How to make money with Yield Aggregators? Is it possible to make money from cryptocurrency passively? How to choose an income platform with minimal risk? These questions were asked by everyone who was somehow immersed in the field of cryptocurrencies and studied ways of passive income.

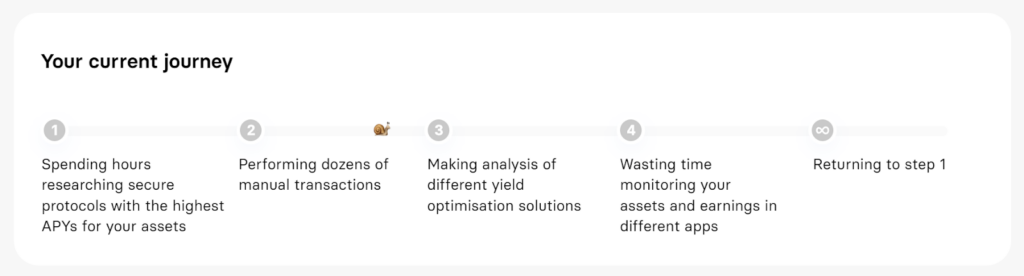

Now there are many such tools on the market – yield aggregators that allow their users to place assets most efficiently and receive passive income. However, they all have high risk, low stability, and practically no automation.

However, it seems that a solution has emerged that can turn the idea of passive income in cryptocurrency on its head. It is superior in functionality to all existing competitors at the moment, because it automates the work and allows you to invest not in specific protocols or coins, but in strategies with selected risks.

We will tell you about Cadabra Finance – a platform that will help you optimize your passive income and take it to a new level.

Cadabra Finance is the first project in its segment that works to make a person earn money. The goal is to create the most useful product for the public:

– A tool to maximize returns from the DeFi market through automation. No more worrying that the pool is no longer profitable because in that case, the strategy will automatically move your liquidity to a more profitable protocol.

– Working well thought-out tokenomics, there will be no hyperinflation in the market (as it usually happens)

– Profitable for the audience referral program

– The team: behind the project are people who have built more than one successful crypto project where people could earn thousands of dollars at the start (Nominex and Nomiswap).

Cadabra is designed to automatically move funds between protocols within the chosen strategy so that the user gets the maximum possible profit. In doing so, the user’s manual work is reduced to zero.

How does Cadabra.Finance work? How can you make money on the platform? Why should you at least try this platform to maximize your profits? What can be the profitability for users – we will tell you in more detail in this article.

Why is Cadabra Finance the best Yield protocol in the crypto market?

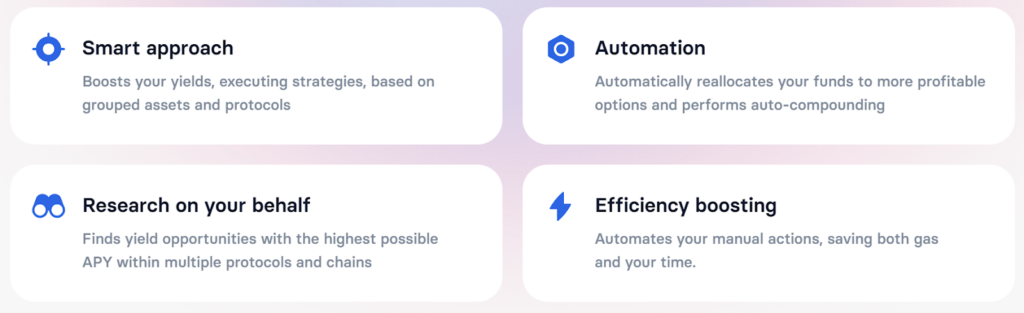

Cadabra is a project that is already many times more powerful than any other similar project. The big advantage is that the user does not have to make any effort to get a good passive income. What is the trick? Automation! Routine actions are automated – funds are transferred between protocols without the need to do it manually.

If suddenly one protocol shows low profitability, your funds will be automatically transferred to a more profitable pool. You risk nothing, and that’s the most important feature.

Who are the people behind this project?

Founders Cadabra.Finance is a public team – founders and developers of CEX exchange Nominex and DEX exchange Nomiswap, which at its peak ranked third in terms of TVL among all exchanges in the BNB network.

The team is a key element of the project. They already have the traction, hundreds of people have been able to earn thousands of dollars and more on Nominex. So, there is no question about the credibility of the project.

The Nominex team has been working in the crypto industry since 2017 (since the beginning of the development of the Nominex exchange), and during all this time their products have never been hacked, unlike their competitors, who simply skidded or went bankrupt.

