- 1 Knightscope has agreed to provide its technologies to Penn Entertainment.

- 2 The PENN share price has consistently followed a downtrend for a long time.

PENN Entertainment Inc. operates in the entertainment assiduity, substantially in the summerhouse and online gaming sectors. It owns and manages several gaming and racing installations, as well as online and retail sports laying platforms. It also has a strategic cooperation with Barstool Sports, which is a digital media company that produces sports and pop culture content.

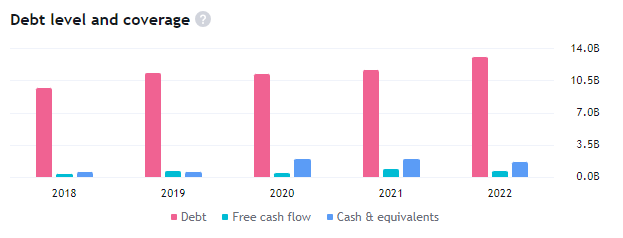

The gross margin of PENN is 33.80% and its net cash decreased by 25.1% as per the second quarter of 2023. PENN Entertainment Inc.’s stock traded between $21.32 and $39.35 levels in the past 52 weeks. Its return on assets rose by 233.2% year-on-year.

The PENN stock is volatile and moves more than the whole market as the beta of the share is 1.6. It has an EPS of $4.77 and a market cap of $3.363B. This company does not pay any dividends to its shareholders

PENN Stock Performance Analysis

The PENN Company’s revenue increased by 2.9% year-on-year and reached $1.67B in the second quarter of 2023. However, this stock’s EBITDA has declined by 23.2% and net income showed a significant advance of 199.2% from Q2 2022 to Q2 2023. It demonstrates that the firm’s financial performance is good enough for sustainability.

Technical Summary of PENN Stock

The PENN share price has been consistently declining for a long time. This decline in price has led to the formation of bearish technicals on the charts. The analysts are further bullish on the stock due to the company’s reliable fundamentals.

PENN Share Technical Analysis

The PENN share price is following a falling wedge channel, resulting in a consistent decline in the share price. This decline in the stock price has led to a powerful downtrend, making bearish candlestick patterns.

Due to a consistent decline in PEN share price, the EMAs are following a downtrend. The 50-day and the 200-day EMAs are trading in a death cross. PENN share’s price is also trading below the EMAs.

The RSI of the share has declined below the 50 level and has also crossed below the 14-day SMA. It has been consistently trading below the median level, indicating bearish momentum on the charts.

Conclusion

The PENN share is following a bearish market structure, trading below the EMAs. The RSI for the share is also giving a sell signal. Currently, the stock fundamentals are reliable for the company but the technicals are not supporting the same factor.

Therefore, the PENN share price can decline to further lower levels unless it breaks above the falling wedge pattern.

Technical Levels

- Support levels for the PENN share are – $16.00 and $21.20

- Resistance levels for the PENN share are – $29.00 and $35.00

Disclaimer

The information provided in this article, including the views and opinions expressed by the author or any individuals mentioned, is intended for informational purposes only. It is important to note that the article does not provide financial or investment advice. Investing or trading in cryptocurrency assets carries inherent risks and can result in financial loss.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News