If you are a crypto exchange owner or creator of a project or token that requires a high level of trading activity, then you should know that finding a reliable liquidity provider is what can drive your crypto business forward. There is no surprise here since liquidity can greatly impact the trading experience of your users.

In 2024, the crypto market is projected to grow significantly, and with more and more institutional investors joining the market, the demand for high-liquid trading services will only increase. In this guide, we’ll discuss the role of crypto liquidity providers, how to provide liquidity to your project, and how to choose the best provider for your needs.

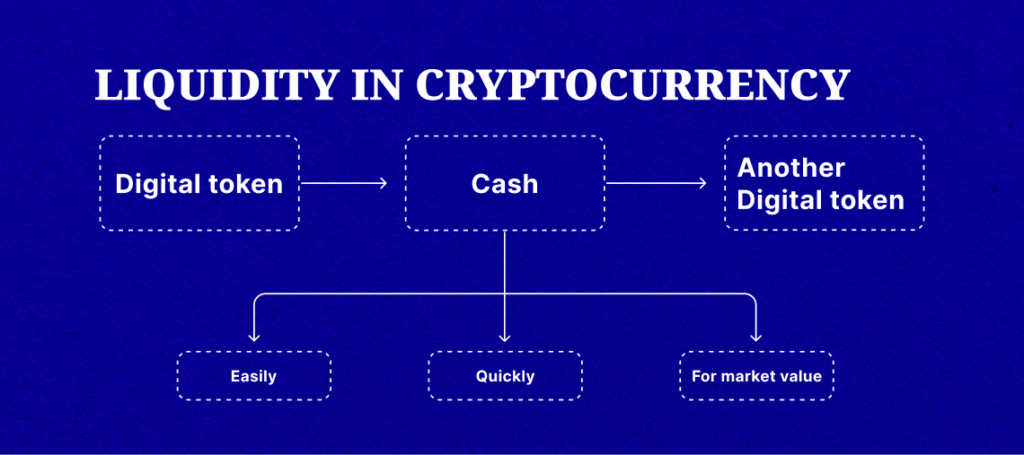

Why Liquidity Matters in Crypto

High liquidity is desirable in the crypto market for several reasons:

– Efficient Trading: Liquidity ensures that traders can execute their orders quickly and at the desired price. It allows for seamless buying and selling of cryptocurrencies, reducing the risk of price slippage.

– Price Stability: Liquid markets tend to have less price volatility as there are more buyers and sellers. This stability is particularly crucial for traders who rely on predictable price movements for their strategies.

– Market Confidence: A highly liquid market instills confidence in investors and attracts more participants. It creates a sense of trust and fosters a vibrant trading environment.

– Arbitrage Opportunities: Liquidity enables arbitrage, the practice of exploiting price differences between different exchanges. Arbitrage traders take advantage of temporary price discrepancies to make profits, which ultimately contributes to market efficiency.|

– Market Depth: A liquid market has sufficient trading volume and market depth, allowing for larger trades without significantly impacting the price. This depth attracts institutional investors and larger traders, who require ample liquidity to execute their strategies.

In summary, liquidity plays a vital role in ensuring an efficient and stable crypto market, benefiting both traders and investors.

Crypto Liquidity Providers

Crypto liquidity providers (LPs) are parties that facilitate liquidity in the crypto market. These agents can be categorized into two groups: liquidity providers for centralized markets and LPs, or users, that contribute their tokens to liquidity pools in DeFi protocols.

Institutional Liquidity Providers

Institutional liquidity providers are usually large companies, exchanges, or financial entities that specialize in providing spot or derivatives liquidity to the market. The term itself is generally used to designate a prime brokerage company in the Forex market with access to deep liquidity pools, which connects numerous brokers to their liquidity pools, allowing them to offer their traders favorable trading conditions.

With the rise of crypto trading, the concept of big crypto liquidity providers is also beginning to gain momentum. Such entities usually offer their services to traditional centralized exchanges (CEXes), filling their order books and helping them connect buyers and sellers with their liquidity. Some companies also help startups to achieve high turnover rates on particular tokens.

Certain providers also offer crypto CFD liquidity (contracts for difference). Cryptocurrency CFD allows traders to speculate on the price movements of cryptocurrencies without actually owning the underlying assets. Some brokers prefer this type of liquidity as it does not involve the exchange of actual cryptocurrencies.

Here are some key characteristics of institutional liquidity providers:

– Market Making: Crypto and CFD Bitcoin liquidity providers act as market makers by constantly buying and selling assets, ensuring continuous liquidity irrespective of market conditions. They provide bid and ask prices, enabling traders to execute their orders quickly.

– Risk Management: These providers employ sophisticated risk management systems to mitigate potential market risks. They use advanced algorithms to ensure market stability and protect themselves from adverse price movements.

– Regulatory Compliance: Institutional liquidity providers are usually regulated by financial authorities. They comply with international standards and national laws to ensure transparency, protect investors, and maintain market integrity.

– Trading Volume: Reliable institutional liquidity providers offer large volumes of trading. They have deep liquidity pools and can distribute liquidity across multiple trading platforms, ensuring efficient order execution.

– Technology: Institutional liquidity providers leverage advanced trading technologies, such as automated or algorithmic trading systems. These systems enable quick order matching, seamless integration with various trading platforms, and real-time price feeds.