The Nominex team claims that they are launching a revolutionary defi product that has no analogues on the market and has more features for its users. More powerful in terms of its features compared to others, Cadabra.Finance is also a unique product in terms of the tokenomics developed.

Objectively, the new tokenomics model developed by the Cadabra team has the potential to change the entire DeFi industry. The one-time issuance of all tokens, as well as the returns that both strategy users and token holders will receive, are only a small part of the structure through which the ABRA token will steadily increase in value. We’re sure we’ll start seeing results soon, but in the meantime, let’s take a closer look at how the Cadabra platform works.

How does it work?

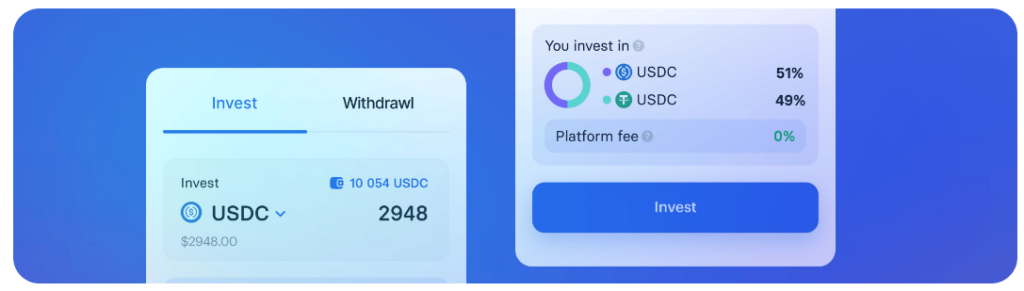

The basic principle of operation is that the user sends money to the Cadabra strategy and it automatically distributes funds within the selected strategy between the protocols. The only thing the user has to do is to choose a strategy that corresponds to the level of risk the user is willing to bear. Let’s look at the whole process in more detail.

A strategy is a variation of the common ERC20 token standard. When you deposit funds into a strategy, you get a token in return, which is very similar in mechanics to liquid staking tokens. Let’s break it down.

The token you receive is your share of the assets under management in the strategy. A conditional receipt that your funds are pledged to the pool in a certain amount. What you receive in the form of tokens is the actual value of the assets in the portfolio of the chosen strategy.

These tokens can be exchanged for the underlying assets of the strategy at any time.

Each user of a strategy owns a proportional share of all the assets locked in the underlying protocols of that strategy. A strategy can have multiple underlying protocols, each containing a different number of assets. For example, if you own 10% of the tokens in a strategy, you own 10% of the value of the assets locked in each of the underlying protocols.

Each strategy consists of protocols of projects to which that strategy directly sends money. The strategy indicates which projects or protocols your liquidity can be sent to: that is, before investing in a strategy, you choose which of the strategies your money can be moved to and among which protocols it will be distributed.

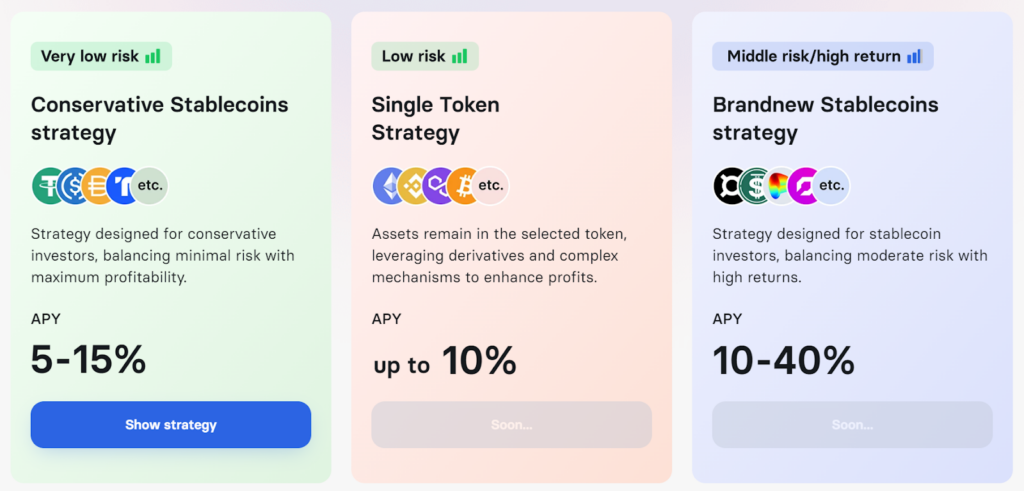

Strategies are allocated based on expected risk. For example, if you choose a conservative strategy, your money will be allocated only to the most reliable and secure protocols. In this way, everyone can find a strategy with an optimal ratio of return (APY) to risk.

