The approval of Bitcoin spot ETF (exchange traded fund) has lured millions of new users to the industry. The Ether spot ETF is expected to help boost adoption and price in the future.

Following the approval of the Bitcoin spot ETF, adoption spiked in the Bitcoin ecosystem and other cryptocurrencies. Ever since the approval of BTC ETF, the hype of Ether spot ETF has stirred the industry.

Most recently, the Securities and Exchange Commission (SEC) of the United States has delayed its decision to approve or reject the BlackRock and Fidelity Ether pot ETF Applications.

Ethereum is the second largest crypto in the market in terms of market capitalization, and its blockchain is widely used for its diverse features.

Approval of the BTC spot ETF largely accounts for the pressure of the finance market on the regulatory commission. A March 4, 2024 filing says that the SEC will delay its decision on the BlackRock and Fidelity applications.

The SEC announced the 1st delay over the Ether spot ETF application of BlackRock and Fidelity investments. BlackRock is a prominent financial giant and one of the biggest asset managers globally.

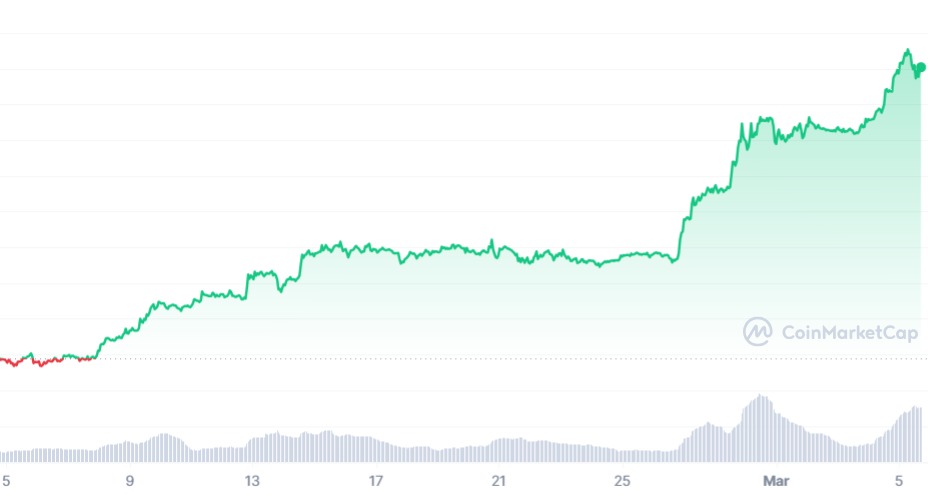

More than ten crypto and traditional-based companies await their chance to file applications and get approval. At the time, Ethereum (ETH) was trading at $3,716, with an intraday surge of 1.07%.

What Does the Entry of BlackRock in Crypto Mean?

In recent years, dozens of traditional financial giants have entered the cryptocurrency industry. Similarly, the entry of traditional players has injected Billions into the market.

BlackRock is one of the most talked about investment players globally, with over $9 Trillion in assets under management.

Some market analysts also claim that BlackRock’s approval of the Bitcoin spot majorly backs ETFs. The company and the US SEC have met over five times to discuss the spot ETF.

On the other hand, some observers speculate that BlackRock and the SEC have met many more times than previously reported.

Crypto Market Update

Most recently, the market capitalization of the most popular stablecoin, Tether (USDT), grew to its all-time high. The market cap of USDT faced a reversal from the boundary of $100 Billion.

The Blockchain Association of Nigeria has recently urged the Federal Government to structure a framework for cryptocurrency exchanges and Binance. It is claimed that the sudden approach to regulation came after the surging concern against Binance in the Nation.

The entire market capitalization of the industry has surged significantly. As of writing, it was $2.51 Trillion. The market cap grew more than 20% in the past few days.

Bitcoin, the market leader, has grown significantly in the past 30 days as it flourished by 55.11%.

eCash (XEC), penny crypto, grew more than 64% in the past 24 hours, making it the leader of the gainer list. Shiba Inu (SHIB) increased by 57.26%, Theta Network (THETA) by 33.03%, and Internet Computer (ICP) by 25.73%.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News