Some well-known institutional liquidity providers in the crypto market offering spot and derivatives liquidity for exchanges and projects:

– NinjaPromo

– GSR Markets

– BitGo

– Galaxy Digital Trading

– Empirica

These providers offer a range of services to cater to the diverse needs of different platforms.

For CFD crypto liquidity, brokers often turn to these companies:

– B2Broker

– Leverate

– GBE Prime

These are also reliable Forex liquidity providers.

DeFi Liquidity Pools

DeFi liquidity pools have gained significant popularity in recent years. These pools enable users to provide liquidity to decentralized exchanges (DEXes) and earn rewards for their participation. Here’s how liquidity pools work:

– Automated Market Makers (AMMs): Liquidity pools are powered by AMMs, which use code algorithms to determine asset prices. Unlike traditional order book-based exchanges, AMMs rely on algorithms to price assets and facilitate trades.

– Liquidity Providers: Users who contribute their assets to liquidity pools are known as liquidity providers (LPs). They deposit two tokens of equal value into the pool, creating a market for those tokens. In return, these investors earn LP tokens proportional to the amount of liquidity they contribute to the pool.

– No centralized entity: DeFi liquidity pools help solve liquidity issues in DEXes by encouraging users to provide liquidity. This approach eliminates the need for traditional market makers and enhances market efficiency in the decentralized finance space.

Prominent liquidity pool platforms offer users the opportunity to earn rewards while contributing to the liquidity of the DeFi ecosystem. These include:

– Balancer

– Uniswap

– Curve Finance

How to Ensure Liquidity on Your Crypto Trading Platform?

If you own a crypto exchange, ensuring adequate liquidity is crucial for attracting traders and maintaining a vibrant trading environment. Here are some ways to provide liquidity to your crypto exchange:

– Liquidity Providers Firms: Partnering with institutional liquidity providers is a good way to ensure consistent liquidity on your exchange. These providers have the expertise and resources to offer substantial trading volumes and market-making services, whether you want to offer spot or crypto CFD trading.

– Interexchange Market Making: As an exchange operator, you can act as a liquidity provider yourself by setting bid and ask prices for assets listed on your platform. This approach eliminates the need for third-party providers and allows you to control the liquidity of your exchange.

– DeFi Integration: Integrating with DeFi liquidity pools can also enhance liquidity on your exchange. By connecting your exchange to popular DeFi platforms, you can tap into the liquidity provided by LPs who participate in these pools.

Selecting a Reliable Crypto Liquidity Provider in 2024

Choosing a spot or CFD trading crypto liquidity agent is paramount to the success of your cryptocurrency trading endeavors. There are several criteria you can look for when researching your options:

– Regulatory Compliance

Ensure that your chosen liquidity provider has all the necessary licenses and complies with the regulatory requirements of your jurisdiction. Different countries and jurisdictions may have varying regulations for managing crypto assets and operating as a liquidity provider. The provider should adhere to these regulations to ensure the safety and security of your investments.

– Trading Volume

A reliable LP should be able to provide substantial trading volumes, ensuring a liquid market. Higher trading volumes indicate a more active market with ample liquidity.

– Speed of Execution

Efficient order execution is crucial for a spot or crypto CFD trading platform. Faster trade executions minimize slippage and ensure a high level of liquidity, especially during market fluctuations caused by news events. Look for a provider that can swiftly match buy and sell orders using automated or algorithmic trading systems.

– Technology

Consider an LP that leverages advanced technology, such as automated or algorithmic trading systems. These systems can quickly fill order books with buy and sell orders, facilitating fast and efficient asset exchange. Look for providers that offer FIX protocol connection and integration with popular trading platforms.

– Risk Management

A robust risk management system is essential for a reliable liquidity provider. Different providers offer varying levels of risk management tools, such as stop-loss orders or negative balance protection.

– Instruments

Evaluate the liquidity provider’s range of instruments and their ability to convert crypto assets to fiat money and vice versa. A reliable provider should offer multi-asset liquidity and support various cryptocurrencies and tokens.

– Price Feeds

A reputable liquidity provider should offer stable and reliable price feeds. Price aggregation should be performed in real-time from all relevant exchanges to avoid price gaps and ensure accurate and up-to-date pricing information.

– Client Service and Technical Support

A reliable liquidity provider should offer excellent client service and technical support. Look for a provider with a robust reporting and communication system that promptly addresses any concerns or issues you may have. Consider the provider’s reputation for providing timely and effective support to their clients.

– Fees

Compare the fees offered by different liquidity providers and choose the most cost-effective option. Some providers may offer discounts and bonus systems that can help you save money. Consider the fee structure and any additional charges for specific services or features.

Final Thoughts

Liquidity is essential in the crypto market as it ensures efficient trading, price stability, and market confidence for your exchange or project. Before signing a contract with a provider, always remember to review and negotiate contracts to protect your interests carefully.

Disclaimer: Any information written in this press release or sponsored post does not constitute investment advice. Thecoinrepublic.com does not, and will not endorse any information on any company or individual on this page. Readers are encouraged to make their own research and make any actions based on their own findings and not from any content written in this press release or sponsored post. Thecoinrepublic.com is and will not be responsible for any damage or loss caused directly or indirectly by the use of any content, product, or service mentioned in this press release or sponsored post.

For publishing articles on our website get in touch with us over email or one of the accounts mentioned below.

Home

Home News

News