The main automatic actions performed by the strategy are

– Rebalance is the process of reallocating assets among a strategy’s underlying sources of return. As returns change between projects in the market, the strategies track these changes and shift users’ money to the most profitable strategies to maximize returns.

–Compounding is the process of exchanging rewards (accrued in tokens of third-party projects) for tokens of the underlying pool and reinvesting them in the same pool within the strategy. This process is designed to maximize the APY generated by the pool and is automatic. First, the most profitable time to receive the reward is tracked, and then the tokens are sold and reinvested in the logs. The conversion is done through the liquidity aggregator 1inch, which guarantees the best exchange rate. In other words, Cadabra does everything automatically, maximizing your profitability.

It is important to note that users can withdraw money at any time. The transfer of liquidity within the approved protocols, which are specified in the contract, is carried out thanks to an automated algorithm. Any new protocols are added via time-locking, so the user knows how long it will take to update the contract, and if something does not suit them, they can always withdraw their funds from the strategy in advance.

Advantages of Cadabra Finance

– A new approach to yield generation in Yield Protocols. Unlike competitors, where in case of negative returns you have to manually “pull out” the asset and move it to a more profitable pool, CADABRA has designed the automation so that users do not lose funds.

– It allows you to have a single point of entry. That is, you simply go to the Cadabra website and with a few clicks send your funds to the strategies where you are already getting returns. You don’t need to set up different networks on your wallet and understand the numerous DeFi protocols and how to work with them.

– The development team looks for new projects appearing on the market and integrates them into the strategies. Thanks to this, you do not have to analyze the market and the reliability of the projects yourself. The Cadabra team does it all and integrates it into the strategies. If it turns out that the profitability of a new project is higher than all other projects in the strategy, Cadabra automatically redirects the user’s money to this more profitable protocol to maximize profits.

– Cadabra implements a crosschain, which makes life much easier for users. For example, you can send to a strategy with USDT stablecoins on the BNB network. This strategy will track not only projects in the BNB network but also projects in other networks. For example, if a project in the Ether network will give the highest stablecoin yield than any other network, the strategy will convert it to a new network via a bridge and send it to a new protocol already in the Ethereum network. The whole process is completely transparent for the user. It means that you can always stay in a network you feel comfortable with: for example, in the BNB network, but your money will already be working in another network.

Cadabra assesses the risks for you and generates simple and effective automated strategies. It greatly simplifies the process for users and allows them to achieve the highest possible returns. It is worth noting that even the tokenomics of the project is aimed at maximizing the benefits for the user.

Tokenomics of Cadabra Finance

Over the past few years, many DeFi projects have used the same tokenomics model: incentivizing users to provide liquidity and buy the project’s tokens by showing high APRs that were guaranteed by issuing the same tokens. As a result, it all comes down to one thing: sooner or later, the token starts to lose value due to high inflation.

Cadabra has developed a new tokenomics model that ensures that all rewards are backed by real profits. In short, the rewards received in the strategies in the form of tokens of third-party protocols are used to buy back ABRA tokens, thus positively influencing the token price.

It is important to note that token issuance will occur only once. The total number of ABRA tokens to be issued is 13,333,337. Once all tokens are issued, there will be no new issuance.

How does CADABRA work?

Step 1: The user invests money (USDT) in the strategy – and receives the strategy’s LP tokens. For example, USDT is split between Pancake and Nomiswap protocols, and the strategy reaps rewards in the form of Cake and NMX tokens.

Step 2. The strategy sells third-party tokens (Cake and NMX) – receives the strategy’s own token (e.g. USDT) – and invests it back into itself, thereby increasing the strategy’s portfolio.

Step 3. The invested deposit is converted into a Strategy LP token (the liquidity token of the strategy) and exchanged for an ABRA token in a separate liquidity pool.

Step 4. Returns are accumulated in the form of ABRA tokens:

– to the holders who have invested in the strategy. They can sell tokens or lock them in for some time to receive new veABRA tokens, which will give them even higher returns on all strategies. You can also increase your referral rewards by locking in a certain number of ABRA tokens.

– to the Strategy Pool (in the form of a pair of Strategy LP/ABRA tokens), which is a separate contract and shares in the liquidity of the strategy with other users.

It is important to note that the returns earned on the strategy with this contract and the commissions for trading in this liquidity pool will be distributed among the veABRA token holders. Users will receive several tokens proportional to the time and volume of tokens pledged: the more of them, the more veABRA tokens can be received.

