BlackRock’s entry into the crypto market will create more opportunities and is expected to revolutionize the market by launching its Bitcoin spot ETF in Brazil.

The regulatory clearance for BTC ETFs places immense political and financial pressures on ETFs. The Securities and Exchange Commission of the United States has approved the ETF after rejecting 11 applications from different companies.

BlackRock, a prominent asset manager, is claimed to be the primary firm that backed the approval of the over-the-spot ETF. There are claims that the SEC and company officials met officially dozens of times, but several meetings were held outside of media coverage.

Following the approval of the spot ETF, a massive inflow of funds was seen in the Bitcoin ecosystem. BlackRock unveiled its plan to launch the BTC spot ETF in Brazil.

Dozens of nations have already bent their rules and regulations to operate cryptocurrencies. El Salvador was the first nation to legalize Bitcoin by introducing the Bitcoin Law.

The launch is scheduled for March 01, 2024, aiming to launch an ETF in the Brazilian market to boost the adoption and usage of digital assets in the region. BlackRock will launch its ETF in collaboration with the Brazilian stock Exchange.

Karina Saade, BlackRock’s country manager, said, “Our digital asset journey has been underpinned by the goal of providing high-quality access vehicles to investors,” she added “IBIT39 is a natural progression of our efforts over many years and builds on the fundamental capabilities we have established so far in the digital asset market.”

Karina also notes, “We believe in the potential of technology and that today it is possible for all investors, individuals, to build a portfolio solely with ETFs.”

Other News

Robinhood’s European arm has listed Dogwifhat, a growing memecoin, which surged over 400% in the past 365% days.

Crypto Market Post ETF Approval

Following the approval of spot ETF, a massive inflow of Billions of dollars of funds is seen in the Bitcoin ecosystem. BlackRock unveiled its plan to launch the BTC spot ETF in Brazil.

The intraday trading volume of BTC spot ETF is $5.38 Billion, and the market capitalization is $51.18 Billion. Regarding price, BRRR offers the spot ETF at the lowest price, and Franklin BTC ETF charges the lowest fee for buying and selling the ETF.

A major positivity in the cryptocurrency market capitalization, when writing, the market cap was $2.32 Trillion.

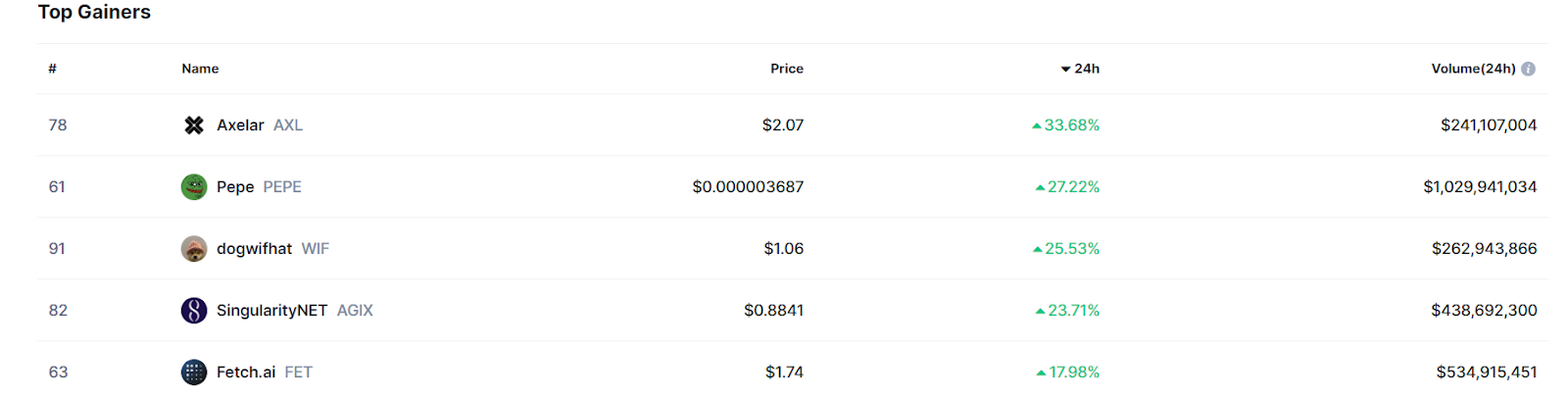

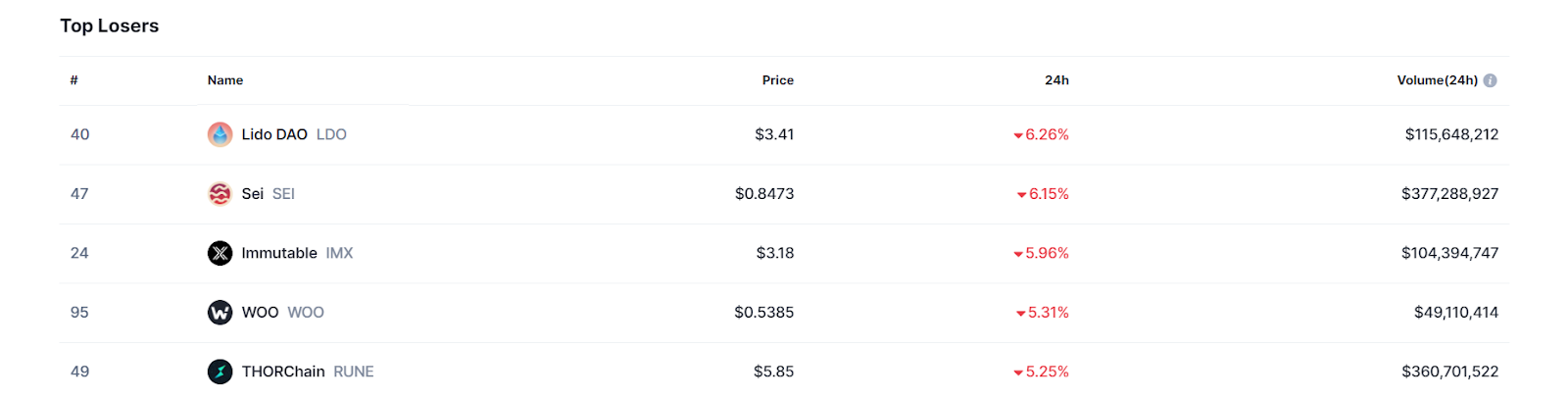

Intraday Gainers & Losers

Axelar topped the list of intraday gainers as its prices grew 33.68%, Pepe (PEPE) 27.22%, Dogwifhat (WIF) 25.53%, SingularityNET (AGIX) 23.71% and Fetch.ai (FET) 17.98%.

In the past 24 hours the trading price of LidoDAO(LDO) slips 6.26%, Sei (SEI) 6.15%, Immutable (IMX) .96%, WOO(WOO) 5.31%, THORChain(RUNE) 5.25% and Celestia(TIA) 4.76%.

Disclaimer

The views and opinions stated by the author or any people named in this article are for informational ideas only and do not establish financial, investment, or other advice. Investing in or trading crypto or stock comes with a risk of financial loss.

Amanda Shinoy is one of the few women in the space invested knee-deep in crypto. An advocate for increasing the presence of women in crypto, she is known for her accurate technical analysis and price prediction of cryptocurrencies. Readers are often waiting for her opinion about the next rally. She is a finance expert with an MBA in finance. Quitting a corporate job at a leading financial institution, she now engages herself full-time into financial education for the general public.

Home

Home News

News