- 1 Liquid Re-staking Tokens emerged from the EigenLayer staking primitives that blend ETH and ETH LST.

- 2 EigenLayer permits stakers to reallocate the staked assets to protect decentralized services on the Ethereum network.

- 3 Innovation and progress in the Decentralized Finance are coupled with risks.

Decentralized Finance (DeFi) eliminated the need for intermediaries and allowed individuals to control their finances. The concept of Liquid Staking Tokens (LST) plays a vital role in the DeFi sector and the emergence of Liquid Re-staking Tokens (LRT) and Layer2 solution blast empowered the field of DeFi staking.

LRT Meaning

LRT meaning is associated with the user’s EigenLayer deposit. The concept was introduced in September 2023 and emerged from the new cryptoeconomic elementary and was introduced by EigenLayer. The tokens can accrue staking interest and be swapped for their underlying value.

It is considered as one of the newest innovations in the Liquid Staking Derivatives (LSD), an area in the Ethereum ecosystem.

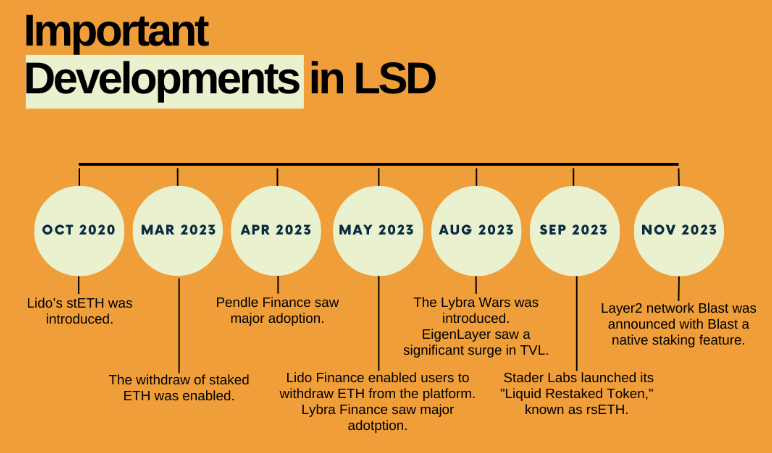

With time, the world of staking stepped to new heights and introduced new innovations and features like major adoption in Lybra Finance, introduction to Lybra Wars, LRT, and Layer2 network blast.

Additionally, Pendle Finance is supposed to be listed on the chart of LSD space. The platform already pioneered yield tokenization of the Ethereum blockchain and enables individuals to trade yield and earn a fixed yield on investment.

Difference between LST and LRT

Despite similar terminology and identical frameworks, LST and LRT hold some differences mainly related to the assets they represent.

Liquid Staking Tokens: LST entered the DeFi sector to offer a new way to get passive income on cryptocurrency investment.Tokenization, ownership, liquidity, use of cross-chain platforms for token staking, and valid collateral are major aspects of LST.

In addition to this, increased rewards, diversification of yielding strategies, liquidity on other DeFi platforms, and a chance to participate in governance decisions are some benefits. Also, Lido Finance and Rocket Pool offer staking services.

Liquid Re-Staking Token: Liquid Re-staking token, on the other hand, was introduced by EigenLayer and represents staked ETH with corresponding staking rewards. The purpose is to address the liquidity constraints of the EigenLayer framework.

The tokens are tradable and usable in DeFi and possess a wide range of flexibility and diversification. The concept offers freedom to engage with the market and diversified strategies for staking on one platform. Also, improved capacity efficiency, revenue maximization, and liquidity enhancement are the main advantages.

Moreover, the emergence of LRT and layer 2 solution blast empowered the field of DeFi staking. However, the concept also holds a few of the challenges and risks.

Challenges and Risks

LRT is more economically and technically difficult when compared to LST. Increased complexity, smart contract risks, governance risks, and liquidity are four major risks associated with LRT.

Increased Complexity: The chance of re-staking assets on different networks for maximized returns increased complexity for investors. Investors should focus on selection and evaluation as well as basic staking and earning mechanisms.

Smart Contract risks: Interaction with multi-layer smart contracts sometimes results in new security vulnerabilities or flaws. The complexity and interactivity of smart contracts make the verification and auditing process more challenging.

Liquidity risks: Although LRT motives to enhance liquidity, under extreme market conditions the liquidity of the investments may be affected, making it difficult to convert into liquidity.

Governance risks: At the economic and technical levels, LRT protocols possess complexity when it comes to governance. LRT protocol’s governance structuring and decision-making process are complex which may result in inefficient governance.

Other paradigms linked to LRT

The concept is attracting more and more investors due to the automation and efficiency of strategies. Such strategies lower the investment threshold. Furthermore, the concept results in enhanced market liquidity due to more funds flow and booming the DeFi ecosystem stability.

Also, the diversified and customization options push market innovation and development. The approach also offers liquidity for illiquid assets along with offering new sources of funding.

Conclusion

The launching of LRT marks an innovative leap in the sector of crypto asset staking and holds the future of DeFi staking. The concept permits assets to be re-staked across different platforms and services to make passive earning and upsurge capital efficiency.

FAQs

What is staking?

Staking is one of the easiest ways of earning bonuses and rewards for holding particular digital assets.

What are liquidity pools?

A liquidity pool is a group of cryptocurrencies that assist more financial transactions including lending, swapping, and yield earning.

Mr. Pratik chadhokar is an Indian Forex, Cryptocurrencies and Financial Market Advisor and analyst with a background in IT and Financial market Strategist. He specialises in market strategies and technical analysis and has spent over a year as a financial markets contributor and observer. He possesses strong technical analytical skills and is well known for his entertaining and informative analysis of the Financial markets.

Home

Home News

News