Coinbase is the second most prominent and preferred cryptocurrency exchange and is constantly working on its global and broader expansion. The Commodities Futures Trading Commission (CFTC) is one of the crucial institutions that can shape the crypto industry.

In its recent letter to the Commodities Futures Trading Commission (CFTC), Coinbase stated that it plans to introduce futures trading for Dogecoin, Litecoin, and Bitcoin Cash.

Coinbase submitted its letter to the CFTC on March 07, 2024; the letter was addressed to Christopher Kirkpatrick, the secretary of the CFTC. The submitted document elaborates on detailed information on contract sizes, settlement methods, and structure.

The exchange utilizes the self-certification route under CFTC Regulation 40.2 (a) to list these future contracts, allowing them to proceed without direct approval from the CFTC as long as they follow the Commodity Exchange Act and CFTC regulations.

Other News

The Ethereum Foundation has been questioned by a ‘state authority,’ although the institution’s name is not available in the media. Market analysts claim that the price might tumble in the coming days if the authority finds any wrongdoing.

Cryptocurrency Exchange Ranking by Volume

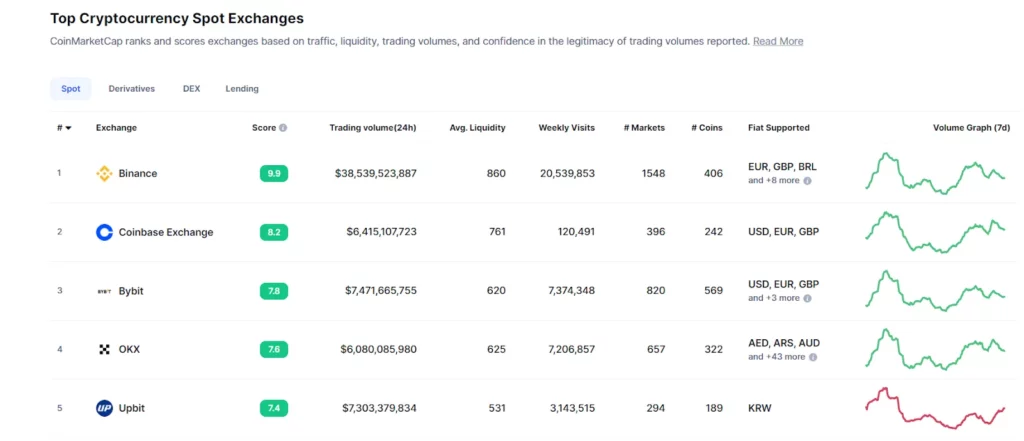

According to CoinMarketCap, Binance is the leader in trading volume among all registered crypto exchanges. Coinbase Exchange, the second most prominent exchange, has a trading volume of $6,365,297,839.

Bybit and OKX are closely competing; however, at the time of writing, Bybit’s trading volume was greater than OKX’s.

Binance remains the topper in derivative trading with a volume of $115,471,433,243, and Bybit leads the race with $34,199,628,025. Uniswap v3 (Ethereum) is one of the most used decentralized exchanges in terms of trading volume.

It is astonishing to note that Venus is the only company in crypto lending with 100% market share, as per CoinMarketCap.

Market Price Update

The market capitalization has reflected a strong reversal in the past 24 hours; as of writing, it was $2.54 Trillion with a growth of 5.10%.

The Fear & Greed Index, powered by CoinMarketCap, shows 82, which denotes extreme greed. Many analysts have observed the Fear & Greed Index of the past 30 days and claim that extreme market greed might direct future price declines.

Bitcoin (BTC) spiked 5.26% intraday; as of writing, it was trading at $67,300. Its prices continued to grow following the much-awaited Bitcoin spot ETF’s approval.

Analysts of renowned firms and institutions claim that the BTC spot ETF has directed the inflow of over $10 Billion in the Bitcoin ecosystem.

Similarly, Ethereum (ETH), the second most prominent crypto in market capitalization, has grown 6.01%.

Ondo (ONDO) price grew 31.11% in the past 24 hours, followed by JasmyCoin(JASMY), which added 27.65%. No significant price decline has been seen in the past 24 hours, although Render (RNDR) slips 2.99%.

Disclaimer

The views and opinions stated by the author or any other person named in this article are for informational purposes only and do not constitute financial, investment, or other advice.

With a background in journalism, Ritika Sharma has worked with many reputed media firms focusing on general news such as politics and crime. She joined The Coin Republic as a reporter for crypto, and found a great passion for cryptocurrency, Web3, NFTs and other digital assets. She spends a lot of time researching and delving deeper into these concepts around the clock, and is a strong advocate for women in STEM.

Home

Home News

News