The main advantages of personal ABRA blocking and receiving veABRA tokens

– Thanks to veABRA voting tokens, you get the right to vote for moving money to other strategies, adding and excluding projects from strategies, etc.

– Receive additional rewards:

– Share of platform performance fees

– Revenue from protocol-owned liquidity

– Immediate reward for lock-in in the form of cashback with ABRA tokens. It turns out that you find fewer tokens. The longer the lockup period, the higher the cashback percentage.

– Referral Reward (we’ll tell you more about all the benefits below)

Thus, the price of the ABRA token will be under constant positive pressure as it will be backed by all the liquidity available in the strategies. Bottom line: the Cadabra team has created a tokenomics that will benefit everyone: strategy users, ABRA token holders, and long-term investors. By the way, if you have any questions, you can always ask them in the chat room of Cadabra’s Telegram channel. The team posts the latest product updates there, so we recommend you subscribe to make sure you don’t miss anything.

Cadabra Referral Program. The most profitable referral program on the market?

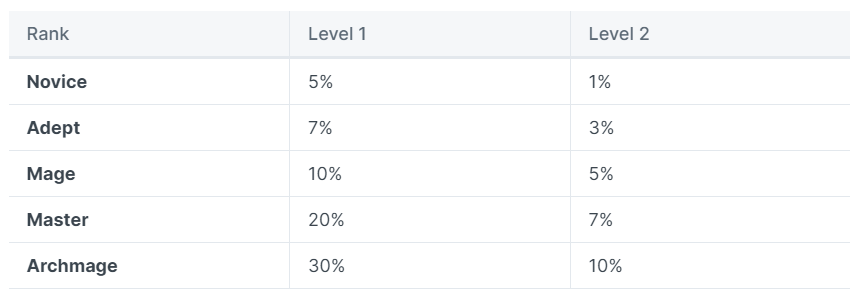

Cadabra Finance has created a unique referral program for its users: rewards can be earned both for personal token locking and for locking referrals (levels 1 and 2).

