- 1 The stock is trading below moving averages.

- 2 Applied Materials, Inc. (NASDAQ: AMAT) technical tools suggest more bearishness.

Applied Materials, Inc. (NASDAQ: AMAT) is an industrial manufacturing company that manufactures equipment and gives services and software for the semiconductor, display, and related industries. Applied Materials, Inc. was founded on November 10, 1967, and is based in Santa Clara, CA.

Its business module has three main business segments: Semiconductor Systems, Applied Global Services, and Display & Adjacent Markets. The Semiconductor Systems segment makes semiconductor capital equipment for various processes.

The Applied Global Services segment offers solutions to improve equipment performance and productivity. The Display & Adjacent Markets segment provides products for making liquid crystal displays, organic light-emitting diodes, and other display technologies for different devices, such as TVs, monitors, laptops, personal computers, smartphones, and other consumer-oriented devices.

In Addition, the AMAT also announced its projections for the next quarter, expecting a revenue of $6.524 Billion and an EPS of $1.991. The next earnings report will be released on November 16th, 2023.

AMAT Stock Analysis, What’s Next?

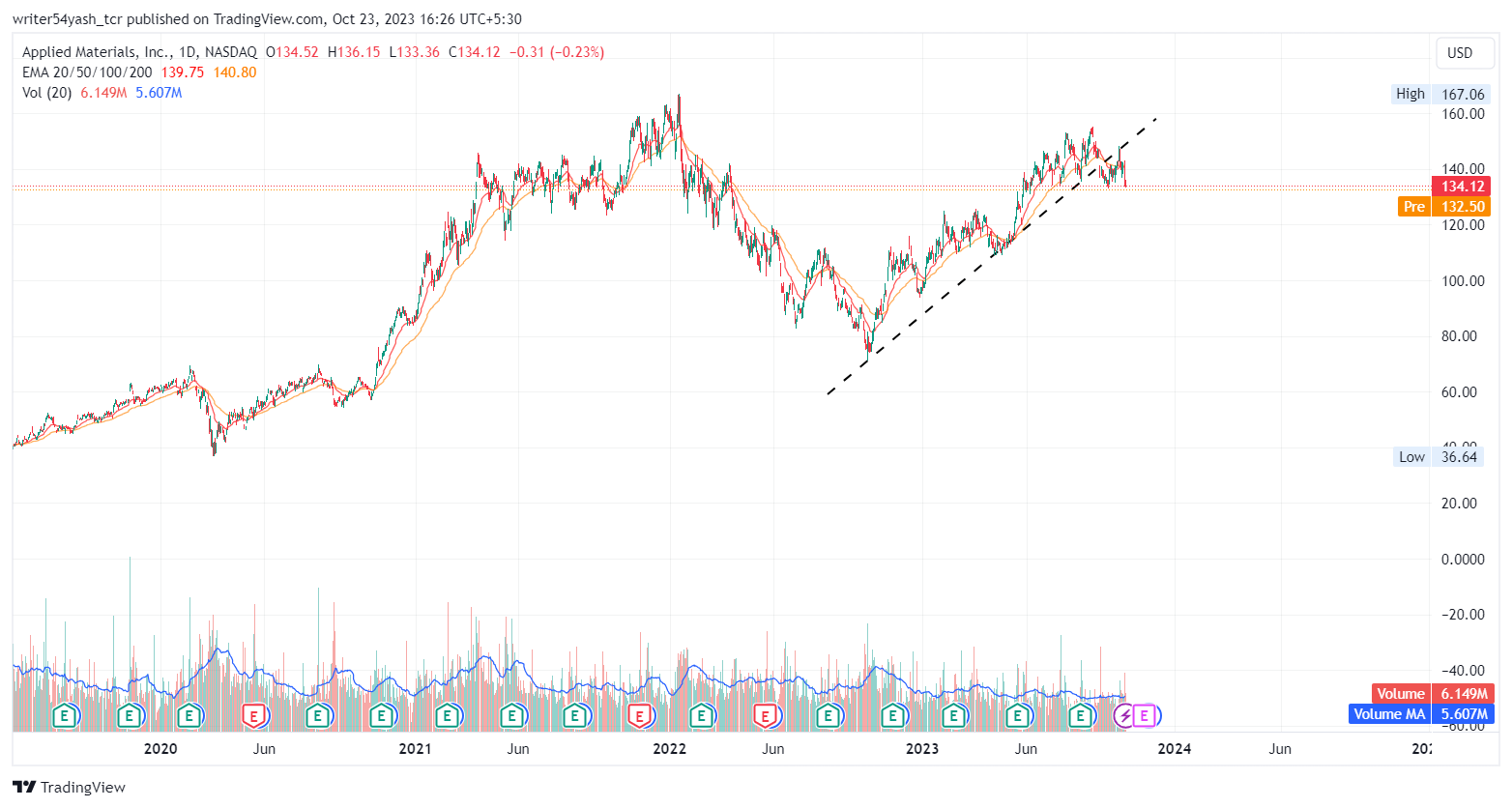

The AMAT stock price has been rising since March 2020, when AMAT rallied from the $36 support level by making higher highs and lows and reached $167 but at the high, it faced resistance and fell to form support around $75 as investors took profit booking from the stock around October 2022.

Thereafter, the stock followed the support received by the trendline and ascended but at $154 price the sellers dragged AMAT stock downward after July 2023 quarter report on August 17, 2023.

Moreover, the stock has failed to show a recovery sign as the AMAT price slid from the trendline.

If AMAT stock cannot maintain its level and keeps falling below and breaking below $125, it may reach $120.

On the other hand, if buyers increase more the AMAT stock may rise sharply from the current level and go above. The potential targets are between $143 and $148.

Currently, AMAT stock is trading above the 20 and 50-day exponential moving averages, which are rejecting the price momentum and showing negativity in the price.

Therefore, if selling volume persists, then the AMAT price might fall more by making lower lows and highs. Hence, the AMAT price is expected to move downward giving a bearish outlook over the daily time frame chart.

The current value of RSI is 37.75 points. The 14 SMA is above the median line at 48.66 points which indicates that the AMAT stock is bearish.

The MACD line at 0.9563 and the signal line at 0.6330 are below the zero line. A bearish crossover is observed in the MACD.

Summary

The technical analysis tools of the AMAT highlight downward signals and support bearishness. The chart indicates that the traders and investors of the share price are bearish in the 1-D timeframe. The price action shows a bearishness in price as the price slipped past the trendline support which it was following for a very long time.

Technical Levels

Support Levels: $125 and $120

Resistance Levels: $143 and $148

Disclaimer

In this article, the views, and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.

Adarsh Singh is a true connoisseur of Defi and Blockchain technologies, who left his job at a “Big 4” multinational finance firm to pursue crypto and NFT trading full-time. He has a strong background in finance, with MBA from a prestigious B-school. He delves deep into these innovative fields, unraveling their intricacies. Uncovering hidden gems, be it coins, tokens or NFTs, is his expertise. NFTs drive deep interest for him, and his creative analysis of NFTs opens up engaging narratives. He strives to bring decentralized digital assets accessible to the masses.

Home

Home News

News