- 1 LMT stock price fell 5.42% in September 2023.

- 2 Lockheed Martin stock broke down crucial support of $438 and traded near to YTD low.

- 3 LMT stock price entered a correction phase.

Lockheed Martin Corp. LMT stock price broke down the crucial support of $438 and entered a correction phase. It formed a bearish pattern and hit new YTD lows.

The trend of Lockheed Martin stock has turned downward and sellers have taken control of the last support levels.

Recently, Lockheed Martin came into the spotlight due to the ongoing talks related to sanctions. China’s Foreign Ministry said that Lockheed Martin will face sanctions by China after the company allegedly sold weapons to Taiwan.

These sanctions may impact the sale of LMT stock in the coming quarters. Moreover, the stock price did not react much and continues to trade with a mild bearish bias.

For the past few months, LMT stock price consolidated in the range between $438.00 to $480.00.

It showed signs of base formation. But, unfortunately, the sellers took over the control and dragged the price below the lower range. Therefore, the recent breakdown looks reliable and more downfall is possible.

Lockheed Martin stock price closed the previous session at $424.05 with an intraday decline of -0.43%. The market capitalization stands at $106.79 Billion.

LMT Stock Price May Test $400 by 2023 End

LMT stock price expanded the range in a downward direction which raised concern for its long-term investors. The rise in the selling volume is also visible; indicating some genuine investors are cashing out their last investments.

Currently, the sellers are more active so any short-term bounce toward $438.00 may face rejection. However, if any positive news comes and buyers succeed in breaking the $438.00 hurdle, then a sharp rise towards $460.00 is possible.

The analysis suggests that LMT stock price has entered a correction phase and more downside of 4% to 5% is possible.

Lockheed Martin Stock: Decoding the Option Chain

Lockheed Martin stock price has entered a new range so the option traders have also adjusted their positions.

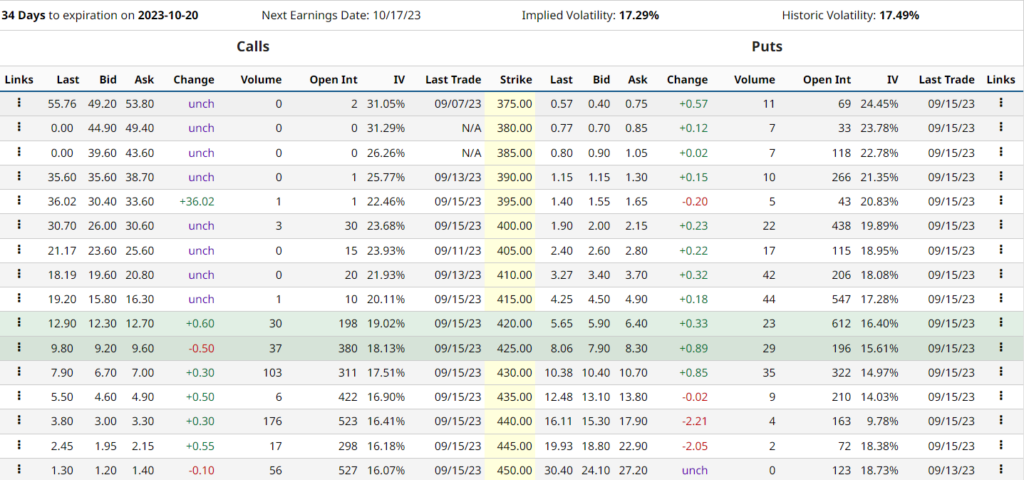

The next month’s expiry is on October 20, 2023. The monthly option chain shows that the highest CALL OI build-up is in a strike of 450 which holds 527 contracts. It is followed by the 2nd highest CALL OI at 440 which holds 523 contracts.

On the PUT side, the highest OI buildup is in the strike of 420 which holds 612 contracts. Therefore, the option chain analysis shows that $420 will act as immediate support, and on the higher side, $440.00 is resistance.

Conclusion

Lockheed Martin Corp. LMT stock price has entered a correction phase. The recent breakdown looks reliable so any short-term bounce may face rejection.

The analysis suggests that Lockheed Martin stock is in the bears’ grip. So, 4% to 5% more downside from the current levels is possible.

Technical Levels

- Resistance levels: $438.00 and $458.00

- Support levels: $420.00 and $400.00

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only. They do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News