Rewards for locking your tokens

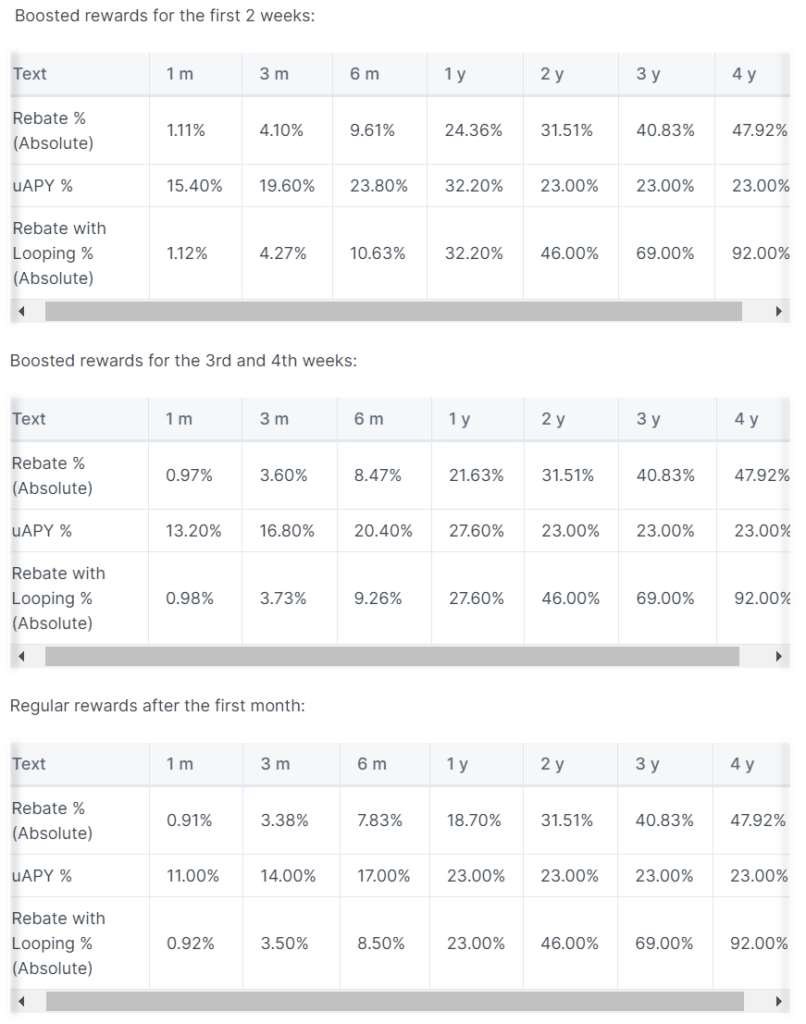

Each person who blocks ABRA tokens receives a certain amount of “cashback” – new ABRA tokens. The number of ABRA tokens received depends on the length of time the ABRA tokens are locked. The rewards increase during the first month after the launch of Cadabra. If you lock for up to 1 year, the rewards increase by 40% during the first 2 weeks and by 20% during the 3rd and 4th weeks. It means that if you lock ABRA tokens for 1 year within the first two weeks, your uAPY will be 32.20%, if you wait until the third week, your uAPY will be 27.60%.

It’s important to note that you will receive new ABRA tokens immediately. Click here for more information.

For example, you lock 10000 tokens for 2 years and you get new tokens (ABRA) at the rate of 33% – 3333 pieces. It turns out that your 10000 tokens remain locked, but at the same time, there are new 3333 ABRA with which you can do anything you want: sell, lock, and get more new tokens.

Rewards from referrals (level 1 and 2).

Owners of the referral structure receive a percentage of the number of tokens that their referrals receive as a reward for personally staking their tokens when they start using Cadabra through the referral link of the invitee. All referral rewards are paid immediately.

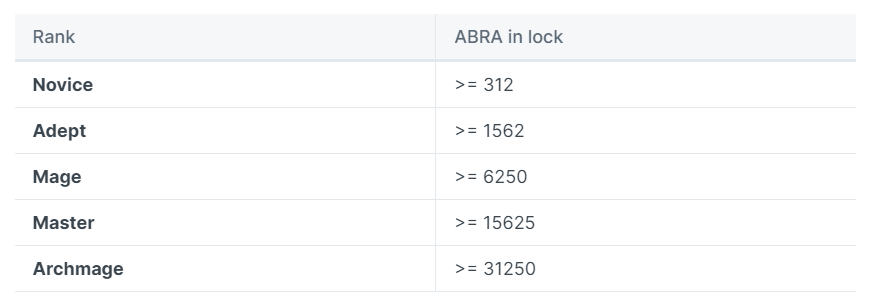

The percentage of rewards is determined by your “rank”, which you receive for staking your personal ABRA tokens, and depends on the number of your tokens. You can check more information here.

Let’s continue with the example above. You have 6250 tokens locked and have reached the rank of Mage.

As long as you have the required number of locked ABRA tokens, you’ll be assigned the appropriate rank (in our example, Mage) and continue to receive instant rewards:

– 10% of the rewards from your referrals’ personal lock (level 1)

– 1.75% of the rewards from the personal locking of the users who registered through your referrals (2nd level).

You’ll also receive additional income for being someone’s referrer – an additional 2% per year on top of your own lock rewards.

Should you use Cadabra Finance?

We analyzed the project extensively – we found information about the project team and their background, analyzed the process of the Cadabra platform, as well as the tokenomics of the project, which is an important indicator of the reliability of the product.

Besides, we really recommend at least trying the project, to invest even a minimal amount of money there, in order not to experience FOMO later, because there are already rumors about a possible airdrop.

Taking into account the team behind the project, we can be sure that in the next few months, the project will take off and show itself as the best among its counterparts. The fact that they decided to create something new, which no one has done before, shows the seriousness of their intentions and lets us know that this is a reliable team working to create a safe and necessary product for its audience.

Technical capabilities, broad functionality and ease of use for users, sustainable tokenization. Cadabra Finance is currently a unique and powerful aggregator that allows the user to manage all transactions through automatic algorithms in the form of smart contracts and still earn a good passive income. We highly recommend this product to our users and will continue to follow its development.

Disclaimer: Any information written in this press release or sponsored post does not constitute investment advice. Thecoinrepublic.com does not, and will not endorse any information on any company or individual on this page. Readers are encouraged to make their own research and make any actions based on their own findings and not from any content written in this press release or sponsored post. Thecoinrepublic.com is and will not be responsible for any damage or loss caused directly or indirectly by the use of any content, product, or service mentioned in this press release or sponsored post.

Mr. Pratik chadhokar is an Indian Forex, Cryptocurrencies and Financial Market Advisor and analyst with a background in IT and Financial market Strategist. He specialises in market strategies and technical analysis and has spent over a year as a financial markets contributor and observer. He possesses strong technical analytical skills and is well known for his entertaining and informative analysis of the Financial markets.

Home

Home News

News