- 1 In the weekly time frame, the crypto market showed significant growth as Bitcoin crossed the $35k mark.

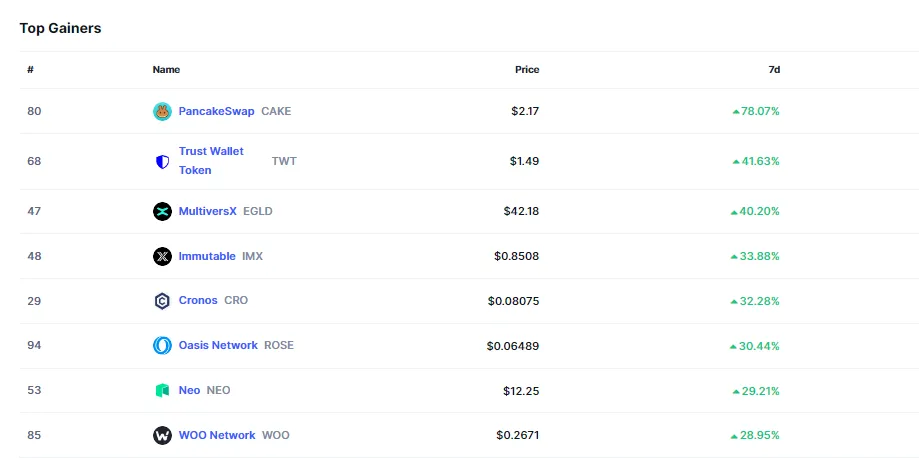

- 2 The weekly gainers list is topped by PancakeSwap as its price surged more than 77%.

- 3 BTC trading volume grew 31.68% in the intraday time frame.

In the weekly time frame, prices of majority of cryptocurrencies grew significantly and Bitcoin crossed the much awaited resistance of $35k. The surge has been largely attributed to the recent conviction of SBF.

Following the Terra decline, a significant decline was observed in the market and since then, till the beginning of 2023, the crypto market was bearish. In the past 7 days, BTC prices grew 3.03%.

In the 24 hours time frame, the entire crypto market capitalization rose 1.55% and when writing, it was $1.34 Trillion. Bitcoin trading volume has shown a significant growth of 31.68% in the intraday time frame.

However, the weekly gainers list is topped by PancakeSwap as its price surged more than 77% and at press time, it was trading at $2.15. The 2nd rank in weekly gainers list is held by Trust Wallet Token (TWT).

One to fifth rank in weekly gainers list is captured by penny coins and tokens and a major improvement in memecoin trading price was also observed in the past few weeks.

Terra collapse is one of the most troubling events that dragged the crypto industry a few years back, and the collapse largely affected the budding companies. Millions of dollars went missing from the market in just a few days.

Limited Losers in Weekly Frame

The weekly loser list has only 9 coins. Monera (XMR) price slipped and lost 3.27% of its trading value in the weekly time frame.

Huobi Token (HT) is the second weekly loser. HT fell 1.99% through the week. The weekly losers list seems to be empty as the tokens/coins declined and lost a nominal portion of their trading price. ‘

The positivity in crypto market is luring investors and on other hand, institutional investors are helping the crypto industry expand. Most recently, DZ Bank of Germany also confirmed its entry in the crypto industry as it launched a crypto custodian platform.

If this positivity remains in the market, then there are possibilities of future surge in trading price and trading volume. A severe boost in the registration of crypto projects and crypto related products has surged significantly since the opening of 2023.

Disclaimer

The views and opinions stated by the author or any people named in this article are for informational ideas only and do not establish financial, investment, or other advice. Investing in or trading crypto or stock comes with a risk of financial loss.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News