- 1 The ACDC stock is underperforming and its earnings for the quarter could possibly reveal its turnaround and recovery prospects.

- 2 The revenue and the EPS for the next quarter are expected to be released on November 9th, 2023.

ProFrac Holding Corp. is a company that makes and sells fracturing units & pumps for the oil and gas industry. It also offers services related to these products.

ProFrac at a Glance

The company combines technology and vertical integration to offer well-stimulation services and proppants production. Also, it offers other related products and services to oil and gas companies that explore and produce unconventional oil and natural gas resources across the United States.

Established in 2016, ProFrac aims to be the preferred service provider for oil and gas companies that need high-quality hydraulic fracturing solutions. ProFrac is committed to using new technologies to significantly lower “greenhouse gas” emissions and increase the efficiency of the unconventional oil and gas development process.

Past Earnings & Future Outlook

The ACDC stock disappointed its investors amid a streak of negative earnings reports with its previous dismal second-quarter results as well. The ACDC missed analysts’ expectations on earnings by 108.76%. However, the revenue was up from estimate, as the company posted revenue of $709.2 million, up 3.60%, and an earnings per share of $0.02.

The stock plunged, breaking down from a consolidation pattern and signaling a further bearish outlook for the stock. which could be a temporary sign. Conversely, this bearish outlook could change since on the longer time frame, a bullish pattern is building up that is commonly known as a falling wedge.

Since the stock has been underperforming the market and its peers, its earnings for the quarter could possibly reveal its turnaround and recovery prospects. This could spark a rally and a reversal in its price trend.

Therefore, the revenue for the next quarter is expected to be $602.853 Million and the EPS to be $0.089. The next earnings release date is November 9th, 2023.

