- 1 BitMEX founder Arthur Hayes cautions that the possible success of spot ETFs could spell doom for Bitcoin.

- 2 Hayes forecasts that widespread adoption of Bitcoin ETFs could lead to a drop in the direct ownership of BTC.

The crypto industry is expecting the approval of a spot Bitcoin ETF (exchange-traded fund) in the United States. However, a prominent industry leader thinks that the success of such financial products could lead to the demise of BTC.

Spot Bitcoin (BTC) ETFs could “totally annihilate” Bitcoin if they are too flourishing, warns Arthur, the former CEO of BitMEX.

Hayes, who co-founded cryptocurrency exchange BitMEX in 2014, explained in a December, 23 blog post that Bitcoin weights because “it moves.”

“Expression” is my final article of 2024. I share some thoughts on expressions of the #crypto investment theme that will ultimately be worthless. May the Pump be with you!, Tweeted Arthur Hayes on December 23, 2023.

However, spot Bitcoin ETFs are designed to “suck up assets” and “store them in a figurative vault,” he said.

If Bitcoin ETF issuers end up owning all of the Bitcoin, and investors end up buying Bitcoin derivatives instead of HODLing themselves — the number of transactions on the network will dwindle, and miners will lose any motivation to keep validating transactions.

“The final product is miners shut down their machines as they can no longer afford the energy needed to operate them,” said Hayes. “Without the miners, the network falls, and Bitcoin vanishes.”

Will TradFi Kill The Bitcoin?

Arthur Hayes warns of possible attempts by traditional finance firms to destroy Bitcoin in his new blog on December 23.

“If ETFs driven by TradFi asset managers are too victorious, they will totally ruin Bitcoin.”, said Hayes.

Arthur Hayes claims that the biggest TradFi asset manager Blackrock is in the asset hoarding game. They will keep Bitcoin and issue a tradeable security, people will buy Bitcoin ETF derivatives instead of buying and holding Bitcoin in self-custodial wallets.

In the future, there will be no real use for the Bitcoin blockchain and this will result in miners shutting down their machines. Miners only get Bitcoin income if the network is used. With Bitcoin locked in a vault, “Without the miners, the network dies, and Bitcoin disappears.”

BlackRock’s Adjusted Filing Arrives With a $10 Million Seed Funding

Hayes’ warning does not seem to deter traditional firms from their goal to get a spot in Bitcoin ETF approved. Several Bitcoin ETF applicants, including BlackRock, Hashdex, and Pando, submitted updated filings to the financial regulator.

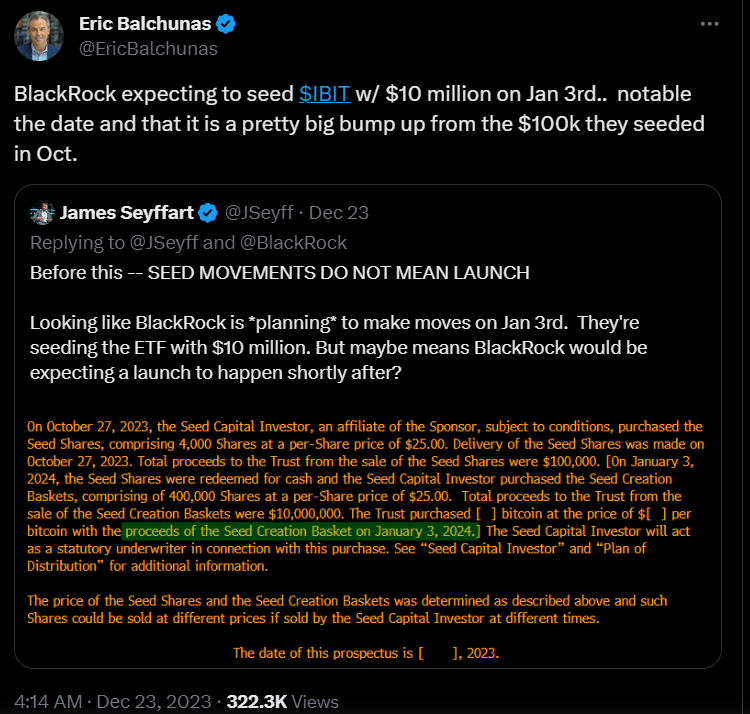

Bloomberg Analyst James Seyffart pointed out that asset manager BlackRock’s updated filing comes with a $10 million seed funding offer. While not ensuring an immediate launch, this proposed funding shows the Bitcoin ETF’s possible readiness for a future launch.

Seyffart noted that BlackRock’s timeline matches with earlier forecasts of a January launch, showing the firm’s plan to move ahead quickly pending approval. This move follows BlackRock’s previous amendment of December 19, which included the SEC-suggested in-cash redemptions into its Bitcoin ETF application.

With a background in journalism, Ritika Sharma has worked with many reputed media firms focusing on general news such as politics and crime. She joined The Coin Republic as a reporter for crypto, and found a great passion for cryptocurrency, Web3, NFTs and other digital assets. She spends a lot of time researching and delving deeper into these concepts around the clock, and is a strong advocate for women in STEM.

Home

Home News

News