Monochrome, the asset management company, has submitted an application to CBOE Australia, a global listing exchange for a spot BTC exchange traded fund.

Australia is familiar with crypto based ETF products but it is the first to hold Bitcoin directly. Monochrome has selected CBOE Australia for the listing of BTC ETF because of its renowned name in the Asia Pacific region and other geographies, investor access and positioning.

CEO of Monochrome Asset Management, Jeff Yew, is very optimistic about working with CBOE, Australia. He said,

“As leaders in digital assets globally, their established track record and commitment to innovation and safe market accessibility aligns with Monochrome’s strategic objectives.”

Monochrome has already secured the required prior approval from the Australian Securities and Investments Commission (ASIC). With ASIC’s approval, Monochrome awaits CBOE’s decision, which is expected by the end of this quarter.

If the decision turns out to be positive, Mononchrome Bitcoin ETF will mark a major milestone in Australia’s financial landscape. It offers a new way to engage with Bitcoin, which attracts a broader range of investors interested in crypto.

More about Monochrome Bitcoin ETF

It is the flagship product of the firm. The company would also select ASX, the biggest rival of CBOE. The competitor also has the largest volumes.

In January 2024, head of legal and compliance Derek Vladimir Henningsen told media agencies that they were anticipating that their Bitcoin ETF would be listed by the second quarter of the year.

The announcement also confirmed that the firm has chosen Australia as the listing venue for its bitcoin ETF because there is strategic synergy between both organizations.

Jeff Yew said, “We expect a decision from Cboe Australia about our bitcoin ETF application before the middle of the year.”

Roadmap For Monochrome ETF

The Monochrome Bitcoin ETF will be launched as a registered managed investment scheme. The launch of this Bitcoin ETF is scheduled for Q2, 2024, subject to approvals.

Vasco Trustees Ltd. will be responsible for the launch of the Monochrome Spot ETF and will be the issuer for its product disclosure statement (PDS) and target market determination (TMD).

The ETF instruments are not yet available for subscription and the PDS and TMD will be available at the official website of Monochrome before the beginning of trading of its spot BTC ETF instruments.

Investors are advised to consider the PDS and TMD before making investment decisions. The available information is general in nature and is not financial advice. The documents do not consider an individual’s investment objectives, financial situations or needs.

Characteristics of Monochrome

Related Exposure

The monochrome Bitcoin ETF is anticipated to offer passive investment exposure to bitcoin. The Fund will not be involved in any trading, derivatives, or short-term price speculation. It will imply a passive ‘buy and hold strategy.’

Custody

Digital assets are stored and handled with all the security necessary, in combination with institutional-grade practices such as offline signing and multi-signature key management.

Leading Industry knowledge

The Monochrome development team has experience across traditional financial markets, fund management and digital asset investments. Its team is a combination of variant talent from popular crypto firms, including BlackRock, Binance Australia and IFM investors.

Their team closely works with technical experts and external businesses and advisors to validate and generate new processes.

Institutional Grade Benchmarking

The UK FCA regulates leading crypto index provider CF Benchmarks. Its benchmark indices have settled more than $500 Billion of futures and options contracts listed by CME Group and are tracked using ETFs and ETPs listed in North and Latin America and Europe.

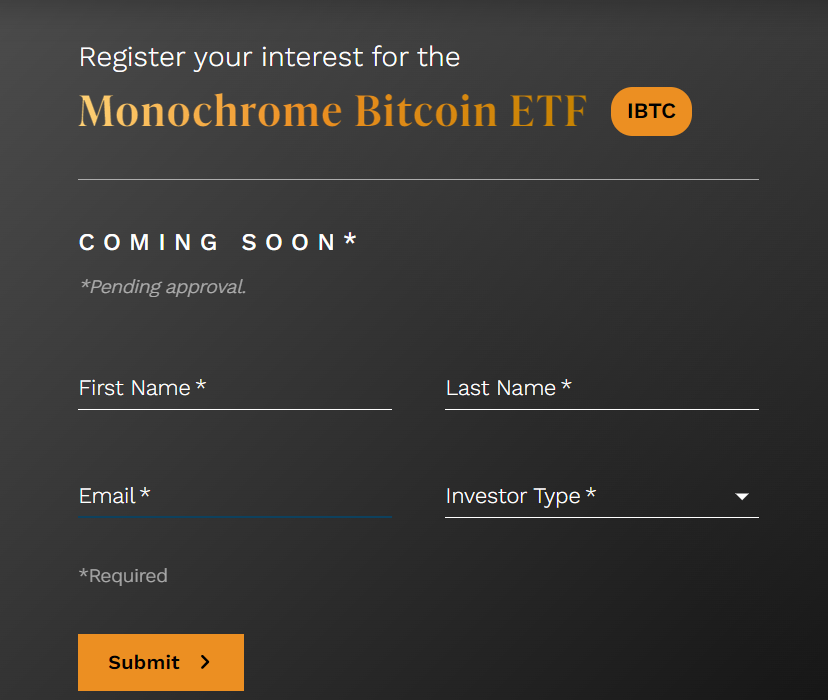

Register Interest

The company is currently receiving users’ interest to know the prospects of their products and reaching out to all the interested investors individually to inform them of all the information in all the details.

For that, the company has created a Register Now link, and clicking on it requires users to enter their full name, email address, and investor type. They will get all the approval and release related information directly to the given email address.

An interested individual can also directly connect with the team to start a conversation and resolve all their queries.

Conclusion

In the end, Monochrome’s application for a Bitcoin exchange-traded fund (ETF) on CBOE Australia represents a sizable leap forward for Australia’s financial landscape. With the listing of the Monochrome Bitcoin ETF, traders in Australia will benefit.

In the end, Monochrome’s application for a Bitcoin exchange-traded fund (ETF) on CBOE Australia represents a sizable leap forward for Australia’s financial landscape. With the capability list of the Monochrome Bitcoin ETF, traders in Australia will benefit from a new road for attractiveness in the cryptocurrency market, facilitated by means of a relied on and set up exchange platform.

As the regulatory approval procedure progresses and Monochrome moves toward launching its ETF, interested investors are recommended to be knowledgeable and bear in mind the potential benefits of incorporating the Monochrome Bitcoin ETF into their investment portfolios.

FAQs

What is the investment strategy for the Monochrome Bitcoin ETF?

It follows a passive investment strategy without directly involving trading. derivatives, or short-term price speculation.

How are digital assets secured and stored within the Monochrome Bitcoin ETF?

It employs institutional-grade practices to improve the security of digital assets.

What differentiates BTC ETF from other similar investment options?

The distinguishing factors include industry knowledge, combining expertise from traditional financial markets, fund management and digital asset investments.

Adarsh Singh is a true connoisseur of Defi and Blockchain technologies, who left his job at a “Big 4” multinational finance firm to pursue crypto and NFT trading full-time. He has a strong background in finance, with MBA from a prestigious B-school. He delves deep into these innovative fields, unraveling their intricacies. Uncovering hidden gems, be it coins, tokens or NFTs, is his expertise. NFTs drive deep interest for him, and his creative analysis of NFTs opens up engaging narratives. He strives to bring decentralized digital assets accessible to the masses.

Home

Home News

News