- 1 FANG stock price rose 7.44% over the last week and trading above major 20, and 50-daily moving averages.

- 2 Diamondback Energy Inc. (NASDAQ: FANG) stock’s 52-week price range is between $110 – $168.

The FANG stock dividend yield for the TTM is 4.11% and its last dividend payment was $0.84 per share. The FANG last ex-dividend date was August 9th, 2023 and its payout ratio is 47.14%.

FANG stock has confidence in its future growth and enough cash flow to invest in its business, as shown by its low dividend payout ratio. Its dividends are also safe and reliable, as FANG stocks’ earnings and cash flows support them.

The FANG dividend amount has shown that the company is financially and fundamentally healthy, as it increased from $0.38 to $8.96 in the past five years.

FANG stock’s latest quarterly balance sheet for the period ending June 2023 reported total assets of $27.59 Billion and total liabilities of $11.38 Billion. The FANG debt-to-assets ratio is at 41.23%.

In the latest quarterly earnings report for the period ending June 2023, Diamondback Energy displayed a revenue of $1.92 Billion with a net income of $551.00 Million and a loss in profit margin from the last quarter of 28.71%. This quarter, the FANG stock’s reported revenue exceeded analysts’ estimates by $22.599 Million (1.19%).

Moreover, the FANG stock reported an EPS of $3.68 for the period ending June 2023, missing the analysts’ estimate of $3.88 by 5.16%. The next quarter’s revenue is estimated to be $2.169 Billion and an estimated EPS of $4.881. The report will be released on November 06th, 2023.

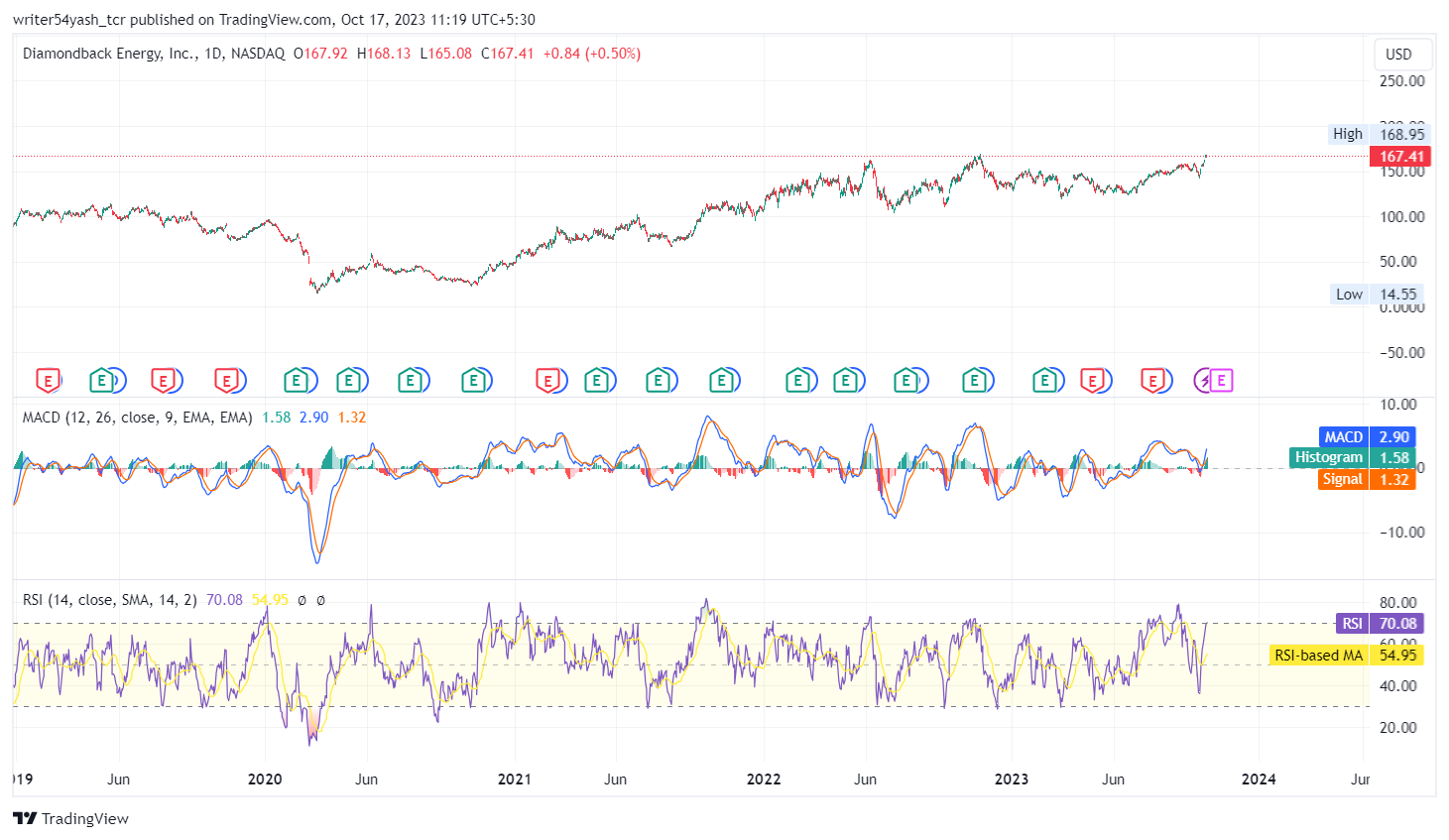

FANG Stock Price Technical Analysis in 1-D Timeframe

The Diamondback Energy stock has a CMP of $157.41 with an intraday gain of 0.50%. The FANG stock’s average volume for the last 10 days is 2.136 Million and its current volume is 1.662 Million. The stock has a float of 169.988 Million shares and a market cap of $29.936 Billion.

According to the Diamondback Energy Inc. (NASDAQ: FANG) chart, the stock price has been on an uptrend since March 2020, when FANG reversed from the $14 support level. It reached a high at $168.95 on October 15, 2023, destroying in between hurdles and making higher highs and lows, and also following the trendline support firmly.

Therefore, if buyers thrust more, the FANG stock might surge abruptly from the current level and surge above, it might make new peak highs. The possible resistance levels or targets are between $170 and $180.

On the contrary, if FANG stock fails to hold its grip and consecutively falls and breaches below $160, it may slide to $150.

At the time of writing, FANG stock is trading above the major 20 and 50 EMAs.

The MACD in FANG stock shows a bullish cross. The RSI is at 70.08 and took support on 14 SMA which is at 54.95. The indicators in the stock suggest bullish signals on the charts.

In addition, The 1-year price forecasts for FANG stock by 29 analysts range between $145.00 to $225.00. The stock ratings for FANG stock are strongly positive and highly recommended based on 32 analysts who have evaluated the stock in the last three months.

Summary

The technical analysis tools of the Diamondback stock price highlight upward signals and support bullishness. Diamondback Energy Inc. (NASDAQ: FANG) chart indicates that the traders and investors of the share price are bullish and positive on the 1-D timeframe. The price action shows higher highs and lows formation in FANG stock showing signs of a bullish outlook at the time of publishing.

Technical Levels

Support Levels: $160 and $150

Resistance Levels: $170 and $180

Disclaimer

In this article, the views, and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.

Mr. Pratik chadhokar is an Indian Forex, Cryptocurrencies and Financial Market Advisor and analyst with a background in IT and Financial market Strategist. He specialises in market strategies and technical analysis and has spent over a year as a financial markets contributor and observer. He possesses strong technical analytical skills and is well known for his entertaining and informative analysis of the Financial markets.

Home

Home News

News