include digital collectibles and other unique crypto assets.

Crypto exchanges must be registered with the CFTC and be regulated by the agency. During the previous bill, registration was optional. Moreover, decentralised finance (DeFi) would be regulated in a separate tab.

The Securities and Exchange Commission (SEC) is included in the equation, as the RFIA Act still requires cryptocurrency issuers to disclose bi-annually to the SEC. But if the assets are classified as commodities per the criteria mentioned above, they remain outside the jurisdiction of the SEC.

Consumer Protection Mechanism of RFIA

The RFIA includes various key features to protect consumers, including the following:

- Installing Consumer Protection and Market Integrity Authority, an agency to oversee consumer protection requirements in CFTC, SEC, banking agencies, and others.

- All crypto asset intermediaries are required to maintain a proof-of-reserve (PoR) and must undergo annual verification enforced by the Public Company Accounting Oversight Board.

- Customer agreements must be written in plain and legible English; any changes, if any, must be recorded in a public database.

- Specifying mandatory notice requirements for customers.

- Instilling risk management, separating third-party custody requirements and standards for crypto lending.

- Customer agreements must specify the date and time of final settlement.

- Advertising standards for digital asset marketing will be standardised.

- Crypto asset intermediaries must report cybersecurity breaches to CFTC and the SEC.

These consumer protection amendments pushed for the reintroduction of the RFIA Act in the House of Representatives. Also, these provisions would help the RFIA combat the use of digital assets in illegal financial transactions. It is further strengthening anti-money laundering and sanctions evasion measures. It would also enhance the Financial Crimes Enforcement Network’s (FinCEN) horizons to combat crypto-related financial crimes.

However, the RFIA Act must undergo a rigorous parliamentary procedure before becoming law. Still, the United States authorities and lawmakers consider it a step in the right direction to regulate digital assets and become a crypto superpower.

Conclusion

It remains to be seen whether the Act will become law, but these mechanisms underscore a significant effort to tackle the issues affecting the regulatory framework in America.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News