- 1 Ethereum has observed significant sales executed through various transactions, such as Celsius’ sale, as a part of its bankruptcy proceedings.

- 2 This has led to a significant decrease in the price of ETH over the past week.

- 3 Michael Van de Poppe suggests a recovery soon, as supported by some of the factors that will push prices up.

Ethereum (ETH) is facing a potential sell-off worth $1 Billion. The bankruptcy actions of Celsius, a crypto lending platform, have resulted in the significant sell-off of Ethereum from its network.

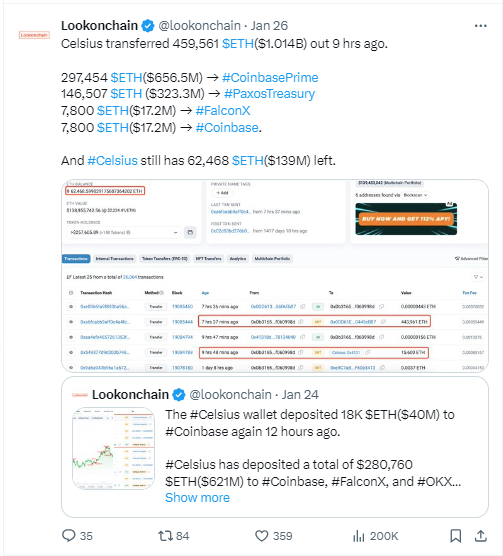

The reports released by the analyst, Lookonchain, have clarified the amount of ETH transferred by Celsius over numerous crypto exchanges.

Breakout of the Transaction

The transactions involved the transfer of 459,561 ETH, estimated to hold an accumulated value of $1.014 Billion. The total amount was transacted in 13 transactions including two trial trades, and were spread across multiple exchanges.

The breakdown of this transaction is, as such, distributed among four transactions. The details of those transactions are as follows: The first transaction involved 297,454 $ETH worth $656.5 Million to the Coinbase price; the second transaction involved 146,507 $ETH worth $323.3 Million to Paxos Treasury; the third transaction was to FalconX involving 7,800 $ETH worth 17.2 Million; and the fourth transaction was also worth $17.2 Million involving 7,800 $ETH to Coinbase and the other transactions involving lesser volumes. The transactions are listed in terms of their trade volume.

At that time, Celsius had 62,468 $ETH worth $139 Million.

These numerous transactions with significant volumes have made a material impact on the Ethereum market. It is likely putting serious pressure on Ethereum investors, with critical implications for broader market sentiment. Ethereum would have observed a most drastic event if the whole lot had been sold simultaneously.

Previous Ethereum Transactions of Celsius

The latest Ethereum transactions are not hidden from any users. LookonChain has previously reported more such significant transactions related to Celsius. One such transaction involved a deposit of 13,000 ETH worth approximately $30 Million on Coinbase and 2,200 ETH worth $5 Million to FalconX.

These moves signify Celsius’s strategy to manage financial challenges. Additionally, they signal an increase in market volatility for Ethereum’s prices.

Moreover, a report by Arkham Intelligence released between January 8 and January 12 confirms Celsius’ liquidation of Ethereum worth more than $125 Million. The reason behind these sales transactions is to cover the obligations to creditors.

Furthermore, Dune Analytics also specified the large-scale Ethereum redemptions. The noted redemptions exceed $1.6 Billion. Since Shanghai’s last year update, this is the highest recorded Ethereum redemption.

Celsius will continue to liquidate Ethereum to pay off its debts as part of its bankruptcy proceedings.

Impact of Sale-off on Ethereum Market Prices

The price of Ethereum declined by approximately 10% in a week as an after-effect of Celsius’s Ethereum transactions. The value of ETH decreased from $2600 to around $2150 in a week. While it started recovering in the last 24 hours, it could not sustain and fell to the weekly low.

Around the same time, a popular crypto analyst, Michael Van de Poppe (X Account: CryptoMinchML) has recommended an upcoming bull trend. He also suggested probable factors that will support the increase in prices of Ethereum are hype around Ethereum spot ETF and Ethereum about to launch new upgrades to reduce costs by 90%.

He also pointed out that the bottoming of the rally around Bitcoin will support price rallies in Bitcoin and other altcoins.

Mr. Pratik chadhokar is an Indian Forex, Cryptocurrencies and Financial Market Advisor and analyst with a background in IT and Financial market Strategist. He specialises in market strategies and technical analysis and has spent over a year as a financial markets contributor and observer. He possesses strong technical analytical skills and is well known for his entertaining and informative analysis of the Financial markets.

Home

Home News

News