- 1 Nansen calls the Solana ecosystem “one of the more actively used chains in terms of DeFi velocity.”

- 2 SOL was changing hands at $23.63 at the press time.

The latest report by Nansen, an on-chain insights provider, takes a deep dive into the Solana (SOL) ecosystem. The seventh-largest crypto asset gained 16 percent this week with improved network health. The digital asset could see some volatility as Galaxy Digital, a liquidity provider, looks forward to liquidating now bankrupt FTX’s SOL holdings.

Recent Developments Hint At Brighter Future For Solana

Total value locked (TVL) in the Solana ecosystem has doubled since the beginning of the year and it is rising consistently. Many of the pressing issues barricading the network are now contained according to the report. It also mentions the SOL ecosystem as “one of the more actively used chains in terms of DeFi velocity.”

Solana: Past, Present and Future

— Nansen 🧭 (@nansen_ai) October 5, 2023

We're excited to publish our comprehensive deep dive into the @solana ecosystem. @sandraaleow covers ecosystem catalysts, risks, and highlights, explores the onchain data, network development, and much more

Here are the key findings…

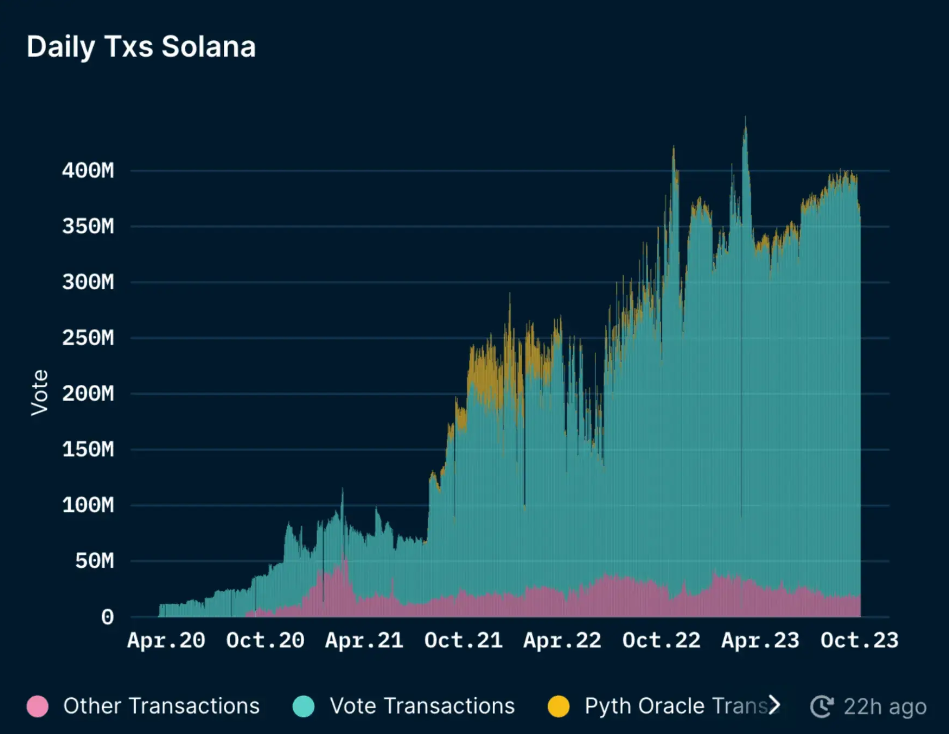

While daily transactions remained stable this year, vote transactions have increased. The blockchain is also seeing a growing number of staking activities on the network with the Jito-Solana Client, an MEC infrastructure for Solana, accounting for over 30 percent of total staked SOL. Furthermore, a spread-out network of nodes aids in decentralization. However, half of them are operating from the United States, providing the nation with the majority of control.

The Nakamoto Coefficient, a metric showing how decentralized a blockchain is, of Solana showed consistent growth over the years. Nevertheless, the report also notes other variables geographic diversity, data center ownership, and validator client diversity should be considered.

The FTX Effect Has Not Left The Market Yet

FTX is the largest holder of SOL with $1.16 Billion worth of assets (representing 13 percent of Solana’s total supply) locked and held. With Galaxy Digital moving ahead with FTX’s asset liquidation, it could turn a calm Solana sea into a raging ocean. The asset has managed to stay above $22 after gaining over 10 percent this month.

Though a solid proportion of these holdings are vested until 2027, liquidators have all the rights to liquidate them all, should they choose to. Nansen highlights a possibility that Galaxy might be “OTC-ing” the holdings. Additionally, if this is the case, it could lift some buying pressure from the market, the report writes.

Solana adoption has been gaining positive momentum lately, the report notes. Some notable events in this context include Visa’s introduction of USDC settlement on the network, Solana Pay integration with Shopify, and Tensor NFT’s launch of a compressed non-fungible token (NFT) platform, among others.

Decentralized Finance (DeFi) still remains a largely untapped arena for Solana. Around 3-4 percent of SOL are staked on its liquid staking protocols. Ethereum (ETH), the second-largest crypto by market capitalization, has nearly 40 percent of its assets staked.

The report concludes that a majority of aspects including TVL growth, partnerships, decentralization, and more hint at positive ecosystem growth. However, the upcoming liquidation of FTX assets by Galaxy Digital could bring about price volatility. This in turn may lead to further sell-offs arising from investor fear.

Anurag is working as a fundamental writer for The Coin Republic since 2021. He likes to exercise his curious muscles and research deep into a topic. Though he covers various aspects of the crypto industry, he is quite passionate about the Web3, NFTs, Gaming, and Metaverse, and envisions them as the future of the (digital) economy. A reader & writer at heart, he calls himself an “average guitar player” and a fun footballer.

Home

Home News

News