- 1 ARK Invest made a strategic transfer of funds from ARKB to BITO on Tuesday after the ETF approval.

- 2 Cathie Wood of Invest has shared her views on the movement of Bitcoin-linked ETFs and connected them to recent transactions.

- 3 She is optimistic about the price of Bitcoin, referring to the upcoming halving event and other factors in the mid-term.

ARK Investment Management LLC, aka ARK Invest, is an investment management firm based in America. It manages several actively managed ETFs. Cathie Wood is the founder of the firm, which was established in 2014.

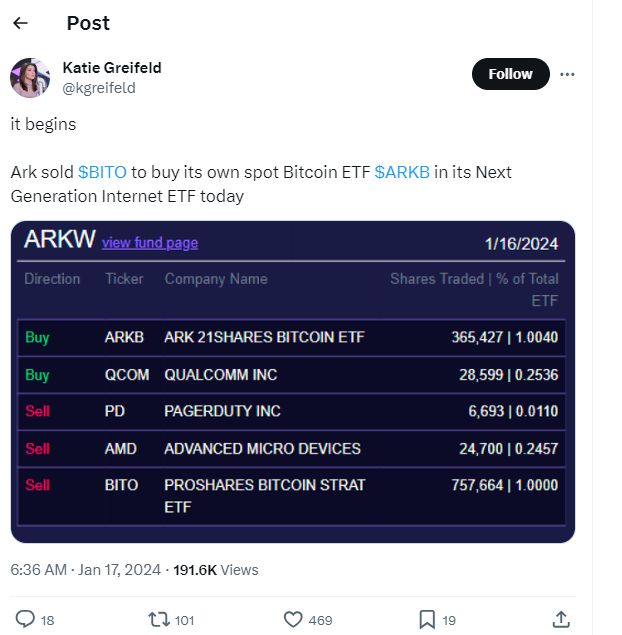

On Tuesday, the company bought shares worth $15.9 million in its bitcoin ETF, which was recently listed. The investment firm added 365,427 shares of the ARK 21Shares Bitcoin ETF (ARKB). It is an addition to its Next Generation Internet ETF (ARKW).

On Tuesday, ARKB shares were closed at $43.51, 11% down from their listing price on January 11 of $49. Besides, it was 0.80% down from the previous day.

Transfer of Funds from BITO to ARKB

Cathie Wood majorly transferred funds from one BTC-linked ETF to another. She has sold shares in the ProShares Bitcoin Strategy ETF (BITO) to the ARK 21Shares Bitcoin ETF (ARKB). BITO is the first ETF linked to bitcoin futures to get listed in the USA.

However, ARK Invest sold BITO worth $15.8 million to invest in ARKB worth $15.9 million. The sale transaction involved 757,664 shares of BITO.

Before this, it also diluted its holdings in the Grayscale Bitcoin Trust (GBTC) in December before its conversion into a Bitcoin ETF. ARK swapped its GBTC shares for BTC as a result of the anticipation of the approval of a spot bitcoin ETF in the USA. To support this move, Cathie Wood said that investing in an already approved fund is more secure than an approval waiting to happen.

With that statement, investors and analysts already expected that ARK would swap a part of its BITO shares for a spot BTC ETF after the approval.

On Tuesday, the BITO price closed 0.71% down from the previous day at $20.91.

Apart from buying ARKB and selling BITO, Ark Invest also sold its holdings in Pagerduty Inc. (PD) and Advanced Micro Devices (AMD) and bought shares of Qualcomm Inc. (QCOM).

With these transactions, some of the analysts were connecting them to strategic changes in the company, such as the shift of upper limit holdings from 10% to 25%. However, some analysts were predicting a further decrease in bitcoin prices with all these movements.

Future Expectations of Cathie Wood

Despite the sale transaction executed by the firm, Cathie Wood, the CEO of Ark Invest, is optimistic about the future of Bitcoin. She shared a long-term provision about the increase in the price of Bitcoin to $1.5 million by 2030. Additionally, she is also optimistic about the impact of the upcoming halving event in Bitcoin.

Her long-term bullish outlook for the currency overpowers her and the company’s long-term prospects for digital assets. The current strategic moves taken are in response to evolving market conditions and ongoing development in the crypto space.

Apart from ETF movements, Ark Invest is also offloading significant holdings in Coinbase (COIN) to buy other equity shares, including TSLA (Tesla Inc.)

Amanda Shinoy is one of the few women in the space invested knee-deep in crypto. An advocate for increasing the presence of women in crypto, she is known for her accurate technical analysis and price prediction of cryptocurrencies. Readers are often waiting for her opinion about the next rally. She is a finance expert with an MBA in finance. Quitting a corporate job at a leading financial institution, she now engages herself full-time into financial education for the general public.

Home

Home News

News