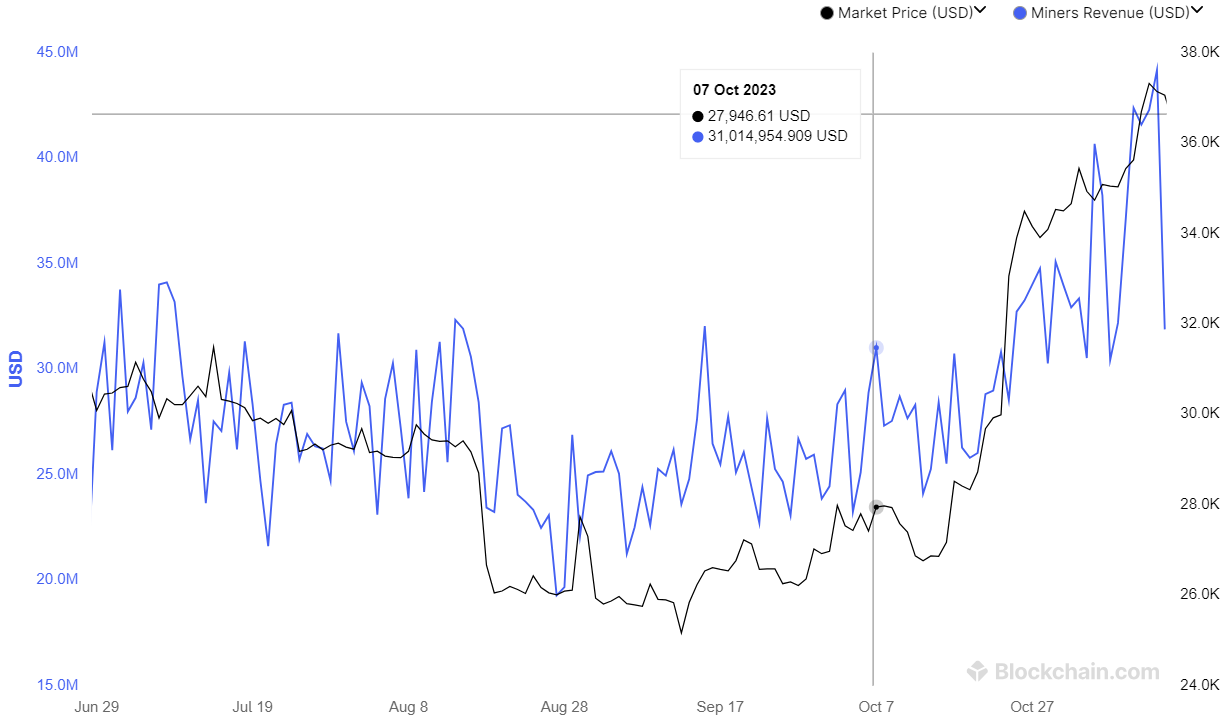

- 1 Mining revenue has moved synchronously with BTC’s price recently.

- 2 The asset was trading at a market price of $36,698 at press time.

Bitcoin (BTC) miners are having a fun day as their mining machines deliver a mouthful of profits. After a long crypto winter, digital assets appear to have been moving positively as the year comes to an end. Data aggregator CoinMarketCap highlights the sector has gained nearly $400 Million during October 2023.

Bitcoin Price on The Move

According to Blockchain.com, a cryptocurrency financial services company, Bitcoin mining revenue for November 12, 2023, reached $44 Million. However, the momentum appeared suppressed again as the number plunged to $32 Million the next day. The asset’s price was on an uproll, adding over 5 percent in the past seven days. The flagship virtual currency was trading at a market price of $36,698 at press time.

Mining revenue has moved synchronously with the asset’s price. As can be seen in the chart, the blue line began rising in October. Miners’ revenue has surpassed the $40 Million mark for the fifth time this month. The number was last seen during May 2023 with miners garnering nearly $42 Million. Additionally, the price remained inversely proportional, unlike this time.

Since mid-October, the asset has managed to add around 40 percent to its price. One major spike came following the speculation of the Bitcoin exchange-traded fund’s (ETF) approval. A potential approval may push the current demand for the asset even higher. Shares of crypto-related companies including Coinbase (NASDAQ: COIN) and MicroStrategy (NASDAQ: MSTR) gained by 7 percent and 12 percent respectively following the news.

As Bitcoin halving nears, crypto miners are already planning to make the best out of the situation by learning the effects of previous halving. Although the events did not have any significant impact on the asset’s price. To this date, the asset has gone through three such events.

Halving reduces block rewards received from Bitcoin mining. Initially, the network gave off 50 BTC to mine a block. After three halvings since its inception, the reward has come to only 3.25 BTC per block mined. The last halving is anticipated to occur in 2140 given that all the units of the biggest crypto asset will enter circulation.

Institutional crypto miners are spreading through the United States. Riot Platforms currently serves as the biggest crypto-miner in the nation. The company is reportedly developing a Bitcoin mine with 1 GW capacity. A study by data aggregator CoinGecko indicates the company stands at number three in the context of BTC holdings by crypto miners.

Marathon Digital, another leading crypto miner holds the top position with 13,726 BTC in their possession. The 14 mentioned public miners on the list conjointly made up 38K BTC in their holdings.

Anurag is working as a fundamental writer for The Coin Republic since 2021. He likes to exercise his curious muscles and research deep into a topic. Though he covers various aspects of the crypto industry, he is quite passionate about the Web3, NFTs, Gaming, and Metaverse, and envisions them as the future of the (digital) economy. A reader & writer at heart, he calls himself an “average guitar player” and a fun footballer.

Home

Home News

News