Bitcoin whales are major market players in the crypto space who are capable of influencing the price of bitcoin and other cryptocurrencies if they decide to buy or sell large volumes of the digital currency.

Bitcoin whales have the capability to significantly impact the price of bitcoin and other major cryptocurrencies when they place a buy or sell order in large quantities. This quality of Bitcoin whales makes them the most important Bitcoin market participants.

This blog post will discuss who the Bitcoin whales are and how they influence the market for cryptocurrency.

Understanding Bitcoin Whales

Whales are institutions or individuals holding a significant share of the circulating supply of a cryptocurrency or any other digital currency. With these large quantities, they have the potential to significantly impact price movements with a single trade. BTC whales hold a significant share of the total circulating supply.

The minimum threshold to be considered a bitcoin whale is the minimum bitcoin holding of 1,000 BTC.

The term or phrase “Bitcoin Whale” is a phrase used for formal conversations to represent the size of a bitcoin holding when the holding is compared with smaller fish existing in the market. The crypto wallet owner can be a group or an individual pooling resources to make significant investments.

The significant holding of bitcoin whales is achieved through mining, early investments and other methods. They have access to substantial bitcoin holdings, which provides them with the capability to manipulate and control the market through major asset purchases or sales that can lead to price fluctuations. The abundance of whales and enhanced volatility are frequently linked in the crypto space.

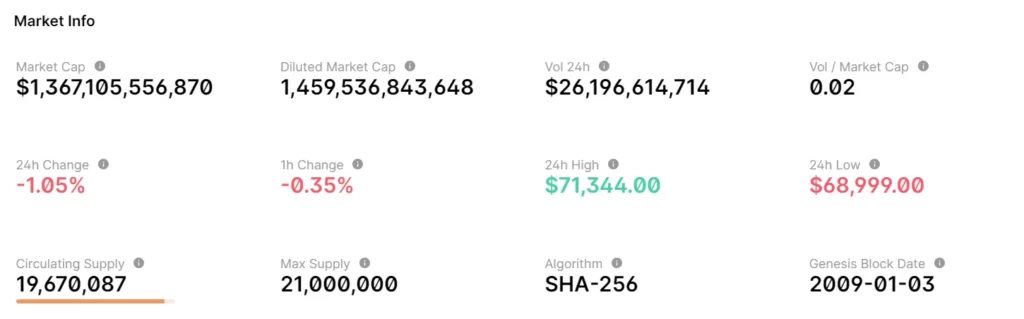

Towards the end of the previous month, that is, March 2024, the ownership or distribution of Bitcoin is highly concentrated among the three major addresses. These three major addresses collectively own 567,502 BTC, ranging in ownership between 100,000 and 1 million BTC.

The next largest 102 owners own a total of 2,384,685 BTC, with respective individual holdings of 10,000 to 100,000 BTC. These 105 wealthiest addresses collectively account for approximately 15% of the total Bitcoin supply.

BTC Whale & Their Influence On The Market

The Bitcoin whales have significant influence over its bitcoin market forces. Their significant holdings provide them with the upper hand to influence Bitcoin supply and demand, leading to price fluctuations with the trade executed by whales.

If whales increase their Bitcoin stash, prices tend to increase, and when they sell off portions of their holdings, it can lead to declines.

Crypto whales generate scarcity, driving their demand and value with their substantial holdings of cryptocurrencies. Whales can cause significant price shifts with their larger transactions that have the capability of guiding other traders’ actions.

These whales do not hide their trades from the public eye, as the wider trading community tracks their wallets. As a result, the trading community anticipates their trading moves based on their previous decisions. It can spark major price tilts based on traders’ views.

Whales can also opt for OTC crypto trading to reduce the impact on prices. Some of the whales also depend on exchanges to manipulate markets by influencing their buys or sells.

Ways to spot a Bitcoin Whale. It would be helpful to know how to spot bitcoin whales, as it adds to their trading arena and provides them with the potential to impact the market with a mere buy or sell order.

This blog discusses three probable ways to spot Bitcoin whales:

Blockchain Explorers

Bitcoin’s public ledger allows observers to access all the transactions. A blockchain explorer like blockchain(dot)com can be used to identify large amounts of bitcoin being moved.

Analyzing Trade Activities And Patterns

Bitcoin whales tend to execute large trades, leading to a sudden price fall or rise. If a small trader or market observer pays attention to trading patterns, the development of unusual patterns or any significant activity can signify a move by Bitcoin whales.

Volume bars in the above graph depict the volume and significant volumes can represent the activities of Bitcoin whales.

Activities On Social Media

Some of the bitcoin whales are very active on social media in that they announce all their major activities in the space through their social media handles. They share their opinions, investment strategies and the bitcoin market. Small traders and observers can infer some insights from their potential trading activities and use this information.

Conclusion: Trading Strategies Of Bitcoin Whales

Crypto or Bitcoin whales are different from ordinary investors because they consider a longer-term perspective of the cryptocurrency market and they often use advanced investment methods.

Bitcoin Accumulation

Whales focus on accumulating Bitcoin by making calculated purchases at low prices or during market downturns. They try to increase their holdings of bitcoin by taking advantage of existing opportunities to buy large quantities of bitcoin at tempting prices.

Market Manipulation

Bitcoin whales are occasionally involved in pump-and-dump strategies, which include buying large quantities of Bitcoin in one transaction to drive up its price and then selling it at a huge profit, causing losses for others.

Moreover, they can influence social media users by boosting interest and promoting the price to attract smaller investors. The Bitcoin whales then sell the holdings which causes a price decline and losses for small investors.

Diversification

Apart from Bitcoin, some whales diversify their cryptocurrency holdings by investigating other digital currencies to spread risk and build potential profit from various areas of the crypto market.

FAQs

Who are some of the biggest crypto whales?

Some of the popular Bitcoin whales are Satoshi Nakamoto, Changpeng Zhao, the Winklevoss Twins, Microstrategy, Michael Saylor and Tim Draper.

What quantity defines a crypto whale?

It is a subjective criteria and the minimum quantity varies depending on the selected cryptocurrency. Whales usually hold a large number of coins available in exchange for a specific currency.

Are whales able to manipulate crypto?

Crypto investors closely observe the actions of crypto whales; however, it is difficult to determine if they intentionally act to manipulate or not. But their actions do cause price movements in the market.

Amanda Shinoy is one of the few women in the space invested knee-deep in crypto. An advocate for increasing the presence of women in crypto, she is known for her accurate technical analysis and price prediction of cryptocurrencies. Readers are often waiting for her opinion about the next rally. She is a finance expert with an MBA in finance. Quitting a corporate job at a leading financial institution, she now engages herself full-time into financial education for the general public.

Home

Home News

News