Blockchain technology holds the potential to unlock $400 bn revenue. Tokenization of private assets will benefit managers from revenue opportunities.

Blockchain technology, the heart of all cryptocurrencies, has appeared as one of the top tech trends. Ongoing updates and innovations made it easy to share facts in a more transparent, secure, and informed way. Blockchain technology is one step closer to unlocking $400 Billion in revenue opportunities in global financial innovations.

Let’s understand the concept profoundly and its influence on the finance sector.

Blockchain Technology Overview

Blockchain technology is an advanced database mechanism that makes it challenging for the system to change, manipulate, or hack stored information. The technology was introduced to the world in 2009 with the launch of Bitcoin, which stores data of any kind, such as cryptocurrency transactions, Decentralized Finance (DeFi) intelligent contracts, and NFT ownership.

The technology evolved with time, presented Blockchain 2.0 in 2014, and holds vast room to run. Whether it is finance, healthcare, retail, or entertainment, the technology has strong roots in every sector. Categorizing based on regions, North America holds over 38% of the revenue share in 2022.

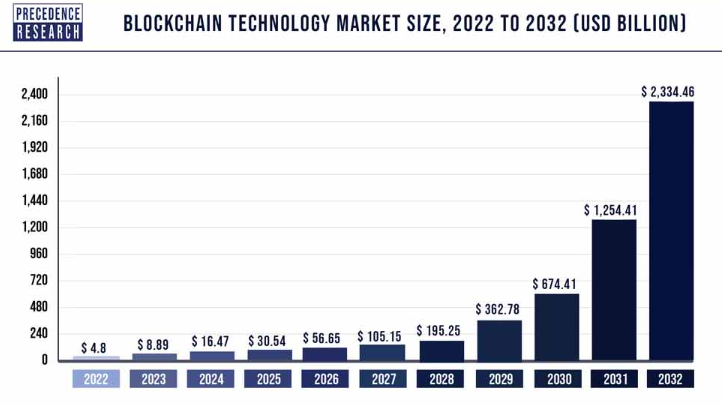

Moreover, the global blockchain technology market was $4.8 Billion in 2022 and is supposed to hit around $2,334.46 billion by 2032. The market size of the technology in the year 2023 was measured at over $8.89 Billion.

Additionally, with over 616 deals, Web3 is the most favored sector for investment. DeFi secured the second position with over 299 deals in 2022. However, a decline was recorded in the investments in the second half of 2022.

How is Technology Influencing Finance?

The technology is used for various purposes, including cryptocurrency, smart contracts, banking, asset transfers, voting, and supply chain monitoring. Despite these, the technology is impacting the financial sector.

Most tech players and financial institutions have experienced the influence of technology and billion-dollar chances in the tokenization of private assets. Tokenization and fractionalization of private assets will enhance the potential of technology to unlock a $400 Billion revenue opportunity.

The three prime examples of institutions that use technology demonstrate the influence of advanced database mechanisms on the finance sector.

In February 2023, German Technology giant Siemens’ tokenized bond issuance on Polygon resulted in reduced costs and settlement times. Similarly, In April 2023, Franklin Templeton tokenized the money market fund on Polygon, which resulted in a faster transaction process, enhanced security, and reduced costs for the fund’s transition to Ethereum’s layer-2 scaling protocol.

What is The $400 Billion Revenue Opportunity?

The $400 Billion revenue opportunities for banks and asset managers in the private asset sector vitrine the strong position of the technology in the crypto universe.

Colin Butler, Polygon’s head of institutional capital, is very sure about the revenue opportunity and referred to Hamilton Lane, the investment manager. Lane initiated tokenizing funds targeting users with net worth between $1 Million and $30 Million to expand the distribution of private assets.

However, tokenizing private equity and hedge funds has several hurdles, including capital lock for years, the need for million-dollar investment, and manual administration procedures.

According to Butler, fractionalizing and tokenizing will help lower the minimum investment from $5 Million to $20,000, along with enhancing the distribution in the case of a private equity manager.

As per Biane & Co’s 2023 private equity report, the revenue opportunity showcases a giant addressable market that all players in the financial system will target.

In addition to this, Polygon’s development through 2023 also demonstrates critical protocol upgrades and releases. The platform recently released an Open-source type 1 prover, permitting ZK-proof generation for any Ethereum Virtual Machine (EVM) chain.

Conclusion

The advanced database mechanism is closer to unlocking a $400 Million revenue opportunity for banks and asset managers by offering tokenization and private asset functionalization. The approach will help investors transact continuously in the blockchain without transforming digital assets and fiat currency.

FAQs

What is a blockchain?

It is a distributed, decentralized, public digital ledger for data records across many systems.

What are the main components of blockchain?

Nodes, hash, wallet, and ledger are the four main components.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News