Popular crypto analysts believed that the immense whale transfers could substantially impact the market, depending on the source of the deployed capital.

Details of the transfer

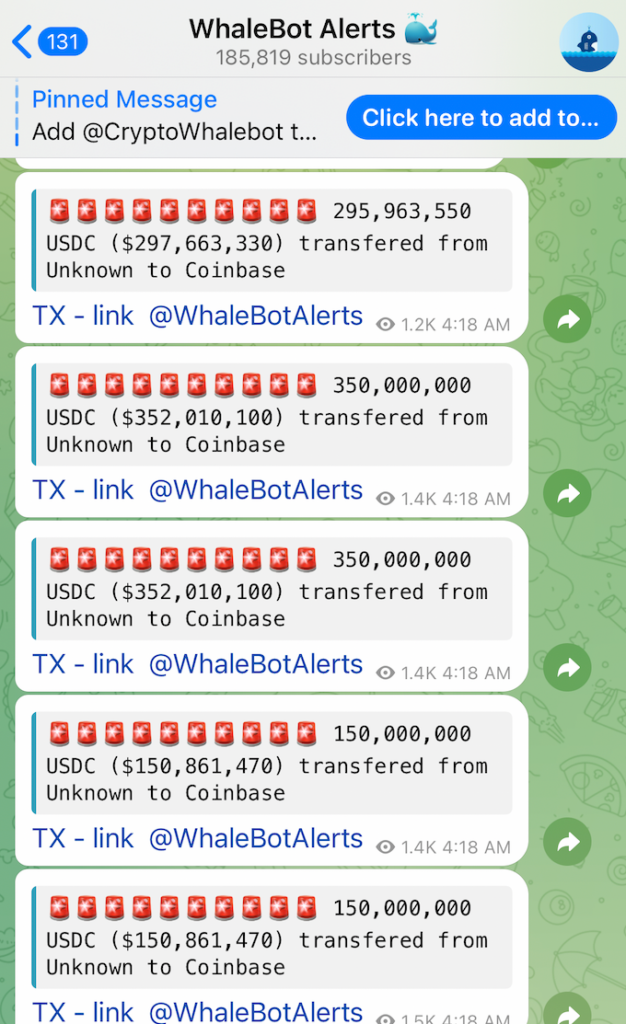

On Thursday, $1.3 Billion was transferred from apparent whales to the popular crypto exchange, Coinbase. According to market observers, This transfer can signal significant buy activities on Bitcoin and Ethereum.

A crypto trader, Blockchain Mane, said, “USDC moving onto exchanges is a giant buy signal, as the saying goes on the internet, ‘money printer go brr.”

Five transfers collectively contributed to $1.3 Billion, with the amount for each transaction ranging from $150 Million to $350 Million. The transaction occurred at Coinbase on April 25 at 08:15 UTC, as per the data from Etherscan.

Significance of the Transfer

Crypto traders consider large stablecoin deposits on exchange a bullish sign, indicating possible large buy orders shortly. Meanwhile, the significant deposits on crypto exchanges signal potential sell-off trades, suggesting a potential downturn in the market and worrying traders.

“The Crypto Lark” crypto commentator Lark Davis stated, “If this is indeed a whale buying and at current prices then yes, it can have a big impact on the price of the asset they are buying, which at that level is almost certainly only Bitcoin and Ethereum.”

The crypto analysts, however, agreed that whale movements are never a guaranteed indicator for the crypto market. The analysts said that much attention has been paid to whale movements, but the users need to learn what the whales are doing or trying to do.

Youtuber and crypto trader Brian Jung added, “$1.3B is a good amount of capital but it depends on where this is getting deployed.”

Lark Davis highlighted that Whales might place limit orders rather than immediately buy the assets, and this strategy can create more robust support levels for the cryptocurrencies they invest in.

Davis stated and explained, “A limit order will go in, creating a buy wall that will act as a layer of price support for the assets.” However, he warned the small traders that the impact of these large transfers on the market is never definitive or confirmed.

Meanwhile, Jung argued that the market could react and move positively if a significant amount of funds went into a single crypto token. As he said, “we would see additional liquidity help move the price of other cryptos up.”

He is curious if an investor can see the benefit of doing it because of the risks of overexposure.

“If this amount were deployed into a single altcoin with a $100M market cap, it would absolutely spike the price, but I can’t imagine any whale in their right mind doing this as it would make it nearly impossible for them to be profitable by doing so.”

Jung added, “If it was used to buy Bitcoin, it wouldn’t have a similar effect.”

The large movements of funds occurred even after the sentiment around the crypto market was slightly declining, as per the Fear and Greed Index data.

Steefan George is a crypto and blockchain enthusiast, with a remarkable grasp on market and technology. Having a graduate degree in computer science and an MBA in BFSI, he is an excellent technology writer at The Coin Republic. He is passionate about getting a billion of the human population onto Web3. His principle is to write like “explaining to a 6-year old”, so that a layman can learn the potential of, and get benefitted from this revolutionary technology.

Home

Home News

News