- 1 The ABT Share price is currently trading at best accumulation zone.

- 2 Abbott Laboratories is about to release its earnings and give dividend to its shareholders.

Abbott Laboratories, an American multinational company that manufactures medical devices and healthcare products. The company has its headquarters in Illinios, U.S. Abbott was founded by Wallace Calvin Abbott in 1888, who was a Chicago Physician. It sells medical devices, branded generic medicines, and nutritional products. The Abbott Laboratories company’s share is traded as ABT in NYSE stock exchange. This share has made its presence in S&P 100 and S&P 500 index.

The ABT share is trading with a volume of 4.33M in the last trading session, resulting in an average volume of 4.5M over the last three months. The current ratio for the stock is 1.64, which denotes that Abbott Labs is capable enough to pay its liability. Abbot’s gross profit margin is 0.55 and has a net profit margin of 0.13.

The ROE of the ABT is 11.23% and the operating margin of the Abbott Labs share is 15.45%. This company has a neutral debt/equity ratio of 45.32%. Abbott Laboratories PE ratio is 32.65, as the investors are ready to pay higher prices for the ABT share. The company also has a very good price-to-book value ratio of 4.47.

Abbott Laboratories. Stock Performance Analysis

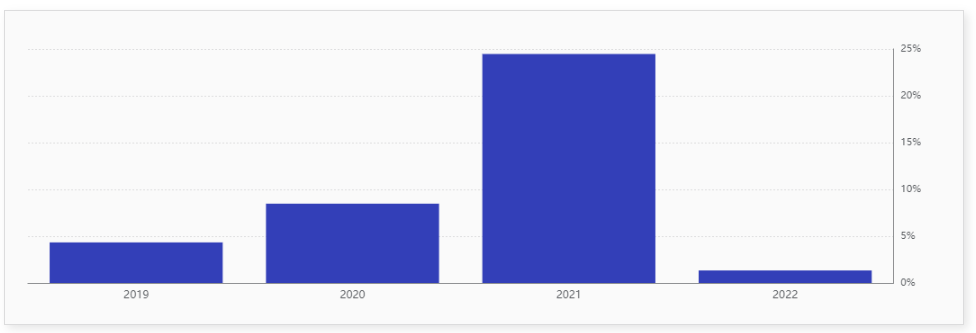

In the Q2 2023, the revenue of the Abbot company has declined by 11.4% year-on-year. The Abbott Laboratories has also witnessed a decline in its gross profit and a decline of 3.4% in its gross margin. The net income of the ABT is reported to be declined by 31.8% in the second quarter of 2023. Considering annual performance of the company, it is showing a decent growth in revenue. The profit margin of the company are also reliable.

Performance Analysis of ABT Stock

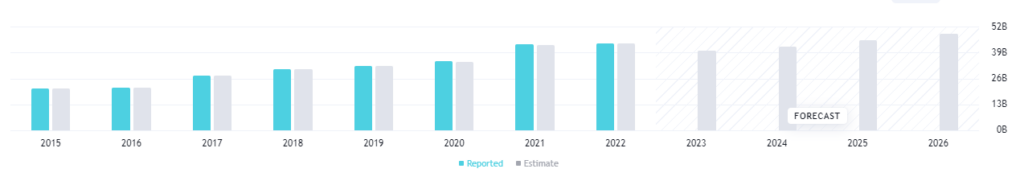

Abbott Laboratories has performed very well when compared to expectations of experts. The company has been overachieving the expected revenue estimates of experts over the years. It indicates that the Abbott is a stable and reliable company for long-term operations.

ABT Stock Technical Analysis

The ABT share price is trading in a range-bound zone for a long time. The share has been consistently forming equal highs and lows. The ABT share price has been consistently reacting to support and resistance of higher and lower levels. It has not been able to break above or below the same.

As the ABT share price is trading in a range, the EMAs for the share are trading in a range-bound aread. The 50-day and the 200-day EMAs have been forming golden and death cross over the time. They have been unable to follow any certain direction. Currently, the EMAs are trading in a death cross on ABT stock chart. Despite if the share fails to break below the support zone, the EMA cross will be useless.

The RSI for the ABT share is in a strong downtrend, trading at the oversold zones. It indicates bearishness as the stock has been declining with fast momentum.

Conclusion

The Abbott has sustainable financials but it has not performed well in the recent quarter, facing a huge decline in the market cap and revenue. The market of the ABT share is uncertain as the share price is trading in a range. Currently, the share price is trading at the support zone of the range. The EMAs and the RSI are indicating bearishness on the charts.

Therefore, if the share price of Abbot Laboratories breaks above the $99.00 level, we can get to see a good upmove. The first expected target is high of the zone, resulting a level of $115.00. If the share price breaks below the zone, the price can lead to further decline hitting the support levels.

Technical Levels

- Support levels for the ABT share are – $87.50 and $93.50

- Resistance levels for the ABT share are – $115.00 and $123.50

Disclaimer

The information provided in this article, including the views and opinions expressed by the author or any individuals mentioned, is intended for informational purposes only. It is important to note that the article does not provide financial or investment advice. Investing or trading in cryptocurrency assets carries inherent risks and can result in financial loss.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News