Analyzing ProFrac Price Movement

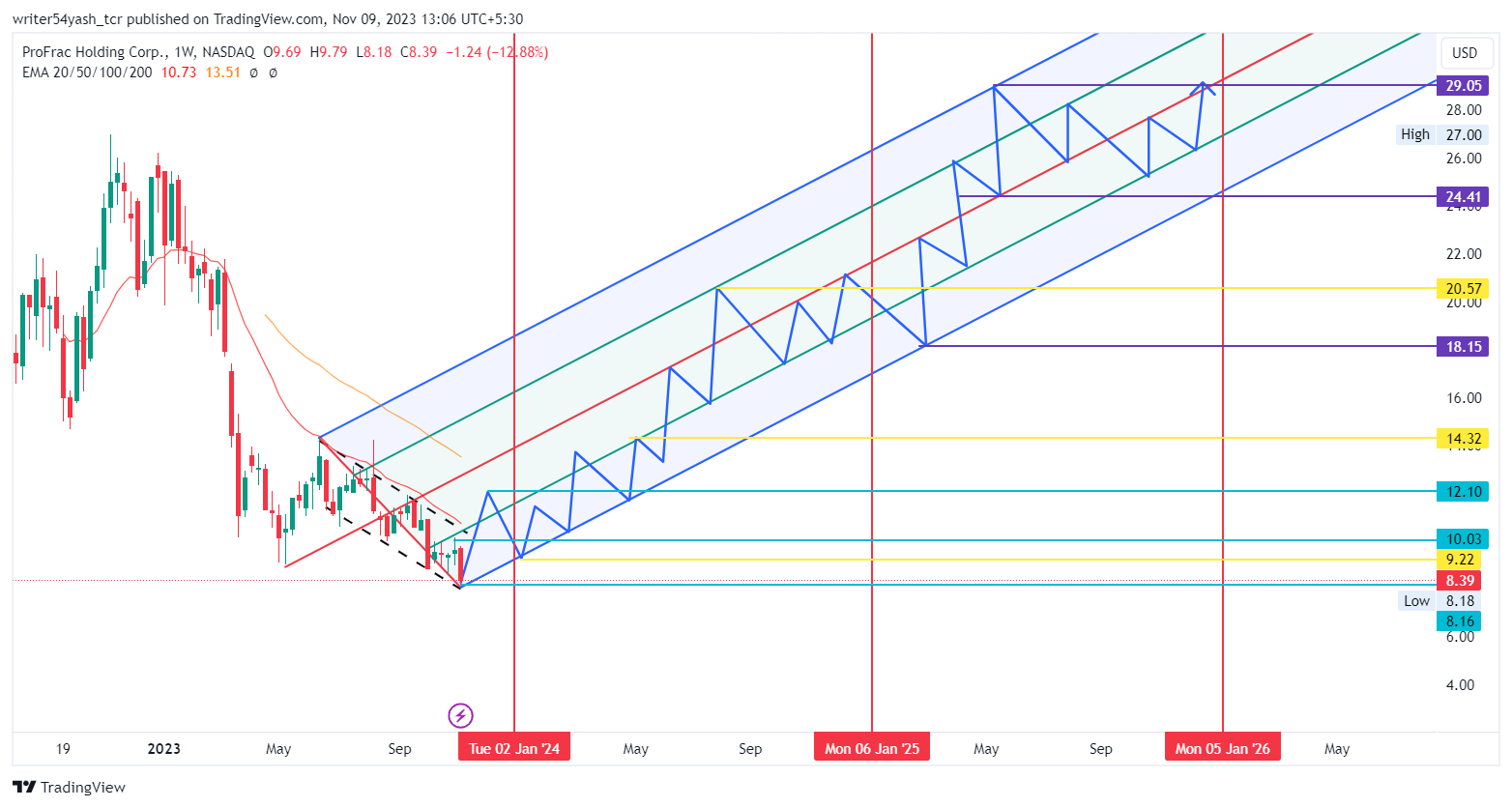

As per the price movement, the stock price exploded from May 2023 and rose higher, creating new highs and lows along the way. It exhibited a spectacular 55% growth in the stock price by June 2023. However, it crashed as investors locked in their profits and ended up in the falling parallel channel.

At press time, the price was $8.39. Analysis of the long term chart suggests ACDC could go up. The pattern it is possibly building is called a falling wedge and it could break out. Now, it seems like the stock is poised for a phenomenal rally, as it has been building a long term bullish pattern. This might gather the bull’s power to break the resistance level and soar to new elevations from the current base zone.

Therefore to thrust upwards, the price needs more buying power in the longer trend. Moreover, the ACDC stock might surge strongly from the current level and surge above the parallel channel. The possible targets are between $10.00 and $11.00.

On the contrary, if ACDC stock fails to hold its grip and declines and breaches below $7.00, then it may hit $6.00.

Currently, ACDC stock is trading below the 20, 50, 100, and 200 EMAs. This is rejecting the price as the stock faced massive consequences led by negative streaks of earnings reports. This stretched the ACDC stock price downtrend for a prolonged period of time.

Nevertheless, if buying volume adds up, then the price might support bullish momentum by making higher highs and lows. Hence, the ACDC price is expected to move upwards giving a bullish outlook over the daily time frame chart.

ProFrac Price Prediction 2023-2025.

Summary

The ACDC stock disappointed investors amid multiple negative earnings reports with its previous dismal second-quarter results as well.

The stock plunged signaling a further bearish outlook, which could be an ancestral and a temporary sign, now. Conversely, this bearish outlook could change since on the longer view, the charts are building a bullish pattern commonly known as a falling wedge.

Since the stock has been underperforming, its earnings for the quarter could possibly reveal its turnaround and recovery prospects. This could spark a rally and a reversal in its price trend.

Now, it seems like the stock is poised for a phenomenal rally, as it has been building a bullish pattern in the longer trend. This might gather the bull’s power to break the resistance level and soar to new levels.

Technical Levels

Support Levels: $7.00 and $6.00

Resistance Levels: $10.00 and $11.00

Disclaimer

In this article, the views, and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.

Adarsh Singh is a true connoisseur of Defi and Blockchain technologies, who left his job at a “Big 4” multinational finance firm to pursue crypto and NFT trading full-time. He has a strong background in finance, with MBA from a prestigious B-school. He delves deep into these innovative fields, unraveling their intricacies. Uncovering hidden gems, be it coins, tokens or NFTs, is his expertise. NFTs drive deep interest for him, and his creative analysis of NFTs opens up engaging narratives. He strives to bring decentralized digital assets accessible to the masses.

Home

Home News

News