The recently approved Bitcoin Spot ETF has become a significant topic to discuss, as it lured millions of new users and billions of funds inflow.

The recently approved Bitcoin spot ETF has lured millions of new users toward the cryptocurrency space, specifically Bitcoin.

As per claims, after a few hours of trading, the Bitcoin Ecosystem saw an inflow of $100 Million. A senior ETF analyst at Bloomberg, Eric Balchunas, has observed a significant development in the spot Bitcoin ecosystem.

On his ‘X’ account, Balchunas wrote, “Volume still elevated, altho not insane, for bitcoin ETFs.. today was the third biggest day ever after Wed and Thur. All told $22b traded this week, about a month’s worth of Volume in 5 days. $IBIT did over $1b every day. Will this subside or is the new normal here? We’ll know next wk.”

Volume still elevated, altho not insane, for bitcoin ETFs.. today was third biggest day ever after Wed and Thur. All told $22b traded this week, about a month's worth of volume in 5 days. $IBIT did over $1b every day. Will this subside or is new normal here? We'll know next wk. pic.twitter.com/2F2OVY9MxE

— Eric Balchunas (@EricBalchunas) March 1, 2024

According to the analyst, BlackRock’s (IBIT) solely traded more than $1 Billion intraday in the earlier week. There is speculation that the approval of the spot BlackRock backs ETF, as it allegedly met the regulators several times unofficially.

The top three performing BTC spot ETFs in the past week were Grayscale’s GBTC, BlackRock’s IBIT, and Fidelity’s FBTC. There are claims that the ETF fully backs a boost in sudden crypto adoption.

Bitcoin, the market pioneer, has shown constant growth since its ETF approval; as of writing, it was trading at $62,084. Market observers also urge that the price will continue to grow and might reach new levels post 4th halving.

With 52.17% of overall market dominance, Bitcoin is the second most traded token in the market. Tether (USDT) is the market’s most prominent stablecoin and the most traded coin.

Market Price Update

The cryptocurrency market capitalization grew more than 50% in the past few months. When writing, the market cap was $2.33 Trillion, with an intraday growth of 1.01%.

Ethereum, the second most talked about crypto in the market, grew over 15% in the past seven days. The race among financial leaders has started to file their application for approval over Ether spot ETF.

The Ether spot ETF is claimed to be approved by the US Securities and Exchange Commission by the end of May 2024.

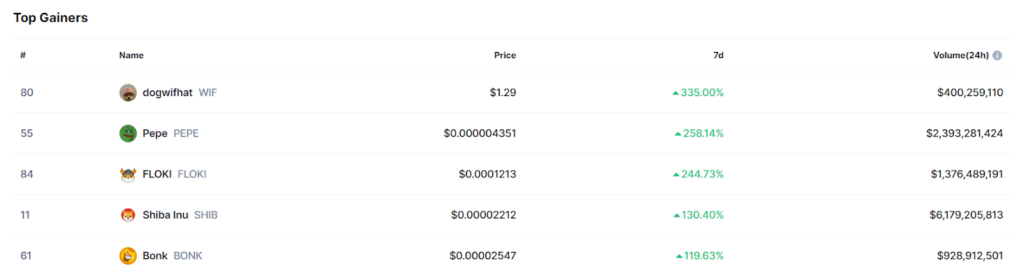

Gainer & Losers

In the past seven days, Dogwifhat (WIF) surged 335%, which makes it the leader of the list. Pepe (PEPE) has added 258% to its trading price in the same time frame, Floki (FLOKI) 244.73%, and Shiba Inu (SHIB) 130.40%.

It is crucial to note that the weekly and intraday gainers list are majorly led by memecoin, specifically trading below $2.

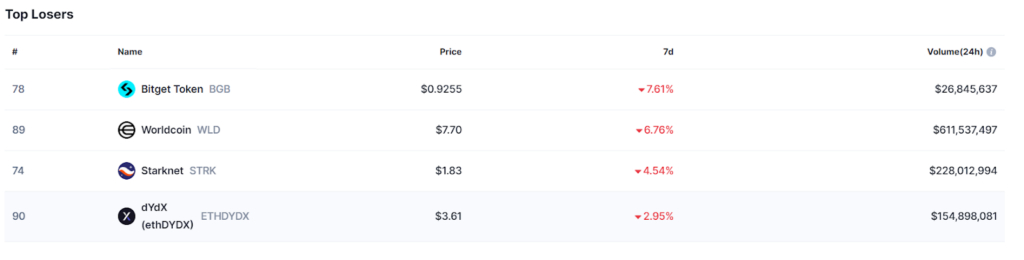

Bitget Token (BGB) has lost 7.61% of its trading price in the past week, WorldCoin (WLD) 6.67%, Starnet (STRK) 4.54%, and dYdX (ethDYDX) 2.95%.

Disclaimer

The views and opinions stated by the author or any people named in this article are for informational ideas only and do not establish financial, investment, or other advice. Investing in or trading crypto or stock comes with a risk of financial loss.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News