- 1 Hong Kong’s crypto sector received $64 Billion in cryptocurrencies from July 2022 to June 2023.

- 2 Trading and mining activities in China primarily provided an uplift to crypto activities in East Asia.

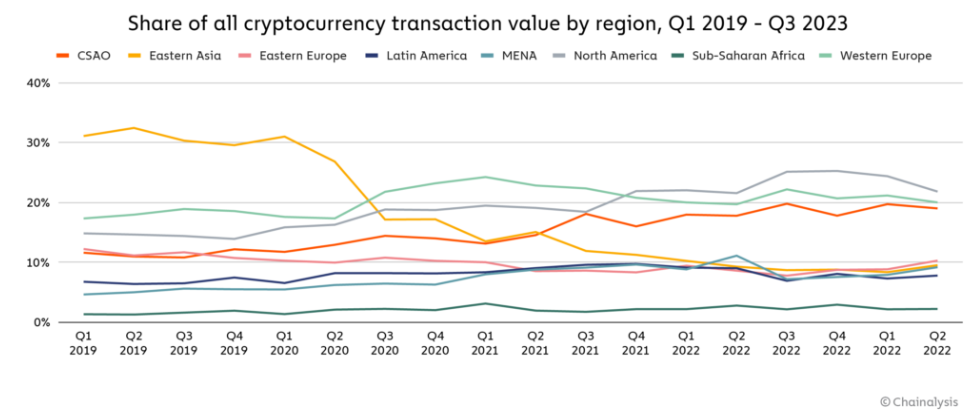

Once abundant with crypto activity, the East Asia digital asset market is facing a cooldown. Chainalysis, a blockchain analytics company, notes in its report that the last few years remain notable in terms of declining affairs. The activity declined after the Chinese government played hardball with the market. Currently, East Asia accounts for nearly 9 percent of the global crypto market.

A Tailwind For East Asia Crypto Market

Crypto activity took a nosedive between Q1 and Q3 2020 in East Asia. By that time, the Middle East and North Africa (MENA) region saw rising crypto affairs. The report mentions that East Asia may experience a potential tailwind through Hong Kong (HK). Chainalysis cites HK’s improving relationship with China could possibly lead to this. Trading and mining activities in China primarily provided an uplift to crypto activities in East Asia.

Hong Kong’s crypto sector received $64 Billion in cryptocurrencies from July 2022 to June 2023. However, South Korea and Japan lead these metrics with over $1 Trillion worth of digital assets received. A better part of Hong Kong’s crypto sector is driven by its over-the-counter (OTC) market.

Moreover, the nation enjoys a major portion of institutional crypto transactions ($10 Million or more) in contrast to any other country the report mentions. South Korea falls short in the category but tops Professional investments (between $10K to $1 Million). Japan appears most in line with the global averages according to Chainalysis.

China is seeing 73.5 percent of crypto activity through centralized exchanges (CEXs) followed by South Korea. South Korea is witnessing only 26.1 percent of activity from decentralized exchanges (DEXs). The report mentions that TerraLuna’s collapse might be the reason for this. Meanwhile, Hong Kong’s activities are coming from DEXs only, same goes for Taiwan.

Chainalyis highlights China was home to the most active crypto markets until it cracked down in 2020. However, recent developments indicate that the Chinese crypto sector might be picking up pace again and Hong Kong may be a testing ground. A couple of OTC firm founders acknowledged “a diverse array of use cases power crypto adoption in China and Hong Kong,” the report reads.

Hong Kong On Its Way To Become a Crypto Hub

In July 2023, the Hong Kong government announced they would establish a Task Force to promote Web3 development in the country. Entrepreneur and angel investor Yat Siu is appointed as an official member of the team. He said, “It is a real honor to serve both Hong Kong and the Web3 community in a common cause to advance the development of our industry.”

The cryptocurrency market is down today with market capitalization losing over 2% in the past 24 hours. Bitcoin (BTC) was down by more than 2% while Ethereum (ETH) was down by nearly 4%.

Anurag is working as a fundamental writer for The Coin Republic since 2021. He likes to exercise his curious muscles and research deep into a topic. Though he covers various aspects of the crypto industry, he is quite passionate about the Web3, NFTs, Gaming, and Metaverse, and envisions them as the future of the (digital) economy. A reader & writer at heart, he calls himself an “average guitar player” and a fun footballer.

Home

Home News

News