An unstoppable advancement of blockchain and Web3 has created new opportunities for hackers and scammers, and the market loses billions of dollars in crypto hacks annually.

Immunefi, a blockchain cybersecurity firm, released a report based on hacks and funds wiped out across the industry. The crypto industry lost over $200 million in two months in 2024. In February, hackers looted $70 Million, a slight decline in hacks.

The report ‘Crypto Losses in the February 2024 Report’ also highlights that Web3 had mirrored a loss of $200,478,42 from rug pulls and hacks in 2024 YTD. The amount that went out of the market was collected from 32 hacks from Web3-based firms.

The lead of communication at Immunefi quoted while talking to a crypto media outlet that “A major boost in losses in cryptocurrencies from compromising wallet and private key is observed, Immunefi also evaluated that the losses are close to 30% of total losses year to date.”

“We expect that 2024 will likely witness the most substantial losses in Web3 ever in terms of volume of funds. We are already seeing an increase of over 15% in losses year-to-date compared with 2023, as anticipated.”

February 2024 Hacks

In February 2024, a decline in the total hacks was seen compared to January, which saw 32 hacks, and in Feb, the total hacks were 12. February 2023 also lost less, which might be because of fewer days.

The lead of comm further states, “Generally, we have observed an average of 26 key incidents per month, based on our data for 2023. Despite this decrease in incidents, February still saw a considerable volume of losses, with notable exploits resulting in losses of as much as $32 million due to hacking.”

Crypto Hacks in 2023

Several analysis firms state that the cryptocurrency space has lost around $1.3 Billion. The hacks and scams over this period are 54.3% less than in 2022. The DeFi sector lost $2.5 Billion in 2021 and $3.1 Billion in 2022. However, the hacks and scams were on their verge.

The lead security architect and researcher of Halborn Mar Gimenez-Aguilar said, “There’s been a worrying trend in the escalation of both the frequency and severity of attacks within the DeFi ecosystem.”

She added, “ In our comprehensive analysis of the top 50 DeFi hacks, we observed that EVM-based chains and Solana are among the most targeted chains, largely due to their popularity and capability to execute smart contracts.”

Total funds lost in 2023 from DeFi hacks have declined more than 62% in the year-to-date time frame.

Crypto Market Update

In the past few years, global crypto adoption has surged significantly, and after a long wait, the market capitalization crossed $2 Trillion. As of writing, the market capitalization was $2.33 trillion. Analysts claim it might reach $3 trillion in the coming weeks.

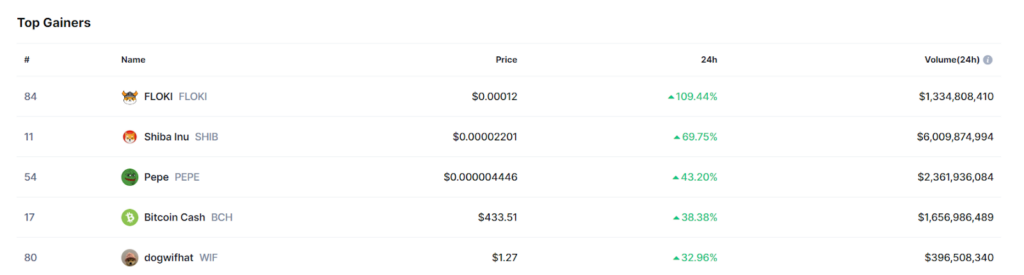

Bitcoin, the market pioneer, surged more than 21.19% in the past seven days when it was trading at $61,948. The intraday gainer list is led by Floki (FLOKI), which surged 110%, Shiba Inu (SHIB), 68.28%, Pepe (PEPE), 39.53%, and Dogwifhat grew 35.36%.

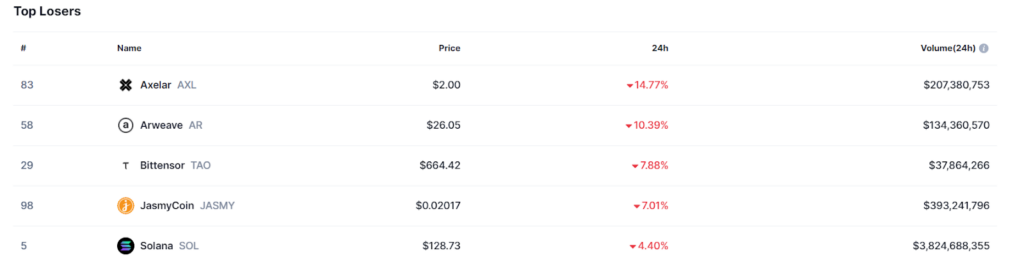

Axelar (AXL) has lost 25.08% of its trading volume in the past 24 hours, Arweave (AR) 11.29%, Bittensor (TAO) 7.87%, Toncoin (TON) 6.09%, Sui (SUI) 4.76% and JasmyCoin (JASMY) 4.25%.

Disclaimer

The views and opinions stated by the author or any people named in this article are for informational ideas only and do not establish financial, investment, or other advice. Investing in or trading crypto or stock comes with a risk of financial loss.

Adarsh Singh is a true connoisseur of Defi and Blockchain technologies, who left his job at a “Big 4” multinational finance firm to pursue crypto and NFT trading full-time. He has a strong background in finance, with MBA from a prestigious B-school. He delves deep into these innovative fields, unraveling their intricacies. Uncovering hidden gems, be it coins, tokens or NFTs, is his expertise. NFTs drive deep interest for him, and his creative analysis of NFTs opens up engaging narratives. He strives to bring decentralized digital assets accessible to the masses.

Home

Home News

News