Grayscale announced its New Fund, titled Grayscale Dynamic Income Fund, available for qualified clients and is already in operation.

Grayscale is the investment firm behind the biggest spot bitcoin ETF. On Tuesday, March 5, Grayscale announced the launch of a new fund, “Grayscale Dynamic Income Fund (GDIF).”

The new fund aims to stake certain cryptos and distribute the earnings back to investors every quarter in USD. The GDIF is Grayscale’s first actively managed crypto fund.

Grayscale’s CEO, Michael Sonnenshein, said,

“As our first actively managed Fund, GDIF is an important expansion of our product suite and enables investors to participate in multi-asset staking through the convenience and familiarity of a singular investment vehicle.”

Development of GDIF

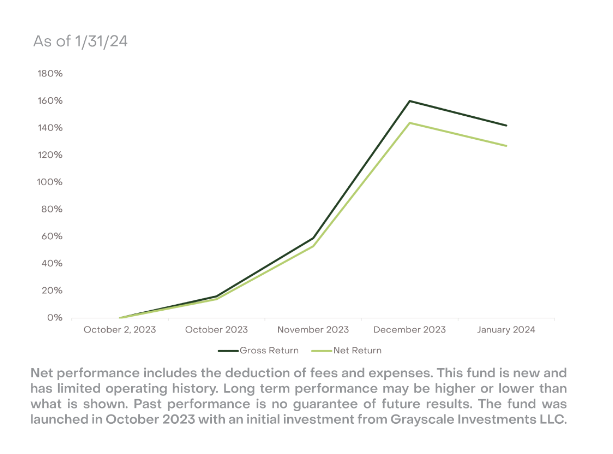

The Grayscale Dynamic Income Fund (GDIF) was seeded with internal capital from Grayscale in October 2023. The fund has recorded growth of over 140% in gross return and over 120% in net return.

The company communication added, “Qualified clients” are able to invest in GDIF, meaning it’s not open to the general public.

A qualified client is a person or entity that meets certain thresholds and the threshold is that the individual should currently have a net worth of at least $2.2 Million as set by the SEC. This value excludes the value of their primary residence or assets under management of $1.1 Million.

Objectives of GDIF

It seeks to:

(i) Optimize income from funds in the form of staking rewards associated with proof-of-stake digital assets,

(ii) achieve capital appreciation from such investments is the secondary goal.

Investors will earn staking rewards in return for securing the network through the validation of transactions. The staking rewards are paid to investors in each blockchain’s native token.

GDIF aims to convert staking rewards into USD every week and it will be issued to users each quarter.

Inclusions Of Grayscale Dynamic Income Fund

The company clarified that initially, it will own assets for nine blockchains, including:

Aptos (APT)

Celestia (TIA)

Coinbase Staked Ethereum (CBETH)

Cosmos (ATOM)

Near (NEAR)

Osmosis (OSMO)

SEI Network (SEI)

Solana (SOL)

Polkadot (DOT)

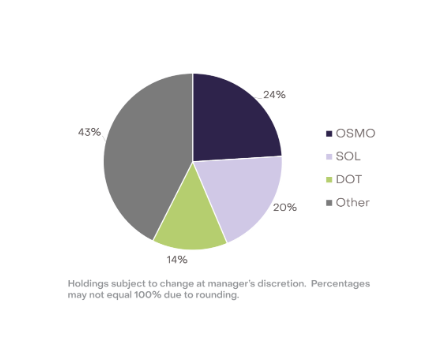

Currently, the biggest contributions for the fund is in Osmosis, Solana and Polkadot

Understanding GDIF’s Fund Strategy and Process

Step 1: Investors invest or commit their capital

Step 2: Grayscale invests capital across a portfolio of proof-of-stake tokens, using qualitative and quantitative factors

Step 3: The company stakes tokens to earn rewards in the form of tokens

Step 4: The fund aims to monetize the token rewards into cash weekly

Step 5: They aim to distribute cash to investors quarterly and rebalance tokens as needed to optimize income.

However, the above-mentioned process can change slightly depending on the growth of the fund, as the fund is at a very early stage of development.

Conclusion: Why is Grayscale promoting GDIF over other funds?

GDIF will enable thorough analysis for selecting proof-of-stake tokens and optimizing for staking rewards. The company also claims that it manages the complexity of staking and unstaking multiple tokens. Each token has its own timelines and requirements for staking and unstaking.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News