- 1 The MSFT stock has given a return of 12.21% since the end of October 2023.

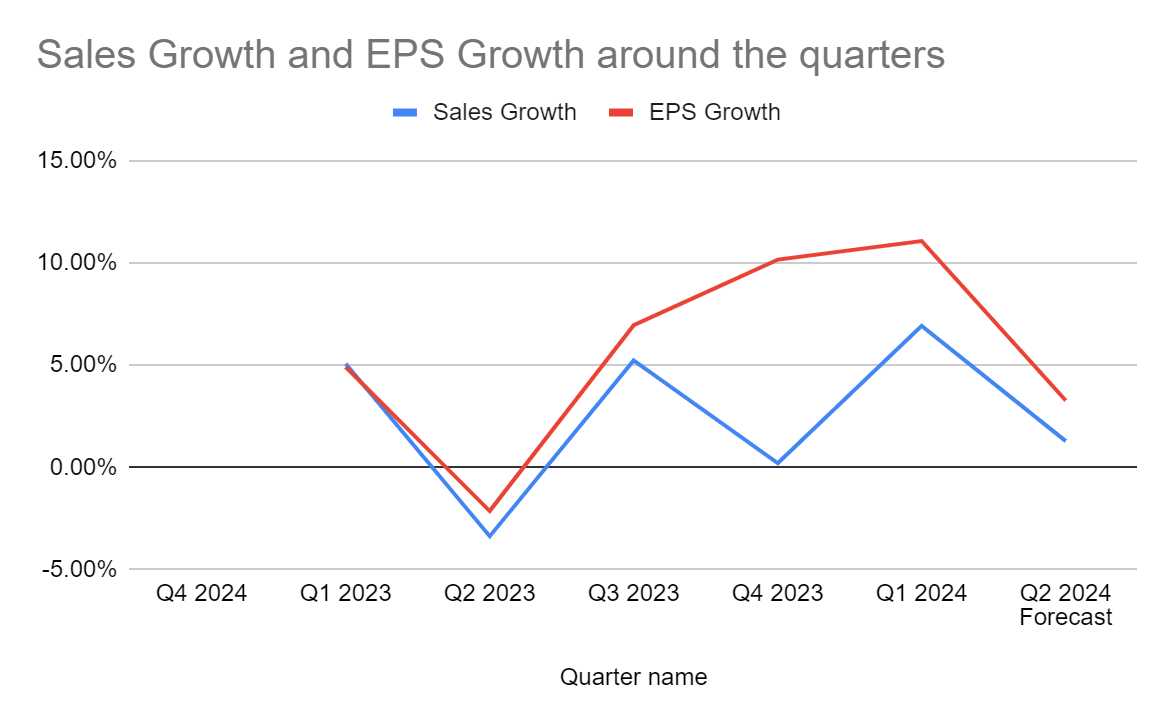

- 2 The Quarter 2 earnings forecast suggests a positive trend in the numbers.

Microsoft has engaged with blockchain technology by Investing in Azure Blockchain technology and also partnering with startups, which are incorporating blockchain into their business models. They have engaged with organizations in areas like supply chain management, identity verification, and financial services.

Since the end of October, Microsoft Corporation (NASDAQ: MSFT) stock has soared high. After the rate hike was stopped, this surge became even more prominent. Since the end of October, MSFT stock price has given more than 12% returns to the investors.

Currently, the market is stable and quiet as per the employment data released by the US government. The market was expecting a decline in the data so that the rate cuts could take place sooner. However, the expectations of the market were short-lived as the data was positive. Therefore, the time for the rate cuts may get extended.

Quarter 1, 2024 Earnings Report and Its Highlights

The revenue in quarter 1 of 2024 came to $56.5 billion, which was 6.9% more than the previous quarter’s revenue. The operating profit for the company stood at $26.9 billion and increased 25% compared to last year’s same quarter. This growth was seen as a positive outlook by the investors and it was also reflected in the MSFT stock price.

“We are making the age of AI real for people and businesses everywhere,” said Satya Nadella, chairman and chief executive officer of Microsoft. The positive comments by the board about A. I. were also an indication that the company will incorporate more of it into its operations and business structure.

Moreover, the CFO of the company, Amy Hood, shred his light upon the current financial outlook of the company. “Consistent execution by our sales teams and partners drove a strong start to the fiscal year with Microsoft Cloud revenue of $31.8 billion, up 24%”

MSFT Earnings Forecast for the 2nd quarter of 2024

| Amount in millions of USD unless mentioned otherwise | ||||

| Quarter name | Revenue | Sales Growth | EPS | EPS Growth |

| Q4 2022 | $49,360 | $2.24 | ||

| Q1 2023 | $51,865 | 5.07% | $2.35 | 4.91% |

| Q2 2023 | $50,122 | -3.36% | $2.30 | -2.13% |

| Q3 2023 | $52,747 | 5.24% | $2.46 | 6.96% |

| Q4 2023 | $52,857 | 0.21% | $2.71 | 10.16% |

| Q1 2024 | $56,517 | 6.92% | $3.01 | 11.07% |

| Q2 2024 Forecast | $57,246 | 1.29% | $3.11 | 3.27% |

Forecast Method: Mean of Linear Regression and Average Growth

In the upcoming earnings result, which is to be released by the board on the 23rd of January, it is forecasted that the revenue will be $57 billion. This revenue will come with a growth of 1.29% as was seen in the first quarter of FY 2024.

Moreover, the shareholders can expect an EPS of $3.11 with a growth of 3.27% as of the last quarter. If the results come near this forecast, it is expected that the MSFT stock price will show a positive trend.

Conclusion

Microsoft Corporation released its earnings report data in which the numbers were positive. The market reacted the same and the stock gave an upward trajectory. However, since the start of this year, the US market has been numb as the expectations of a rate cut were short-lived. The earnings forecast for the upcoming quarterly results is positive.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only. They do not establish financial, investment, or other advice. Investing in or trading stocks comes with a risk of financial loss.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News