- 1 As a settlement with NYDFS, Gemini has been asked to repay $1.1 Billion to the customers of its Earn program.

- 2 The Winklevoss twins are also required to pay a penalty of $37 Million to NYDFS.

- 3 If the court approves the settlement, Earn users are ‘expected’ to receive 97% of their assets by the end of April 2024.

The Winklevoss twins – Cameron Winklevoss and Tyler Winklevoss own the crypto firm Gemini Trust Company, founded in 2014. They were among the first prominent figures to disclose their Bitcoin holding of $11 Million publicly.

The Winklevoss twins’ net worth is approximately $1.6 Billion as of May 2023, which is more than the combined amount of penalty and repayment. Their net worth is primarily attributable to their Bitcoin holdings.

Developments in the Filing Against Gemini

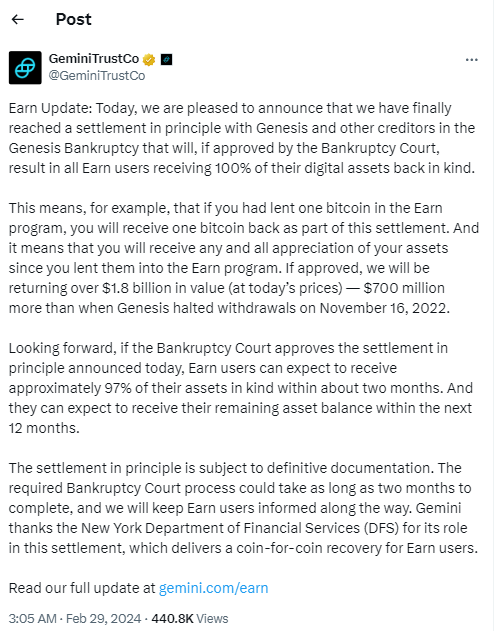

On February 28, Genesis shared a post to announce the settlement details with creditors in the bankruptcy. As a part of a settlement with the New York Department of Financial Service (NYDFS), they agreed to pay a $37 Million fine and repay $1.1 Billion to customers in the Gemini Earn lending program.

This agreement is a significant step towards the resolution of the disputes involving the Earn program. The problems arose after Genesis Global Capital LLC filed for bankruptcy in January 2023.

Gemini is obliged to return $1.1 Billion to the users who were part of its Earn program. This victory of NYDFS over Gemini has been referred to as a representation of attention to Gemini’s assets, which were under their control.

Customer Reimbursement Settlement Schedule and Details

The customers are expected to receive 100% of their digital assets back in kind. The customers will receive any appreciation for the users’ assets since the assets were lent to the Earn program.

Gemini said that if they get approval, they will return over $1.8 Billion in value, $700 Million more than when Genesis halted withdrawals on November 16, 2022.

If the bankruptcy court approves the settlement in principle announced on February 29, all the users can expect to receive 97% of their assets in kind within about two months, that is, by the end of April 2024.

Moreover, the remaining amount will be returned within the next twelve months. The payment settlement is subject to definitive documentation. The required process in the bankruptcy court can take up to two months to complete. However, Gemini promised to inform Earn users about all the updates in case proceedings.

Also, the New York Attorney General’s office is filing a case against Gemini, Genesis Global Holdco, and Digital Currency Group (DCG) about crypto loans.

The SEC has also pointed out Gemini Earn’s lapses in their relation to securities offerings, where the program had raised significant crypto investments

Conclusion: Impact of the Case on the Crypto Industry

This case emphasizes the need for due diligence and regulatory compliance in the cryptocurrency industry. The failure of Gemini to observe and monitor the tie-up with the unregistered lender firm, Genesis Global Capital, had adverse consequences.

Around 200,000 crypto users were affected, out of which 30,000 were New Yorkers. The outcome highlights the risks associated with crypto exchanges and lending firms not being properly risk-assessed or not following guidelines.

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News