- 1 CHPT stock price declined more than 25% in a week and over 45% in the monthly time frame.

- 2 ChargePoint Holdings Inc. has a market capitalization of $957.744 Million.

- 3 The reported revenue of the company of Q2 2023, is 1.80% smaller than the estimated figures.

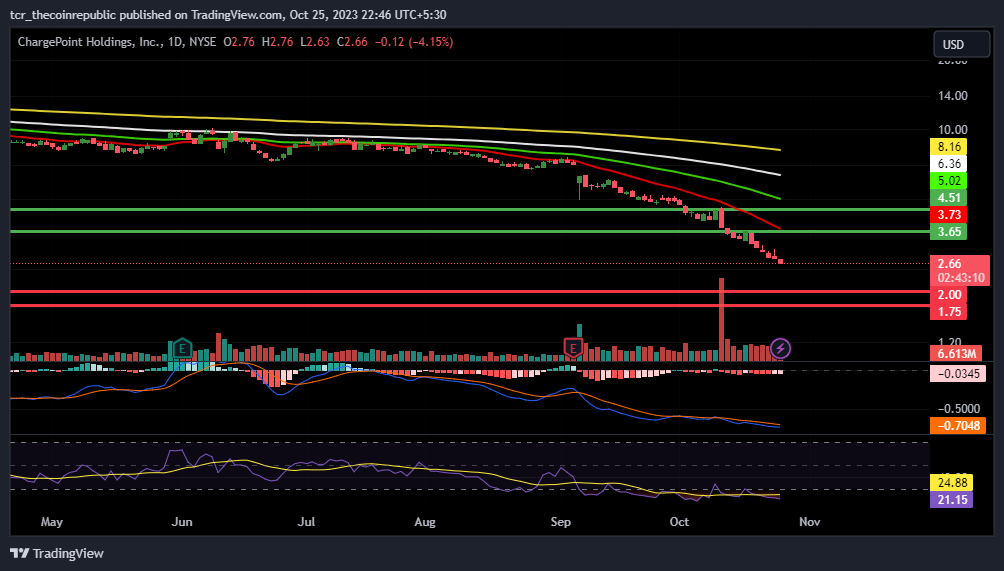

CHPT stock price has been following a continuous declining path for the past few weeks and lost 25.42% in a week and a 47.11% decline is seen in the monthly time frame.

CHPT Stock Price Analysis

In the 52-week time frame, ChargePoint stock peaked at $14.62 and its lowest trading price was $2.63. ChargePoint Holdings Inc. has a market capitalization of $957.744 Million.

Since the past few trading sessions a massive bear pressure has been observed which directs CHPT price near to its 52-week low. The MACD and signal line are in the bearish territory and a further decline in CHPT share price is expected.

The RSI line is clearly in the bear’s region and the line seems to be moving away from the bulls’ region at a constant speed. When writing ChargePoint Holdings Inc. stock was trading below the 20, 50, 100, and 200-day exponential moving averages.

The annual price target of CHPT stock is $10.19 which is 284.43% greater than the press time trading price. TradingView data states that 282.898 Million CHPT shares are free-floating in the market and the remaining 77.156 Million are closely held.

It is important to note that when writing CHPT stock prices were trading around their all-time low and if declined further, it might fall below $2.

ChargePoint Holdings Inc (CHPT) Financials

The reported revenue of the company of Q2 2023, is 1.80% smaller than the estimated figures. As per analysts, ChargePoint Holdings, Inc. was supposed to report $153.25 Million in revenue.

The estimated EPS of the company for the same quarter was negative $0.13 however it failed to beat the estimates and the reported EPS was 161.62% smaller.

In the financial year 2022, ChargePoint Holdings Inc. reported $468.09 Million in revenue from which its net income was negative $345.11 Million and profit margin was negative 73.73%.

In the long term, the total liabilities of the company are $455.81 Million and its assets are $390.97 Million. The company majorly leads its operation in the United States including 14 other nations.

ChargePoint Holdings, Inc. operates as an electric vehicle charging network provider. It designs, develops and markets networked electric vehicle charging system infrastructure and its Cloud Services enable consumers the ability to locate, reserve, authenticate, and transact electric vehicle charging sessions.

Technical Levels

Support Level: $2.00 & $1.75

Resistance Level: $3.65 & $4.51

Conclusion

Since the past few months CHPT stock price has declined heavily and when writing it was trading near its all-time lowest trading price. If the stock price continues to fall then there are expectations that it might fall below $2.00.

Disclaimer

The views and opinions stated by the author or any people named in this article are for informational ideas only and do not establish financial, investment, or other advice. Investing in or trading crypto or stock comes with a risk of financial loss.

Adarsh Singh is a true connoisseur of Defi and Blockchain technologies, who left his job at a “Big 4” multinational finance firm to pursue crypto and NFT trading full-time. He has a strong background in finance, with MBA from a prestigious B-school. He delves deep into these innovative fields, unraveling their intricacies. Uncovering hidden gems, be it coins, tokens or NFTs, is his expertise. NFTs drive deep interest for him, and his creative analysis of NFTs opens up engaging narratives. He strives to bring decentralized digital assets accessible to the masses.

Home

Home News

News